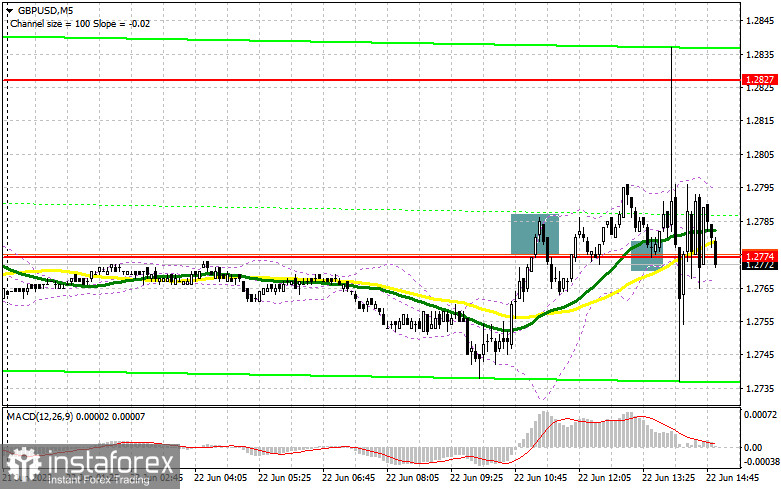

In my morning forecast, I highlighted the level of 1.2774 and advised making entry decisions based on it. Let's examine the 5-minute chart and analyze the events. Although there was a false breakout and a signal to sell the pound, a significant decline did not materialize, which is understandable considering the Bank of England's plans. However, a later breakout and retest of 1.2774 provided a signal to buy the pound, resulting in a gain of over 60 points. The technical outlook has been reevaluated for the second half of the day.

To initiate long positions on GBP/USD, the following conditions are necessary:

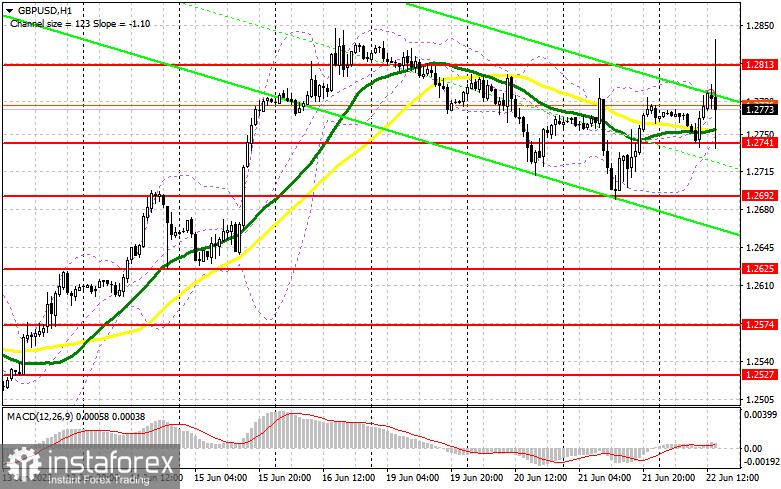

The decision to raise interest rates by 0.5% was surprising, despite rumors circulating since yesterday. The Bank of England emphasized its intention to combat high inflation by increasing borrowing costs, leading to a sharp rise in the pound. Major players used this to secure profits from the upward trend in June. Given that the Federal Reserve has hinted at resuming its rate hike cycle, it is challenging to predict the pair's next move under the current circumstances.

If pressure persists on the pair in the second half of the day, I will only act upon a false breakout near the nearest support level of 1.2741, formed earlier. Such a false breakout would present a favorable entry point for increasing long positions. Weak US labor market data could drive a significant upward movement of the pound towards 1.2813. Breaking and retesting this range from top to bottom would nullify sellers' chances and serve as an additional signal to open long positions with a target towards the maximum of 1.2876. Ultimately, my profit-taking target would be around 1.2911.

In the event of a decline towards 1.2741 and a lack of buyer activity following the release of US statistics, the pound would face increased pressure, leaving fewer reasons to buy it. In such a scenario, defending the next area of 1.2692 and observing a false breakout at that level would indicate an opportunity to initiate long positions. I plan to buy GBP/USD only on a rebound from 1.2625, targeting a correction of 30–35 points within the day.

