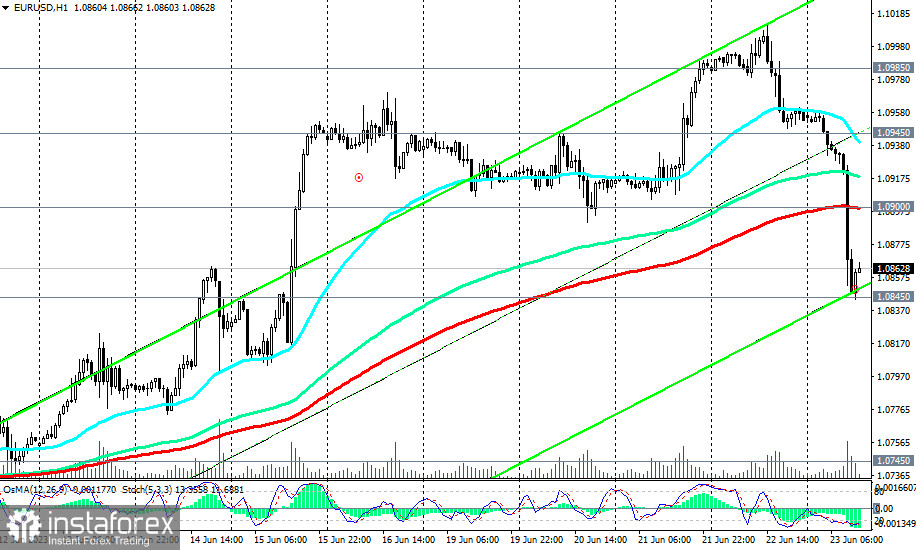

As of writing, EUR/USD was trading near the 1.0865 mark, bouncing off the important support level of 1.0845 (200 EMA, 144 EMA on the 4-hour chart, 50 EMA on the daily chart) reached at the beginning of today's European trading session.

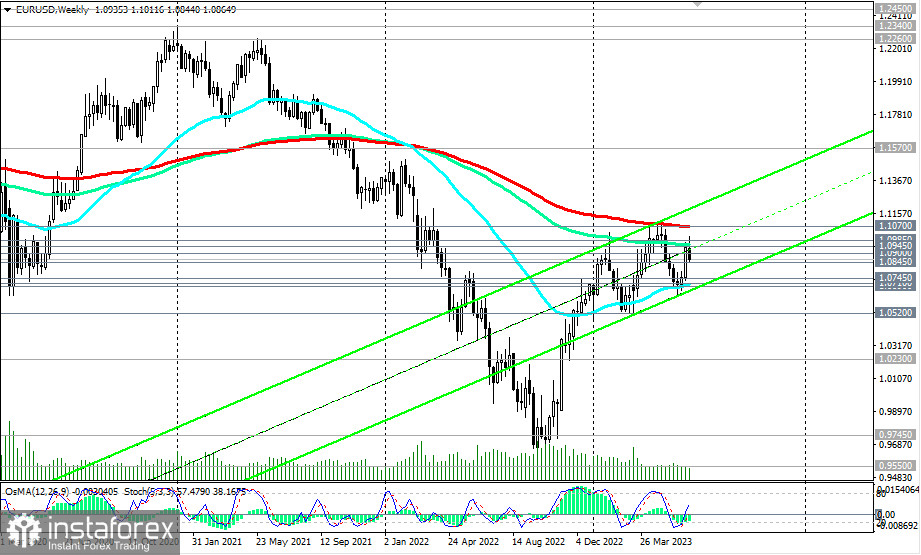

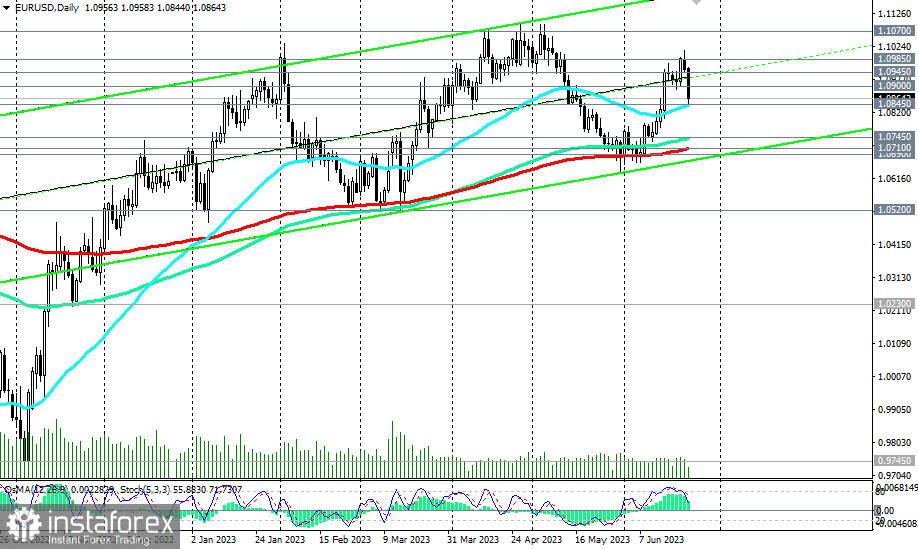

We also assumed that considering the medium-term upward trend of EUR/USD, this decline should be evaluated as a corrective move, providing an opportunity to enter new long positions with the prospect of growth towards the 1.1570 resistance level (200 EMA, 144 EMA on the monthly chart), separating the global bullish trend of EUR/USD from the bearish one, with an intermediate target at the resistance level of 1.1070 (200 EMA on the weekly chart).

Therefore buy from 1.0845 and 1.0850. Breaking through the resistance level of 1.0900 (200 EMA on the 1-hour chart) will strengthen the positive dynamics of EUR/USD, and breaking the resistance levels of 1.0945 (144 EMA on the weekly chart) and 1.0985 will confirm our assumption.

In an alternative scenario, EUR/USD will break the support level of 1.0845 and move towards the key support levels 1.0745 (144 EMA on the daily chart) and 1.0710 (200 EMA on the daily chart, 50 EMA on the weekly chart). Breaking through these levels, in turn, will indicate a resumption of the long-term bearish trend, and breaking the local support level of 1.0520 will ultimately return EUR/USD to the zone of the global bearish market.

Support levels:1.0845, 1.0800, 1.0745, 1.0710, 1.0685, 1.0600, 1.0520, 1.0500

Resistance levels: 1.0900, 1.0945, 1.0985, 1.1000, 1.1070, 1.1100