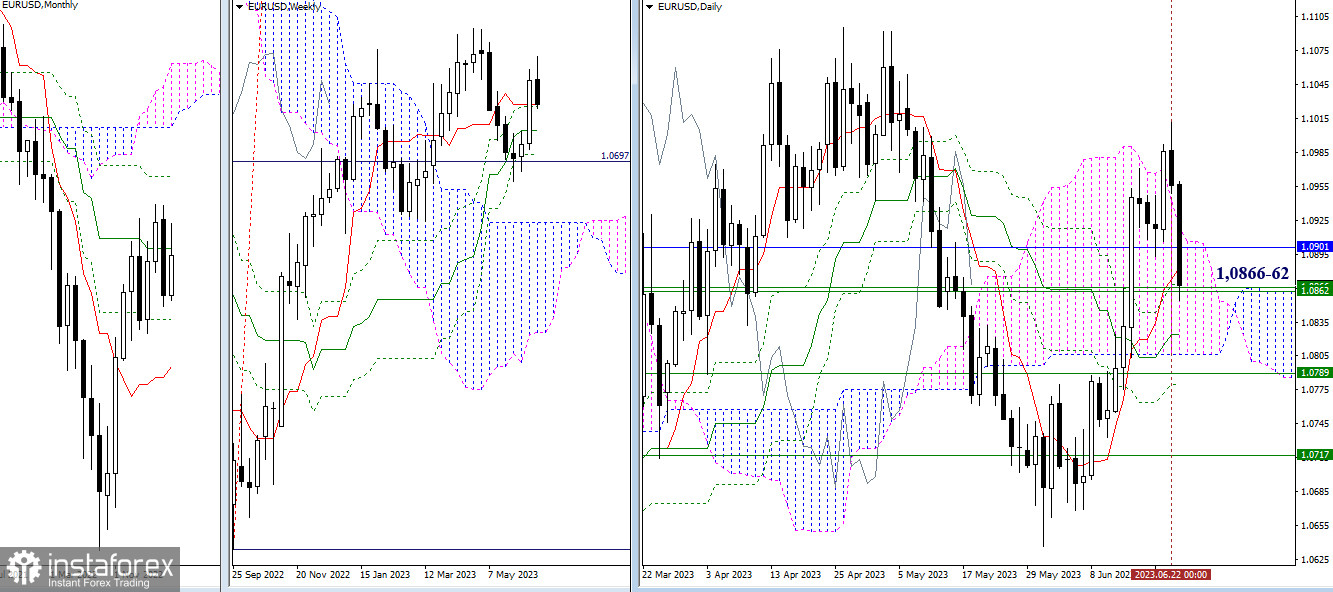

EUR/USD

Higher timeframes

Bearish players not only once again halted the opponent's progress but also managed to implement a significant decline, breaking the monthly level of 1.0901 and testing the area of 1.0866-62 (daily and weekly levels). Much depends on the outcome of this interaction. A return of the short-term trends of the day and week to the bearish side will provide the market with an opportunity for further strengthening of bearish sentiment. The main tasks on this path will be breaking out of the daily cloud (1.0806), piercing the weekly medium-term trend (1.0789), and eliminating the daily Ichimoku cross (1.0780). The greatest importance will be given to the liquidation of the weekly golden cross (1.0717), as it was precisely this task that the bears stumbled upon last time.

H4 - H1

Today's movement efficiency allowed the bears to work through all the established targets of the lower timeframes. Currently, they are testing the final support of the classic pivot points (1.0870). In case of further decline, the focus should now be on the support levels of the higher timeframes (1.0824 - 1.0806 - 1.0789 - 1.0780). If bulls takes the initiative, the most important value will be testing and breaking through the key levels of the lower timeframes at 1.0940 - 1.0972 (weekly long-term trend + central pivot point of the day).