To initiate short positions on GBP/USD, the following conditions are necessary:

Sellers successfully defended the area around 1.2819, keeping the pair in a sideways channel and preserving the potential for a correction by the end of the week. As long as trading remains below 1.2813, a downward correction can be anticipated. In the event of GBP/USD rising after the US labor market report, a false breakout at this level would validate the correct entry point for short positions, leading to another substantial sell-off towards 1.2741. Breaking and retesting this range from bottom to top would exert greater pressure on buyer positions, forming a selling signal with a drop toward 1.2692. The ultimate target remains at a minimum of 1.2625, where I would take my profits.

If GBP/USD rises and shows limited activity at 1.2813, buyers will likely continue building a bullish trend, particularly considering the Bank of England's interest rate decision. In such a scenario, I would postpone selling until a resistance test at 1.2876. A false breakout at that level would provide an entry point for short positions. If there is no downward movement, I will sell GBP/USD only on a rebound from 1.2911, expecting a correction downwards by 30–35 points within the day.

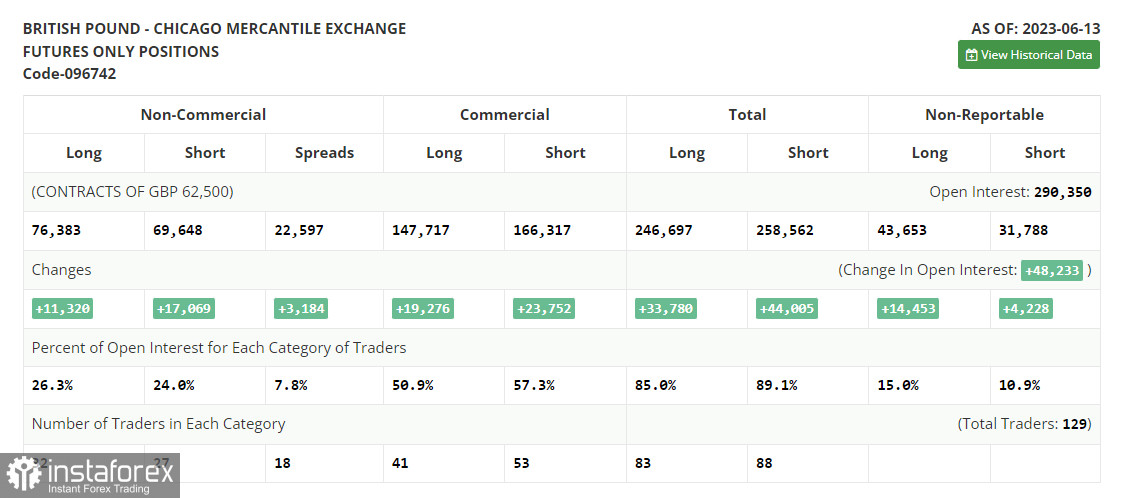

The COT report (Commitment of Traders) for June 13 showed a sharp increase in both long and short positions. The pound has seen significant growth recently, attracting sellers' attention. However, the aggressive policies of the Bank of England and the latest inflation data in the UK are bringing new buyers into the market, anticipating further interest rate hikes. The fact that the Federal Reserve has paused its monetary policy tightening cycle while the Bank of England has no plans to do so makes the attractiveness of the British pound quite strong. According to the latest COT report, non-commercial short positions increased by 17,069 to 69,648, while non-commercial long positions jumped by 11,320 to 76,383. This led to a slight decrease in the non-commercial net position to 6,736 compared to 12,454 the previous week. The weekly price rose to 1.2605 from 1.2434.

Indicator signals:

Moving Averages:

Trading occurs around the 30-day and 50-day moving averages, indicating market uncertainty.

Note: The author considers the period and prices of moving averages on the hourly H1 chart, which differs from the general definition of classical daily moving averages on the daily D1 chart.

Bollinger Bands:

In the event of a decline, the lower boundary of the indicator, around 1.2741, will act as support.

Description of Indicators:

- Moving Average (determines the current trend by smoothing volatility and noise). Period: 50. Marked in yellow on the chart.

- Moving Average (determines the current trend by smoothing volatility and noise). Period: 30. Marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence): Fast EMA period 12, Slow EMA period 26, SMA period 9.

- Bollinger Bands: Period 20.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open positions of non-commercial traders.

- Short non-commercial positions represent the total short open positions of non-commercial traders.

- The non-commercial net position is the difference between non-commercial traders' short and long positions.