The GBP/USD currency pair traded calmly and sluggishly on Friday and Monday, with no significant price changes despite the business activity indices in the service and manufacturing sectors of the UK and the US failing to impress pound traders. As of Tuesday morning, the price is near the moving average and has attempted but failed to surpass the Murray level of "4/8"-1.2695 twice. Therefore, there is no guarantee of a further decline in quotes, despite the price being below the moving average. This pattern of unjustified growth followed by unexpected declines has become typical for the pound in recent months, making its movements less predictable compared to other currencies like the euro.

Given this scenario, focusing more on technical analysis is advisable, as it reacts quickly to market changes. In the 24-hour timeframe, the GBP/USD pair is near the 61.8% Fibonacci level without a clear breakthrough or rebound. Since the price is above all the lines of the Ichimoku indicator, further growth is more likely. From a fundamental perspective, the pound has already priced in all potential growth factors, even with the recent 0.5% rate increase. Over the past ten months, the British currency has steadily grown, gaining 2500 points. It's worth noting that the Federal Reserve is also tightening its monetary policy, but for some reason, only the pound is experiencing significant growth.

It should be remembered that the Bank of England has already raised its key rate to 5%, raising questions about how much more objectively they can increase it. The decision last Thursday to opt for the most "hawkish" option was surprising. What's next? If inflation next month shows an unsatisfactory value, will there be another rate hike of 0.5%? At this rate, the rate could rise to 6% or 7%, but what impact will it have on the economy?

This week, there are a few significant events in the UK. Notable highlights include speeches by Hugh Pill and Silvana Tenreiro and the GDP report for the first quarter (final estimate) on Friday. However, it is important to note that GDP reports rarely deviate from forecasts and rarely elicit significant market reactions. The British GDP has remained around 0% for four consecutive quarters, and only a significant decline in this indicator can stir emotions among traders. Considering the Bank of England's strategies to combat high inflation, an economic decline is possible.

There are more significant events in the United States this week, with two speeches by Jerome Powell being the primary focus. These will be his fourth and fifth speeches in 2.5 weeks. Last week, during discussions in the US Congress, Powell confirmed that the talks in June were only about a pause in the tightening cycle, not its end. His rhetoric can be considered "hawkish," and it is unlikely to change this week. The US will publish a report on durable goods orders and new home sales on Tuesday. Tomorrow, Powell will deliver a speech. On Thursday, Powell will have another speech, the GDP report for the first quarter (final estimate), and unemployment claims. On Friday, personal income and expenditure data for the American population and the University of Michigan's consumer sentiment index will be collected. While there are several events, most are expected to have minimal impact on the market. It is challenging to predict the movement of the GBP/USD pair this week due to its recent illogical trading behavior.

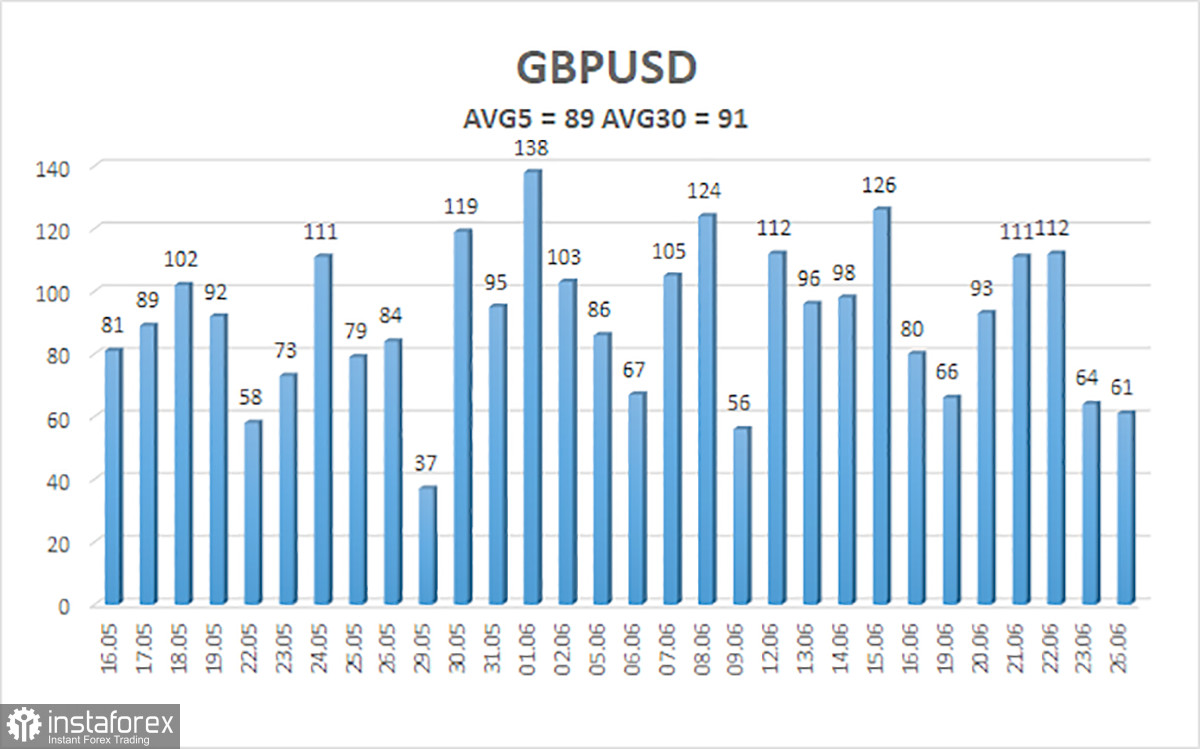

The average volatility of the GBP/USD pair over the past five trading days has been 89 points, considered "average" for this currency pair. Consequently, on Tuesday, June 27, movement within the range of 1.2638 and 1.2816 is expected. A reversal of the Heiken Ashi indicator upwards would signal a potential resumption of the upward movement.

Nearest support levels:

S1 - 1.2695

S2 - 1.2634

S3 - 1.2573

Nearest resistance levels:

R1 - 1.2756

R2 - 1.2817

R3 - 1.2878

Trading recommendations:

On the 4-hour timeframe, the GBP/USD pair continues to correct. Currently, long positions with targets at 1.2756 and 1.2817 are relevant, and they should be opened in case of a reversal of the Heiken Ashi indicator upwards. Short positions can be considered if the price consolidates below the level of 1.2695, with targets at 1.2638 and 1.2573.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both channels move in the same direction, it indicates a strong trend.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel the pair is expected to trade in the next 24 hours based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or overbought area (above +250) indicates an upcoming trend reversal in the opposite direction.