During the June meeting, the Bank of England implemented the most hawkish and least expected scenario by raising the interest rate by 50 basis points for GBP/USD. However, despite this unexpected move, the pound's performance against the dollar shows conflicting trends. After experiencing a sudden surge towards the 28th figure, the British currency sharply declined to the base of the 27th figure, demonstrating anomalous price dynamics primarily attributed to the significant strengthening of the greenback. Meanwhile, the US Dollar Index is attempting to regain its position following Jerome Powell's second appearance in Congress. Yesterday, the head of the Federal Reserve presented a semi-annual report to the House of Representatives, and today he addressed the senators of the Upper House of Congress.

Nevertheless, the current activity of dollar bulls is characterized by emotional and irrational behavior. In reality, the Bank of England maintained a hawkish stance and intensified its aggressiveness while the Federal Reserve was preparing to conclude the current cycle of tightening monetary policy. Moreover, there has been a recent decoupling of inflation indicators: in the United States, both the Consumer Price Index and the Producer Price Index are gradually declining, whereas the core CPI in the United Kingdom demonstrates the opposite trend, prompting the English regulator to take corresponding measures. Under these circumstances, it is not appropriate to discuss the development of a downward trend in GBP/USD. Even the current corrective pullback appears unconventional and unjustifiable.

Before the Bank of England meeting, most experts anticipated implementing a moderately hawkish scenario involving a 25-point interest rate hike and tightening the accompanying statement's rhetoric. The inflation report released in the United Kingdom just a day before the meeting left no room for choice—the central bank only needed to decide the magnitude of the rate hike. The experts did not doubt the tightening of monetary policy.

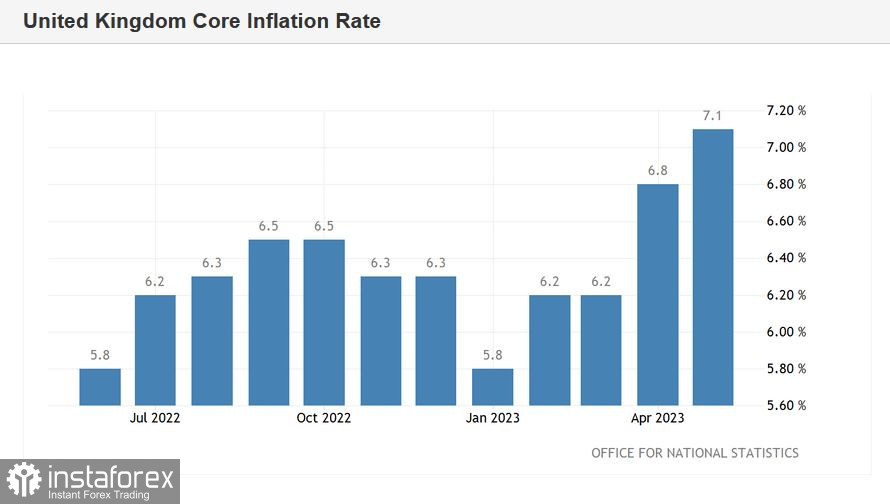

In May, the core Consumer Price Index, excluding food and energy prices, surged to 7.1%, surpassing most analysts' predictions, who expected a decrease to 6.7%. This represents a multi-year record, indicating the strongest growth rate of the indicator since 1992. The indicator has shown an upward trend for the second consecutive month in the current year.

Based on these results, the Bank of England raised the interest rate by 50 basis points, while the " for-against " voting ratio remained unchanged. Seven out of nine members of the Monetary Policy Committee voted in favor of the rate hike. In comparison, two members, Swati Dhingra, and Silvana Tenreyro, traditionally advocated for maintaining the previous level.

The accompanying statement text remained largely unchanged, with the central bank refraining from softening its formulations and hinting at further tightening of monetary policy.

The final statement confirms that the Bank of England will continue closely monitoring inflationary pressures in the economy, including the labor market, wages, and services sector. However, the regulator warned that if signs of more sustainable pressure emerge, further tightening of monetary policy will be necessary.

In simpler terms, if future inflation releases fall within the desired range (especially core inflation), the interest rate will be increased.

The hawkish stance of the Bank of England suggests that the central bank may raise rates by 25 basis points at each subsequent meeting until November, according to economists at TD Securities. They predict three more rate hikes in August, September, and November, resulting in a final rate of 5.75%. However, TD Securities experts caution that the side effects of such a policy will become apparent by the end of the year, with a potential recession in the winter and a decline in the bank rate starting in February of the following year.

It is premature to discuss the prospects for 2024. The English regulator's support today has benefited GBP/USD buyers, and this factor will favor them in the coming weeks.

Powell's speech influences the current downward correction in GBP/USD. After his cautious comments yesterday, he slightly intensified his rhetoric and suggested two rate hikes by the end of the year. However, it is important to note that the Fed Chairman's remarks still have a conclusive tone. He stated that the central bank is nearing its rate target and emphasized the need for an extremely cautious approach to avoid excessive rate hikes.

I believe GBP/USD buyers have received a significant fundamental advantage today, which will remain effective for a considerable period, especially if British inflation remains strong. Therefore, downward corrections in the pair can be seen as an opportunity to open long positions. The nearest and primary target for an upward movement is the 1.2880 level, representing the upper line of the Bollinger Bands indicator on the daily timeframe. Surpassing this target will pave the way for GBP/USD buyers toward the 29–30 range.