Overview of macroeconomic reports

A significant number of various macroeconomic reports are slated for release on Friday. Not exactly diverse, but there are quite a few. Manufacturing and Services PMIs for June will be published in the European Union, the United Kingdom, Germany, and the United States. According to forecasts, no significant changes are expected compared to May, but the actual values may still differ from the forecasts. And the greater the difference, the higher the likelihood of a market response to a particular report. For now, we can only say that the service sectors in all four are feeling great, while the manufacturing sectors are doing very poorly. It is unlikely that the situation will change.

Also, we should take note of the UK retail sales report, which carries the same weight as a PMI.

Overview of fundamental events

There are also noteworthy fundamental events, but first, we would like to mention that this week saw a huge number of speeches by representatives of the Federal Reserve and the European Central Bank monetary committees. In essence, the market only reacted to Fed Chair Jerome Powell's speeches in the US Congress, while all other speeches were background noise. We believe that this situation will extend on Friday as well.

Fabio Panetta is scheduled to speak in the European Union, and James Bullard, Raphael Bostic, and Loretta Mester will speak in the United States. However, after Powell's speeches, the market already has a clear understanding of what to expect in the upcoming meetings. It is unlikely that Bostic, Mester, and Bullard (who also does not have voting rights) will convey a different point of view to the market. Especially since Powell already affirmed that the majority of committee members currently hold the same view.

Bottom line

There won't be any important events, but there will be plenty of supporting ones. Each individual report can trigger a small market reaction, and there will be many reports. However, it is currently very difficult to expect significant values. The service sector indices are well above 50, while the manufacturing sector is well below 50.

Main rules of the trading system:

- The strength of the signal is calculated by the time it took to form the signal (bounce/drop or overcoming the level). The less time it took, the stronger the signal.

- If two or more trades were opened near a certain level due to false signals, all subsequent signals from this level should be ignored.

- In a flat market, any currency pair can generate a lot of false signals or not generate them at all. But in any case, as soon as the first signs of a flat market are detected, it is better to stop trading.

- Trades are opened in the time interval between the beginning of the European session and the middle of the American one when all trades must be closed manually.

- On the 30-minute timeframe, you can trade based on MACD signals only on the condition of good volatility and provided that a trend is confirmed by the trend line or a trend channel.

- If two levels are located too close to each other (from 5 to 15 points), they should be considered as an area of support or resistance.

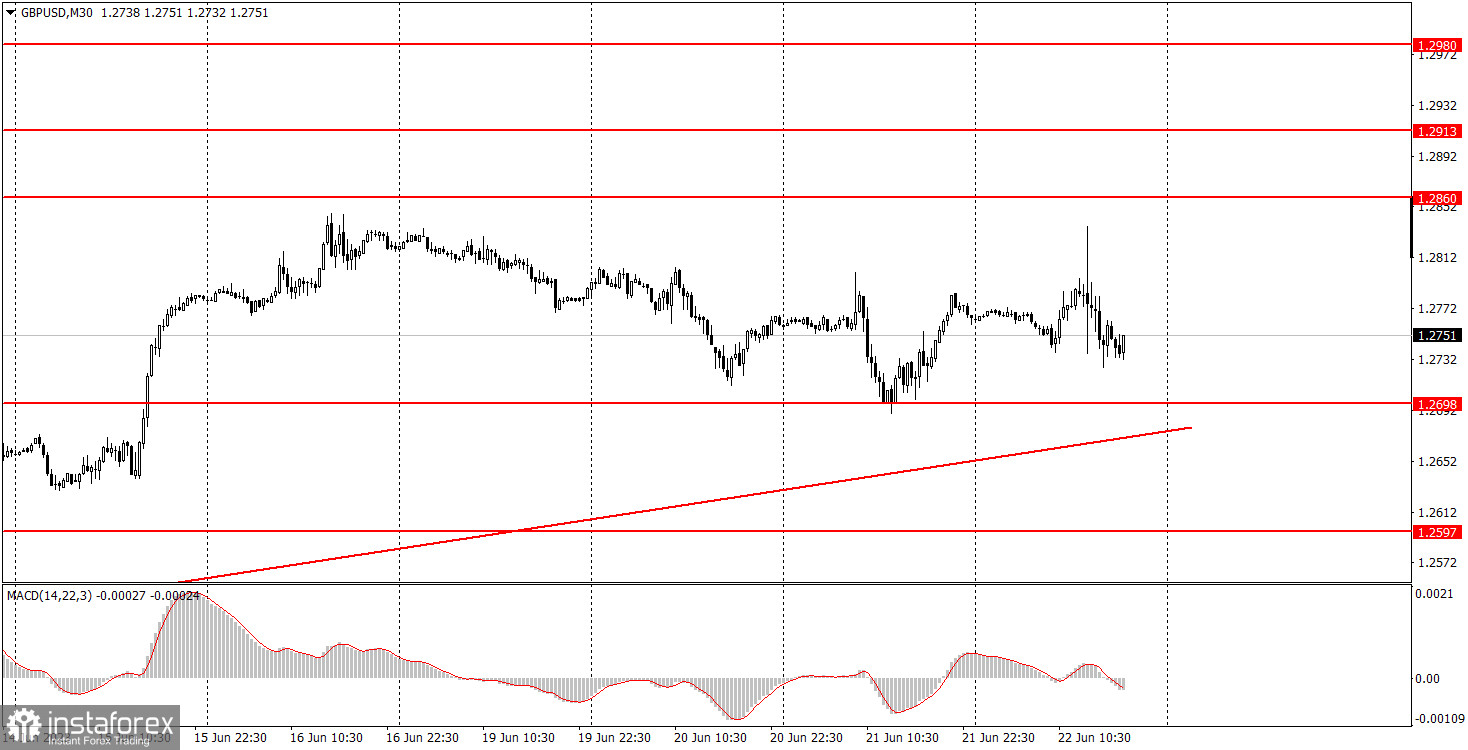

Comments on charts

Support and resistance levels are levels that serve as targets when opening long or short positions. Take Profit orders can be placed around them.

Red lines are channels or trend lines that display the current trend and show which direction is preferable for trading now.

The MACD (14,22,3) indicator, both histogram and signal line, is an auxiliary indicator that can also be used as a source of signals.

Important speeches and reports (always found in the news calendar) can significantly influence the movement of a currency pair. Therefore, during their release, it is recommended to trade with utmost caution or to exit the market to avoid a sharp price reversal against the previous movement.

Beginners trading in the forex market should remember that not every trade can be profitable. Developing a clear strategy and money management is the key to success in trading over a long period of time.