On Wednesday, U.S. stock indexes showed growth, instilling optimism amid the assumption that the Federal Reserve may have completed its cycle of interest rate hikes, and the economy still remains stable. This rise is also attributed to the strengthening of the consumer services, healthcare, and financial sectors.

Despite economic reports indicating a slowdown in the economy, data on unemployment benefit claims showed a larger-than-expected decrease in the number of Americans filing for benefits. This may suggest that the economy, while slowing down, still retains enough strength to avoid a recession.

At the latest Fed meeting, a cautious approach to monetary policy was noted, but stocks have significantly risen in recent weeks, based on the belief that the Fed's rate hike cycle is coming to an end.

"Overall, the market has a strong foundation, despite concerns about the economy and consumer spending," says Quincy Crosby, Chief Global Strategist at LPL Financial in Charlotte, North Carolina. "This market appears stable in one of its most favorable times of the year."

In addition, stocks tend to rise before Thanksgiving in the U.S. and towards the end of the year. It's worth noting that the market will be closed on Thursday in observance of Thanksgiving.

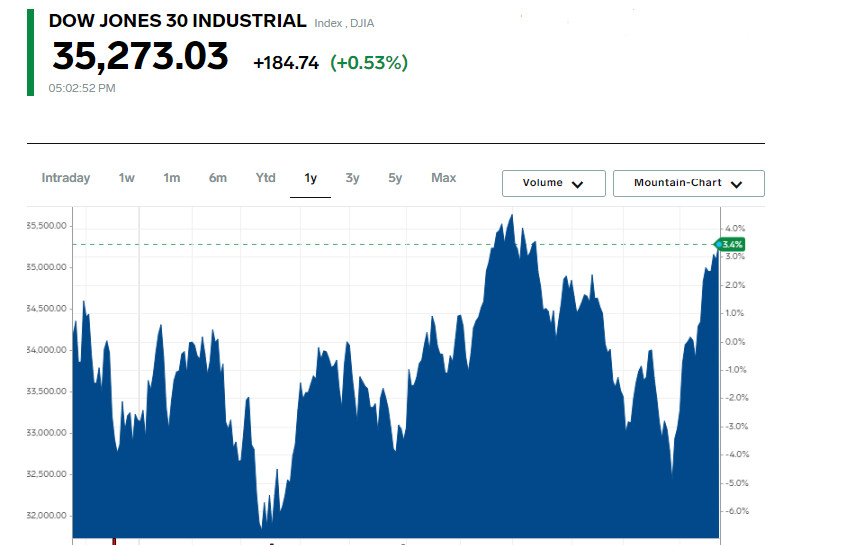

On the stock market, the Dow Jones index added 0.53%, the S&P 500 index increased by 0.41%, and the Nasdaq Composite index grew by 0.46%.

Among the components of the Dow Jones index, 3M Company's shares are leading, up by 1.47%, as well as Microsoft Corporation's quotes, which rose by 1.28%. Home Depot Inc's shares rose by 1.27%.

Among the components of the S&P 500 index, eBay Inc's shares stand out, gaining 3.09%, Advanced Micro Devices Inc rose by 2.81%, and HP Inc's shares increased by 2.80%.

The communication sector showed significant growth, up by 0.9%, and became the leader in growth among the components of the S&P 500 index, except for the energy sector, which declined by 0.1%.

However, there were also negative developments on this day. Nvidia (NVDA.O) shares fell by 2.5% after the chip developer reported a revenue forecast for the fourth quarter that exceeded Wall Street's expectations but expressed concerns about export restrictions in the U.S., which could significantly reduce sales in China.

Another negative event was the 3.1% decline in Deere & Co (DE.N) shares after the profit forecast for 2024 turned out to be lower than analysts' expectations.

The trading volume on U.S. exchanges amounted to 8.57 billion shares, which is below the 20-day average of 10.82 billion shares.

On the New York Stock Exchange, the number of advancing stocks (1845) exceeded the number of declining ones (1023), and the prices of 107 stocks remained virtually unchanged. On the NASDAQ exchange, 2137 companies saw their prices rise, 1296 fell, and 150 remained unchanged from the previous closing.

Microsoft Corporation (NASDAQ: MSFT) shares reached an all-time high, rising by 1.28% or 4.78 points, and closed at $377.85.

The CBOE Volatility Index, which reflects options trading on the S&P 500, decreased by 3.75% to 12.85, reaching a new monthly low.

December gold futures lost 0.51%, or $10.15, dropping to $1,000 per troy ounce. As for other commodities, January WTI crude oil futures fell by 1.27%, or $0.99, to $76.78 per barrel. January Brent crude oil futures dropped by 0.96%, or $0.79, to $81.66 per barrel.

In the Forex market, the EUR/USD pair showed minor changes, rising by 0.18% to reach 1.09, while USD/JPY quotes increased by 0.83% to reach 149.62.

USD index futures also demonstrated growth, increasing by 0.31% to reach 103.77.