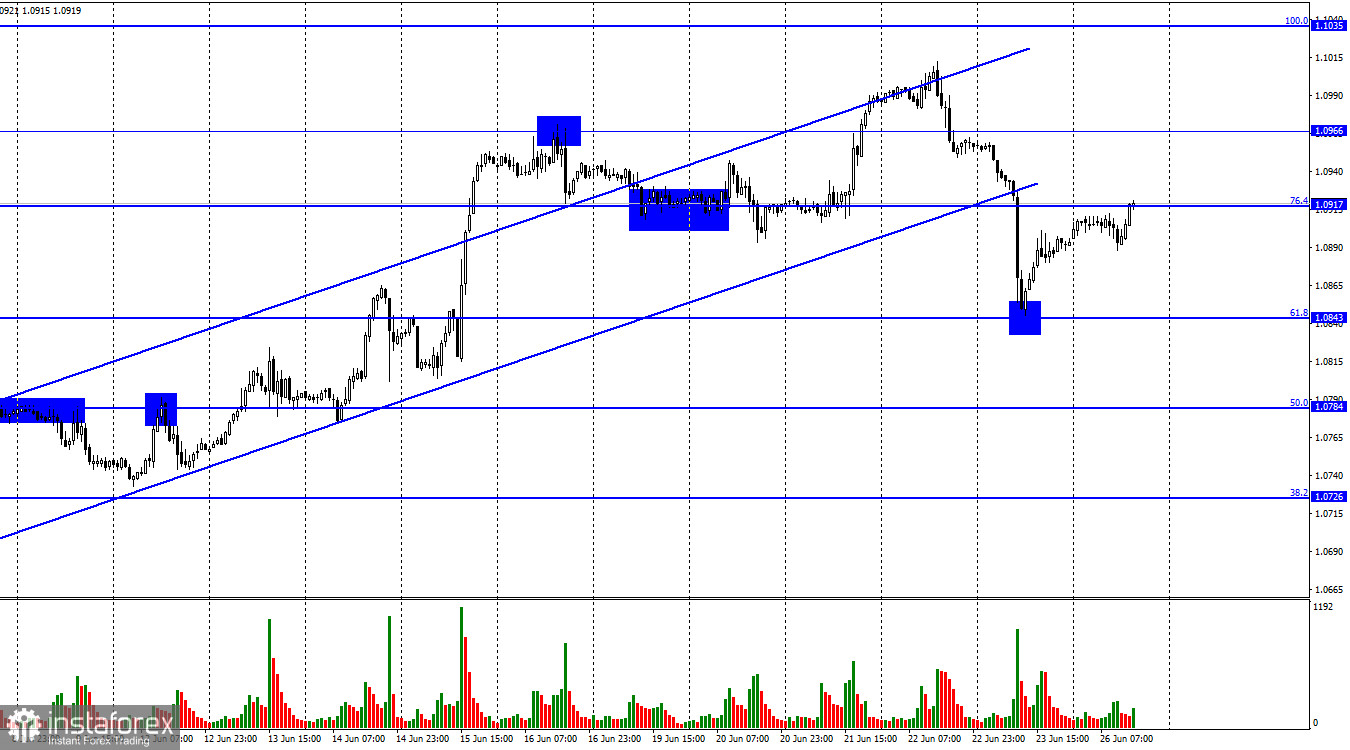

Hi, dear traders! On Friday, EUR/USD declined to the 61.8% retracement level at 1.0843 and rebounded upwards. On Monday, the pair retraced to the 76.4% Fibonacci level at 1.0917. If the pair bounces off that level and reverses downwards, it will lead to a new decline towards 1.0843. If EUR/USD manages to stay above 1.0917, further growth towards levels 1.0966 and 1.1035 will become more likely. Last week also saw a breakout below the ascending trend corridor, which was expected to change traders' sentiment to bearish.

On Friday, nine business activity index data were released, which caught the attention of traders. All of them turned out to be negative. Both European and German indices declined, with the European indices experienced a more significant drop compared to the American ones. As a result, we witnessed a substantial decline in the European currency in the first half of the day, followed by a milder decline of the US dollar in the second half.

There were no data releases on Monday, but today ECB President Christine Lagarde is set to give her speech. Lagarde is likely to once again talk about high inflation and the need to continue raising interest rates, and will likely not provide any new information. Later this week, the European inflation data will be released - only then can we draw new conclusions and expect changes in the rhetoric of the ECB Governing Council members. However, there is no doubt that the rate will be increased by 0.25% at the next meeting. Thus, the current rhetoric of ECB policymakers is not particularly important.

