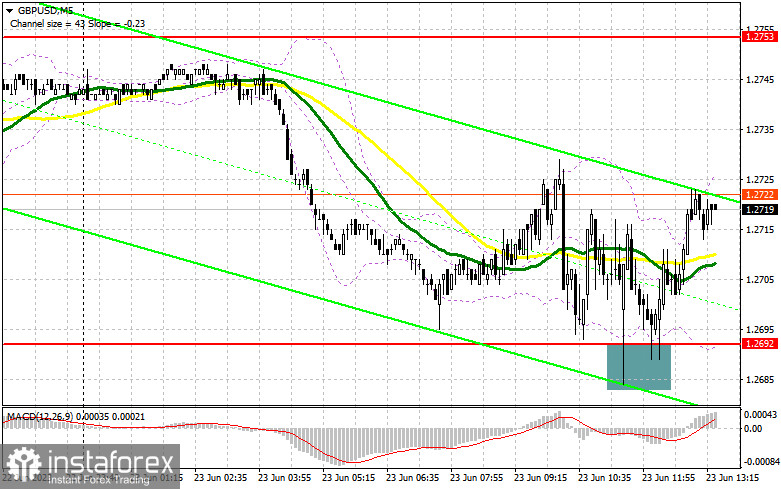

In my morning forecast, I highlighted the level of 1.2692 and recommended considering it for entry decisions. Let's examine the 5-minute chart to analyze what transpired. The pound experienced a drop followed by a false breakout at the mentioned level, which generated a buy signal along the trend, resulting in a 40-point upward movement for the pair. The technical picture remained unchanged in the second half of the day.

To initiate long positions on GBP/USD, the following conditions should be met:

Yesterday's 0.5% interest rate hike by the Bank of England is convincing evidence of maintaining an aggressive monetary policy in the future. Hence, today's weak reports on UK PMI should have been considered. In the second half of the day, we anticipate similar reports for the US manufacturing sector's business activity index, the service sector's business activity index, and composite PMI. If these indicators surpass economists' forecasts, considering the current strength of the US economy, we can expect further depreciation of the pair.

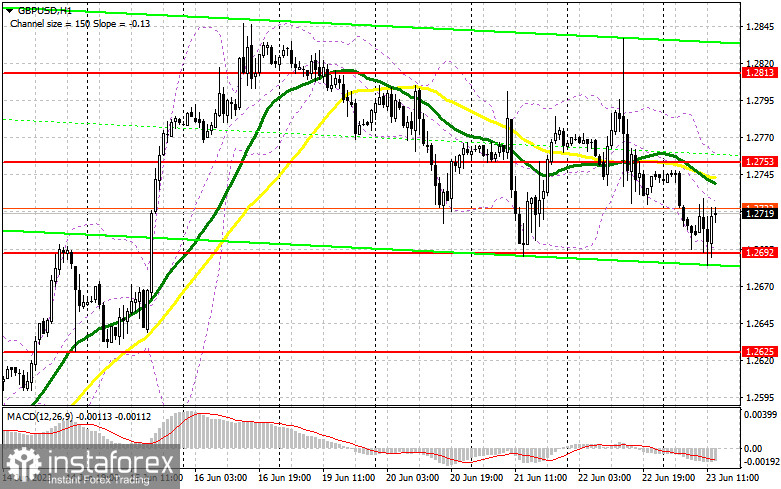

As long as trading continues above 1.2692, demand for the pound is likely to persist. As discussed earlier, a drop followed by another false breakout at this level will provide an additional entry point for long positions, potentially pushing GBP/USD toward the middle of the sideways channel at 1.2753. At that point, the moving averages favor sellers. Suppose the upper boundary of this range is breached and tested from top to bottom. In that case, it will eliminate all chances for sellers and serve as an additional signal to open long positions, targeting the maximum at 1.2813. The ultimate target will be the area around 1.2876, where I plan to take a profit.

In the scenario where the pair declines towards 1.2692, and there is a lack of buyer activity after the release of US statistics, pressure on the pound will increase, giving fewer reasons to buy it. In such a case, defending the next area at 1.2625 and a false breakout at that level will signal to open long positions. I intend to buy GBP/USD only on a rebound from 1.2574, with a 30-35 point correction target within the day.

