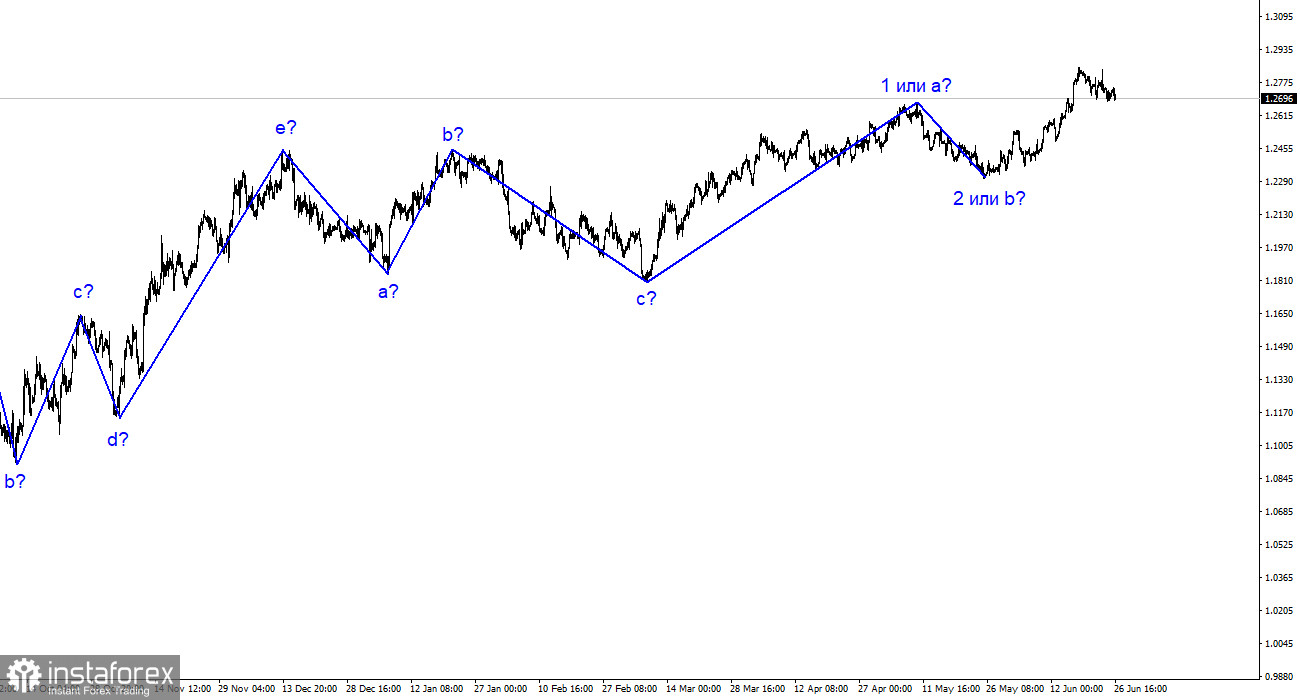

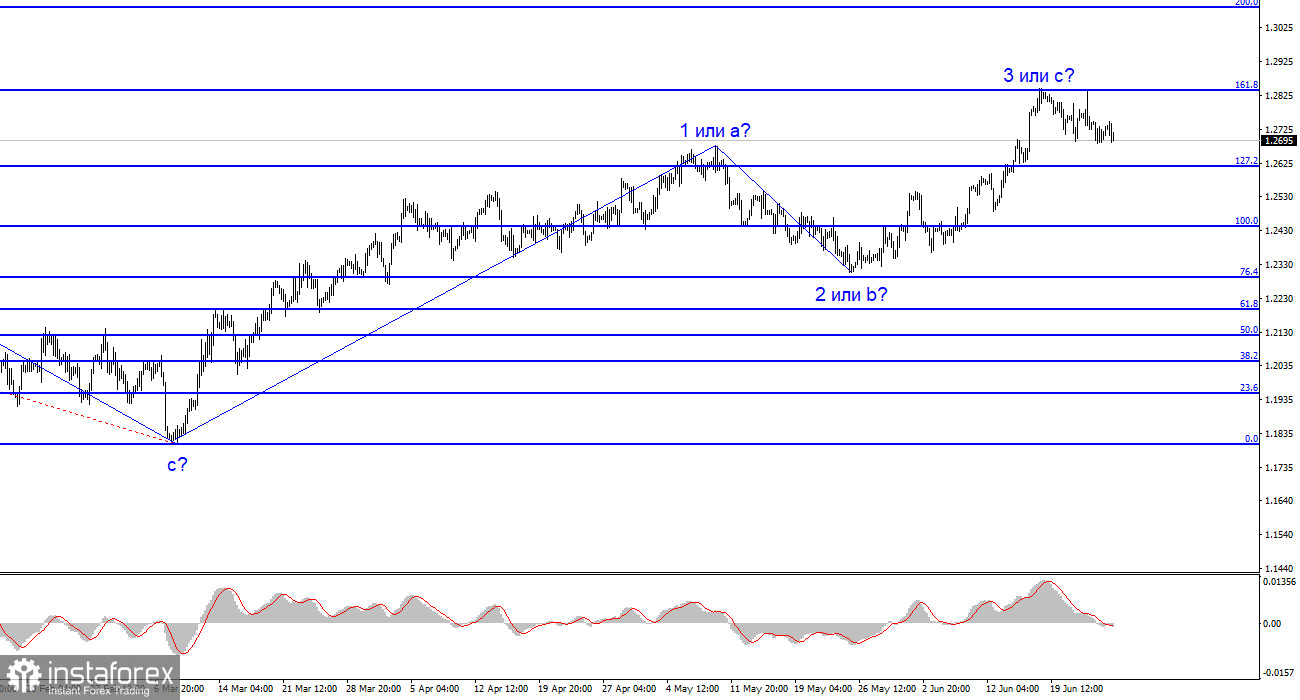

The wave analysis for the GBP/USD pair has been simplified for better understanding. Instead of a complex corrective trend, we may witness either an impulsive upward movement or a simpler corrective wave. Ongoing construction of an ascending wave 3 or c presents an opportunity for the British pound to rise towards the 1.30 level. However, evaluating if the current news background justifies this is important. There are no solid grounds for the British pound to continue rising to the 1.30 or 1.35 levels (unless it is part of an impulsive trend). It is also possible that the presumed wave 3 or c has already been completed. While wave analysis can become more complex, I prefer to rely on simpler patterns for easier analysis.

It's worth noting that the wave analysis for the EUR/USD pair differs significantly from GBP/USD, which is uncommon. The expectation for the euro is the formation of a descending wave pattern, but wave analysis may transform into a similar pattern as the British pound, aligning the two. For the British pound, it is an ascending trend. The 161.8% Fibonacci level and two unsuccessful attempts to break it suggest a potential decline.

Demand for the British pound continues to decrease gradually.

The GBP/USD exchange rate remained stagnant on Monday. Although there has been a sluggish retreat from previous highs over the past week, it's challenging to confidently state the completion of ascending wave 3 or c and the entire trend segment due to its weak nature. The 161.8% Fibonacci level has hindered upward movement twice, but that doesn't prevent further attempts. The market might expect the formation of a new descending wave pattern, but currently, the British pound doesn't show a willingness to decline.

This situation arises from the surprising move by the Bank of England last week, raising the interest rate by 50 basis points. The market anticipates more aggressive tightening from the British central bank to combat inflation. The Bank of England cannot consistently raise interest rates; eventually, they must halt the increases. However, there is still potential for further growth. I didn't anticipate such radical measures from the Bank of England.

This week, the speeches of Jerome Powell, the Federal Reserve Chair, will also impact the GBP/USD pair. Despite speaking twice last week and once the week before, significant new information may still be shared. The market needs a complete understanding of the number of expected rate hikes, and the more hawkish Powell's statements are, the higher the likelihood of increased demand for the dollar, which is currently in demand.

In summary, the wave pattern for the GBP/USD pair has changed, indicating the formation of an ascending wave that could complete at any moment. Consider buying the pair, but only if a successful break is above the 1.2842 level. Selling could also be an option, as there have been two unsuccessful attempts to break this level, with a stop loss set above it. Additionally, the MACD indicator has signaled a downward movement.

The picture is similar to the EUR/USD pair on a larger scale, but there are still some differences. The descending corrective trend segment is complete, and a new ascending segment is being formed, which could conclude soon or take the form of a complete five-wave structure. Even if it is a three-wave structure, the third wave could be extended or truncated.