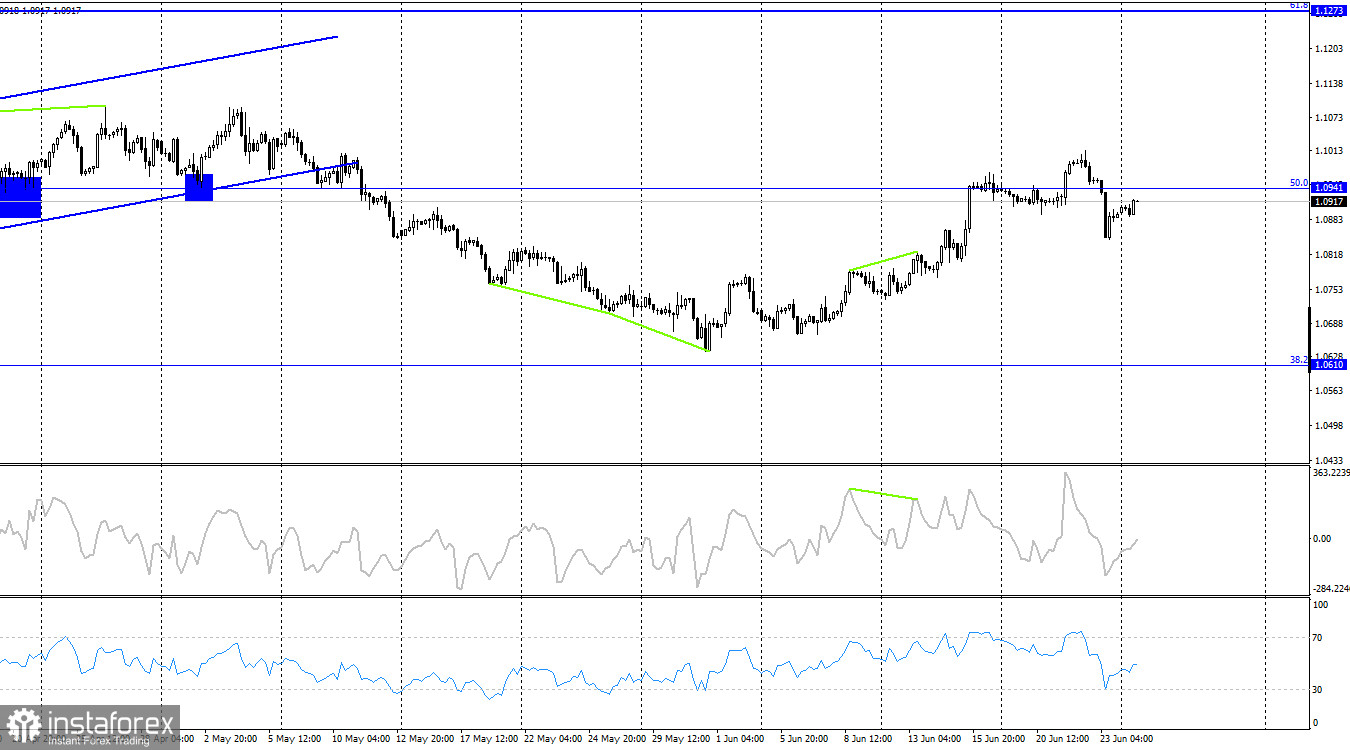

On the H4 chart, the pair reversed downwards, settling below the 50.0% retracement level at 1.0941. Consequently, it may continue to slide down towards the next Fibonacci level at 38.2% (1.0610). Indicators are showing no imminent divergences today. If the quote manages to stay above 1.0941, it will once again give support to the euro, potentially leading to EUR resuming its upward movement towards the 61.8% retracement level at 1.1273.