To open short positions on GBP/USD, the following conditions should be met:

Sellers exhibited activity following the weak PMI index reports, but there still seems to be interest in the pound. If we observe weak data from the US, only a false breakout at 1.2753 will signal a selling opportunity, renewing pressure on the pair to retest 1.2692. Breaking through and testing the lower boundary of this range from bottom to top will deliver a more significant blow to buyer positions, pushing GBP/USD towards 1.2625. The ultimate target remains at a minimum of 1.2574, where I plan to take a profit.

If GBP/USD experiences growth and limited activity at 1.2753 in the second half of the day, the attempted downward correction will halt, and the bulls will regain control of the market. In such a scenario, I will delay the sale until a resistance test at 1.2813. A false breakout at that level will provide an entry point for short positions. If there is no downward movement at that level, I will open short positions on GBP/USD upon a rebound from 1.2876, but with the expectation of a 30-35 point downward correction within the day.

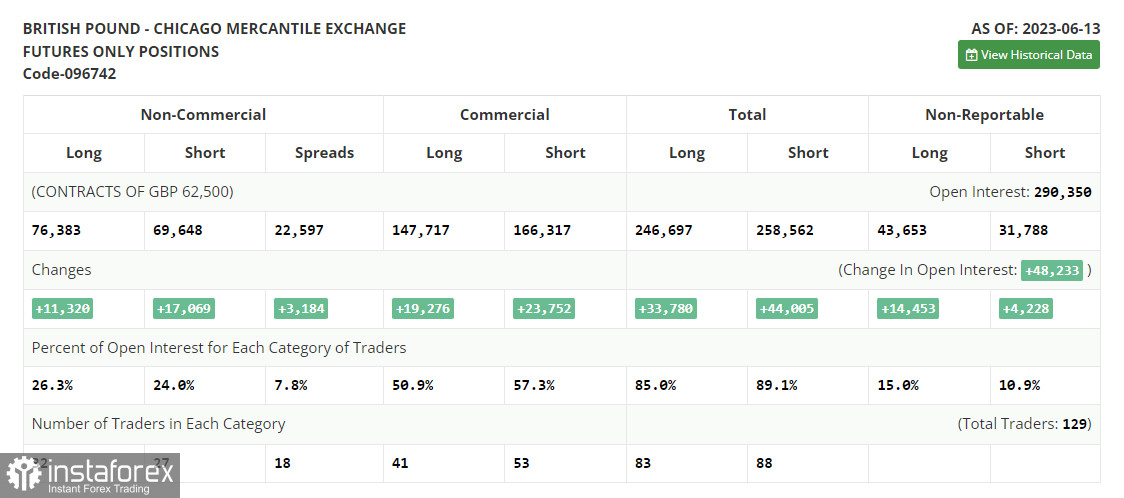

The COT (Commitment of Traders) report for June 13 indicated a significant increase in both long and short positions. The pound has recently risen considerably, attracting the attention of sellers. However, the Bank of England's aggressive policies and the UK's recent inflation data attract new buyers anticipating further interest rate hikes. The attractiveness of the British pound remains strong due to the Federal Reserve pausing its monetary tightening cycle while the Bank of England has no such plans. The latest COT report states that short non-commercial positions increased by 17,069 to 69,648, while long non-commercial positions jumped by 11,320 to 76,383. This resulted in a slight decrease in the non-commercial net position to 6,736 compared to the previous week's 12,454. The weekly price increased and reached 1.2605 compared to 1.2434.

Indicator signals:

Moving Averages

Trading is taking place below the 30-day and 50-day moving averages, indicating further decline in the pair.

Note: The author considers the period and prices of the moving averages on the hourly H1 chart, which differs from the general definition of classical daily moving averages on the daily D1 chart.

Bollinger Bands

In case of a decline, the lower boundary of the indicator, around 1.2692, will act as support.

Description of Indicators:

• Moving Average: Determines the current trend by smoothing volatility and noise. Period: 50. Marked in yellow on the chart.

• Moving Average: Determines the current trend by smoothing volatility and noise. Period: 30. Marked in green on the chart.

• MACD Indicator (Moving Average Convergence/Divergence): Fast EMA period 12, Slow EMA period 26, SMA period 9.

• Bollinger Bands: Period 20.

• Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.

• Long non-commercial positions represent the total long open positions of non-commercial traders.

• Short non-commercial positions represent the total short open positions of non-commercial traders.

• Non-commercial net position is the difference between non-commercial traders' short and long positions.