***

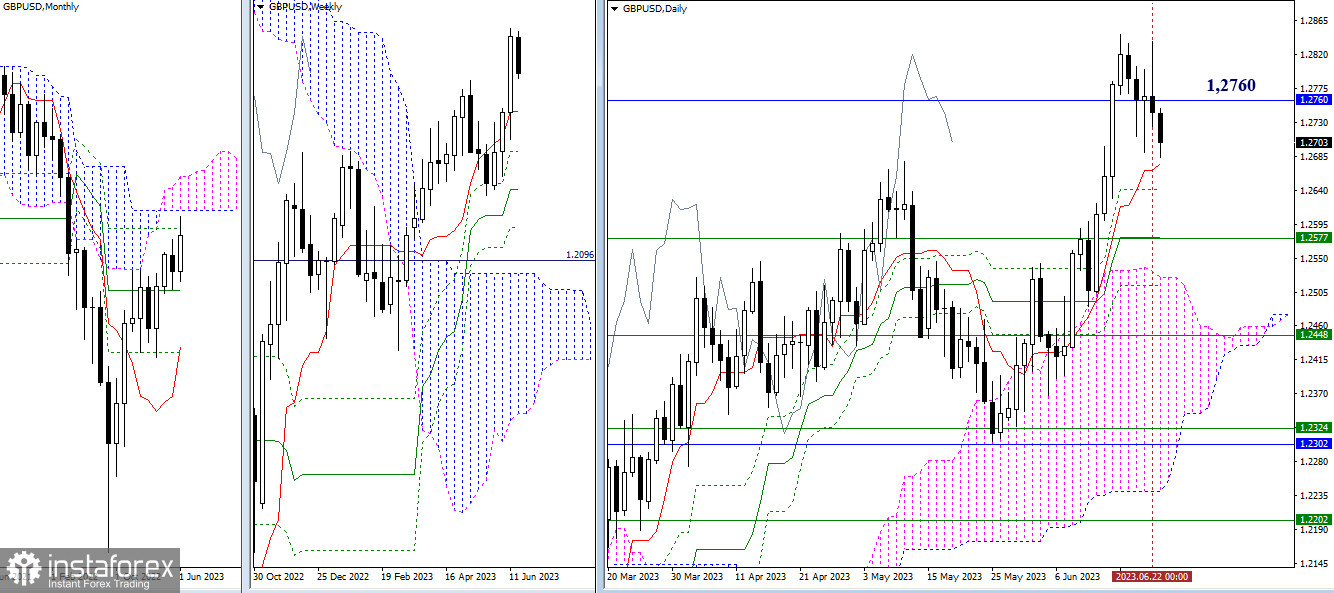

GBP/USD

Higher timeframes

After several attempts, bears closed the trading day below the monthly support level (1.2760). The downward correction gained momentum, and now the nearest targets for further decline are the daily levels (1.2641 - 1.2675). Next, the interests of bearish players will be directed towards the significant level of 1.2577, where the weekly short-term and daily medium-term trends converge.

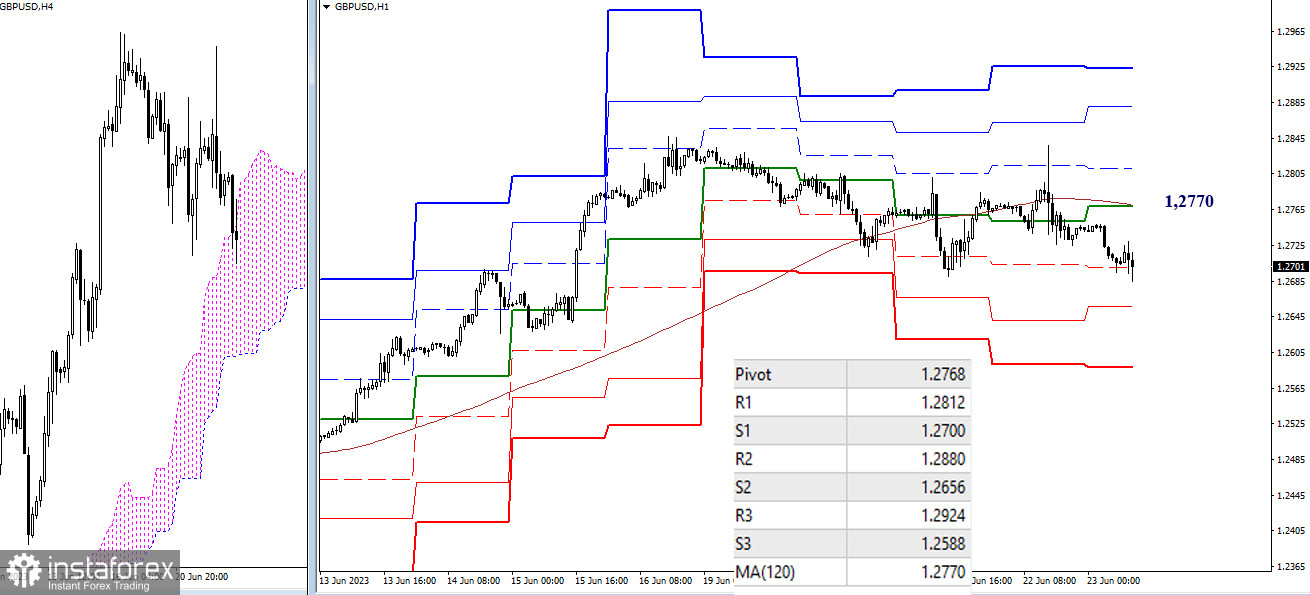

H4 - H1

On the lower timeframes, the situation is such that bullish players failed to reclaim the key level—the weekly long-term trend, which is currently located at 1.2770, allowing bearish players to maintain their main advantage. Currently, the testing of the first support of the classic pivot points (1.2700) is underway, and below that, the reference points are S2 (1.2656) and S3 (1.2588). In the current conditions, for the emergence of new bullish prospects, bulls need to reclaim the lost monthly level of 1.2760 and establish themselves above the moving average at 1.2770, turning the moving average in the direction of their plans.

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)