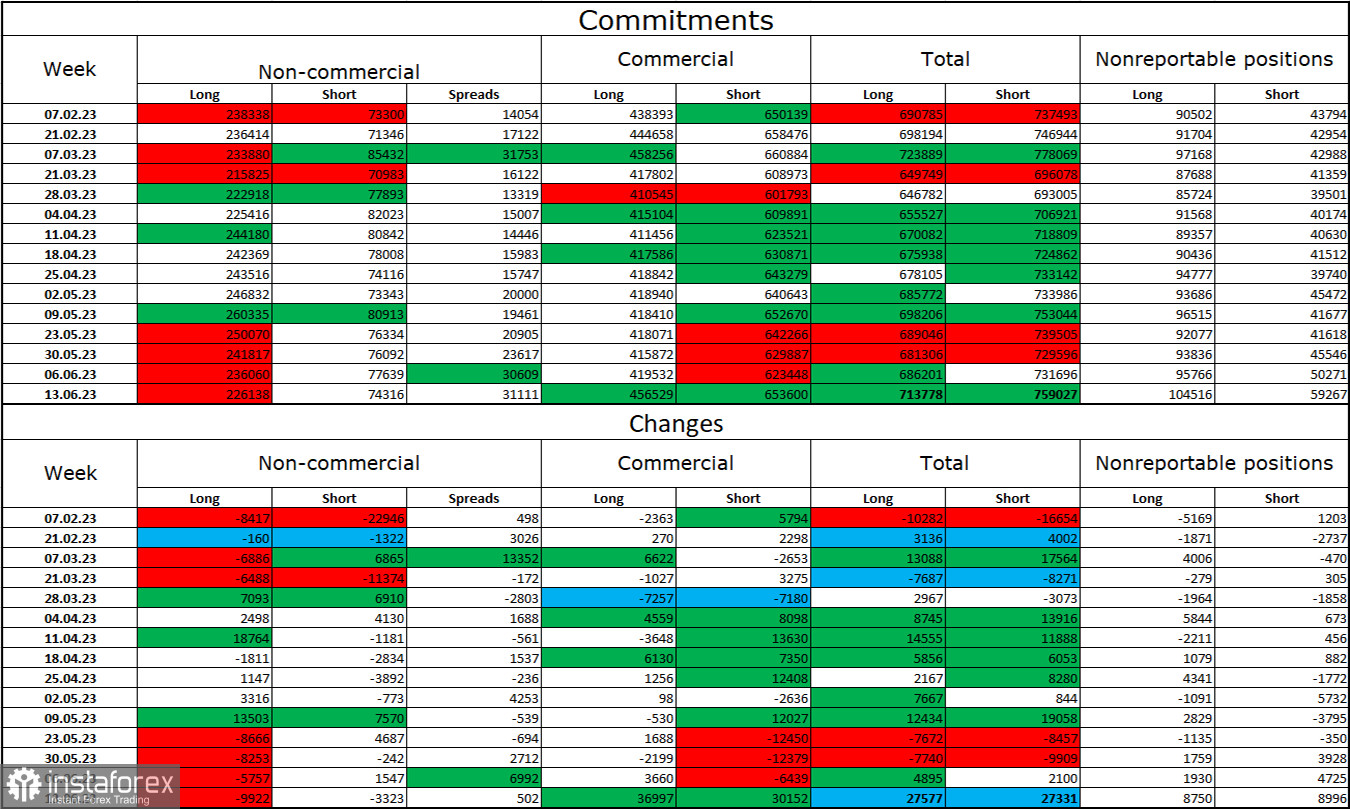

Commitments of Traders (COT) report:

During the last reporting week, speculators closed 9,922 Long contracts and 3,323 Short contracts. The sentiment of large traders remains bullish but is gradually weakening. The total number of Long contracts held by speculators is now 226,000, while open Short contracts amount to only 74,000. Strong bullish sentiment has remained for now, but I believe the situation will continue to change in the near future. The European currency has been experiencing more frequent declines than gains over the past two months. The large amount of open Long contracts suggests that buyers may start closing them soon (or have already started, as indicated by the latest COT reports). The bullish imbalance is now too strong. I believe the current figures allow for a new decline in the euro in the near future.

EU and US economic calendar:

EU - Speech by ECB President Lagarde (17:30 UTC).

On June 26, the economic calendar is practically empty, with only one event that can be considered significant. It can have a moderate influence on traders.

Outlook for EUR/USD:

Earlier, I advised opening short positions if the pair closed below the trend corridor on the hourly chart, with a target at 1.0843. This target has been reached. New short positions can be considered if EUR/USD rebounds from 1.0917, with targets at 1.0843 and 1.0784. Long positions can be opened if the pair closes above 1.0917, with targets at 1.0966 and 1.1035.