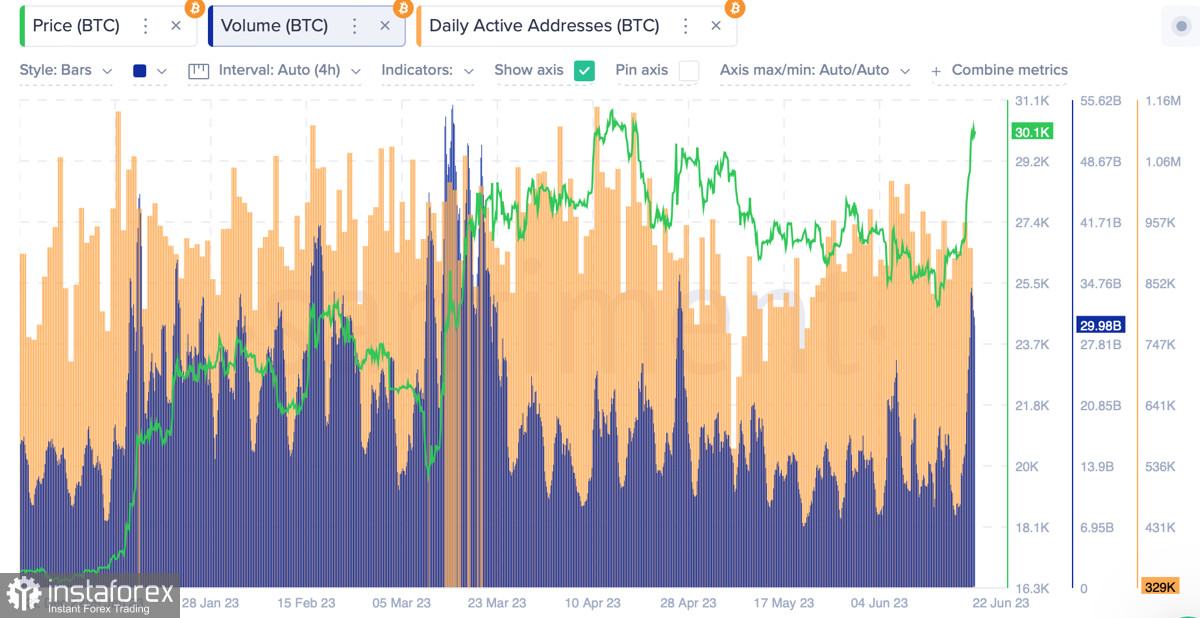

Throughout May, we observed how the price of Bitcoin steadily set new local lows. This process was accompanied by a gradual decline in trading volumes and an increase in pessimistic sentiment in the cryptocurrency market. For most of June, the price of Bitcoin has been in a consolidating movement.

However, over the past few days, the crypto market has lived up to its reputation as a highly volatile industry. In just five days, cryptocurrency trading volumes have increased by 30%, and the price of Bitcoin has reached the $30k level, completely recovering from the May price decline. It is likely that within the framework of the current upward trend, local price highs will be updated.

Statements from the Federal Reserve Chairman

Federal Reserve Chairman Jerome Powell became an unexpected supporter of the crypto market, adding fuel to the rising trend of Bitcoin and digital assets. Powell acknowledged that the Federal Reserve sees stablecoins as a means of payment. The official also noted that he considers cryptocurrencies an asset class, significantly increasing interest in BTC.

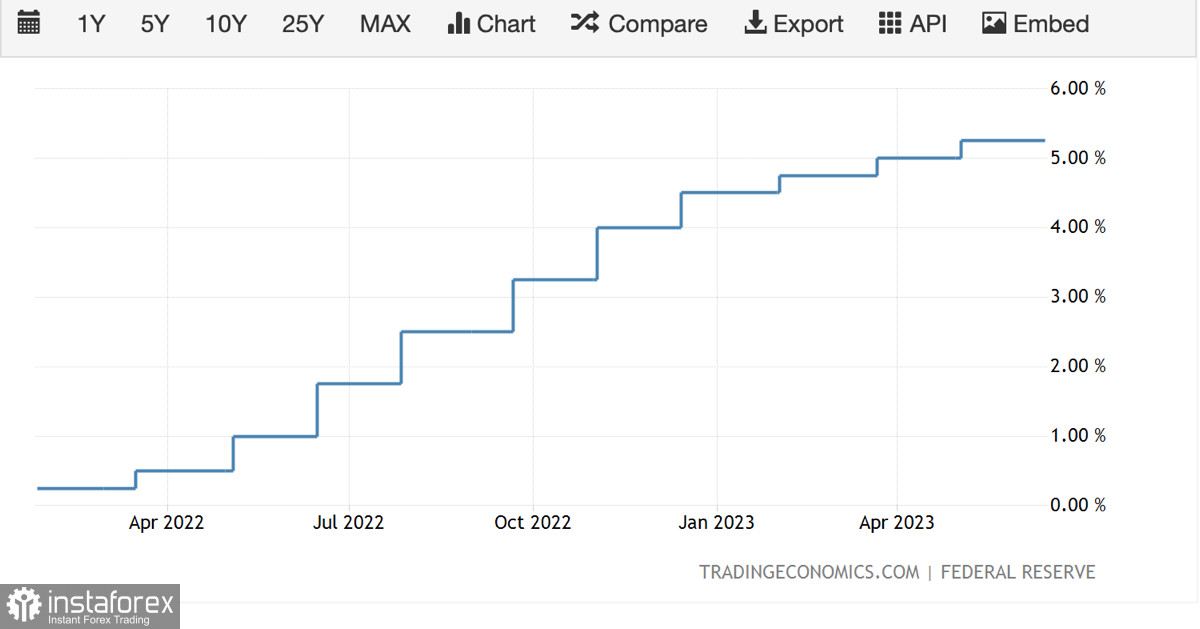

Despite all the positivity, Powell noted that the fight against inflation in the United States is far from over. The official deems it appropriate to raise the key interest rate twice more within the current cycle, which means that the target range may reach 6%–6.25%. Against the backdrop of this statement, investors on the CME are pricing in a 77% probability of a rate hike as early as July.

Crypto industry spreading its wings

In anticipation of Bitcoin's upward impulse, many important events have occurred in the market, such as active accumulation of BTC by all categories of investors and substantial inflows of stablecoins. However, we would like to focus on other factors that have strengthened the position of the crypto industry.

Crypto exchange Binance has allocated $1 billion for legal disputes with the SEC. As an example, Ripple spent around $150 million on legal battles with the regulator. This event has reinforced investors' belief in crypto assets, leading to a potential decrease in BTC dominance and increased investments in altcoins.

Banking giants Fidelity, Citadel Securities, and Schwab are launching their own crypto exchange called EDX Markets. For the first time, major players in the global economy openly create a crypto product for a wide range of investors. It has also been announced that Fidelity and BlackRock have filed an application with the SEC to register a spot Bitcoin ETF.

Deutsche Bank has applied for a license to custody digital assets, including cryptocurrencies. Mastercard has also filed an application to trademark a range of instruments based on digital assets and blockchain technologies. All these news items have a positive influence, encouraging investors to buy cryptocurrencies and driving the market towards new highs.

Bitcoin reached $30k: what's next?

As of June 22, Bitcoin has firmly established itself above $30k with trading volumes around $30 billion. The asset has increased by 21% in the past seven days, which is a direct result of increased trading activity following the accumulation period and positive news.

Looking at the nearest bullish targets for BTC/USD, it is worth highlighting the range of $30.5k–$31k, where the previous price high was located. In the short-term perspective, this level will be crucial for the asset. It is important to remember that such a strong impulse will be followed by a local correction. The key levels to consider are $28.3k–$28.6k, $29.2k–$29.4k, and $30k.

Regarding Bitcoin's medium-term targets, the upward movement towards the $35k–$36k range, where the CME gap is located, will be crucial. It is likely that Bitcoin's upward movement will be limited to the period between Federal Reserve meetings, where a key interest rate hike is expected. Taking this into account, the second week of July marks the end of the bullish BTC movement.

Conclusion

Bitcoin begins another phase of upward movement with ambitious targets around $35k–$36k. Short-term targets for the asset should be considered within the range of $29.5k–$31k. It is evident that a local correction will follow in the near future to cool down the market, but overall, the second phase of the bullish movement is still ahead.