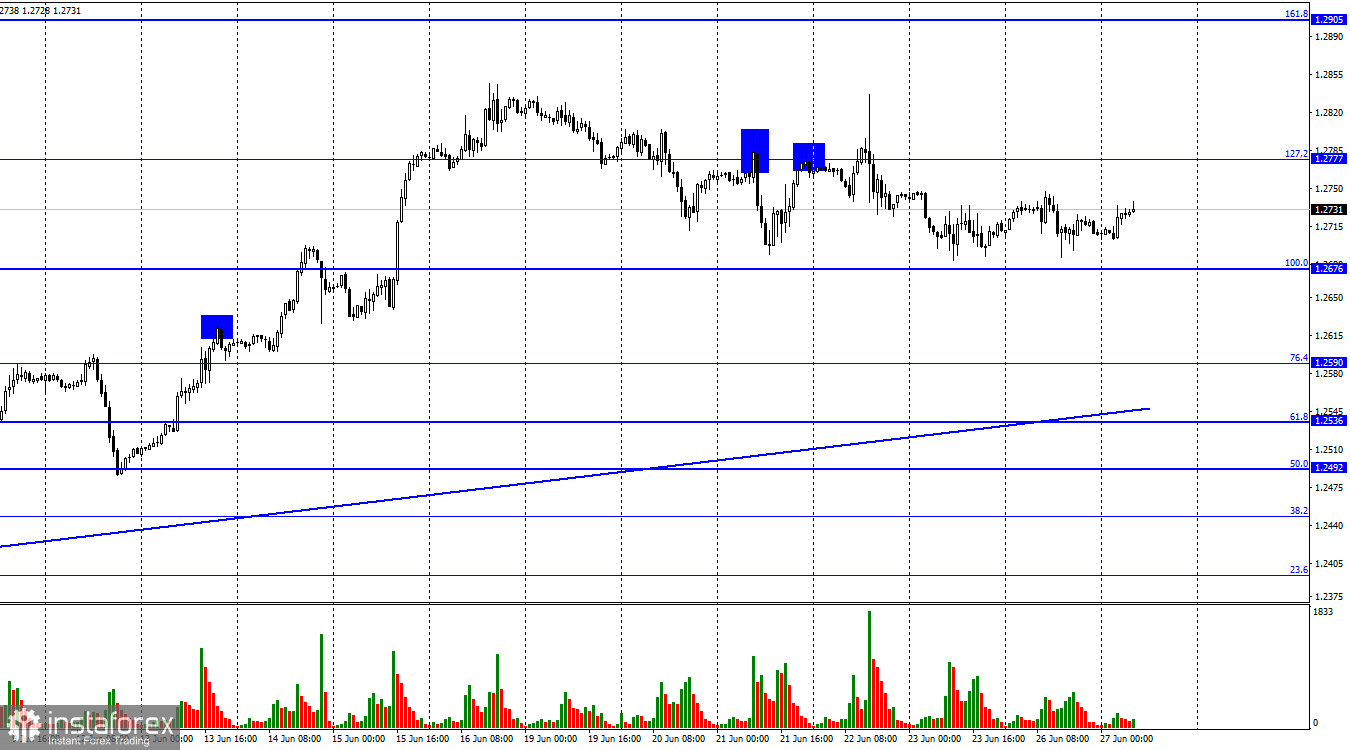

Hello, dear traders! On the 1-hour chart, GBP/USD is trading horizontally between 1.2676 and 1.2777. There have been no rebounds from these levels in recent days. Consequently, there have been no buy or sell signals. The ascending trend line reflects bullish market sentiment.

According to a Reuters survey, economists mostly bet on two more 0.25% rate hikes from the Bank of England. Due to high inflation, the regulator will unlikely pause tightening. Economists also anticipate easing as early as the second quarter of next year.

Interestingly, most economists now see interest rates peak at 6%, which is higher compared to all the forecasts published in recent months. It is possible that the BoE's rate is raised higher than the Fed's, but inflation in the UK is also higher.

So, the pound will likely be in demand in the coming months. The Fed may also lift rates twice more. However, there is a greater likelihood that it would be done by the BoE. This factor may urge the bulls to keep buying. Today, MPC member Silvana Tenreyro will deliver a speech. Her remark may confirm the opinion of the economists surveyed by Reuters, or it may not.

In the 4-hour time frame, a bearish reversal occurred. The downtrend resumed toward the 100.0% retracement level of 1.2674. A rebound from this level will indicate a resumption of the uptrend to 1.2860. If quotes close below 1.2764, the fall may extend to 1.2441. The MACD reflects a bearish divergence.

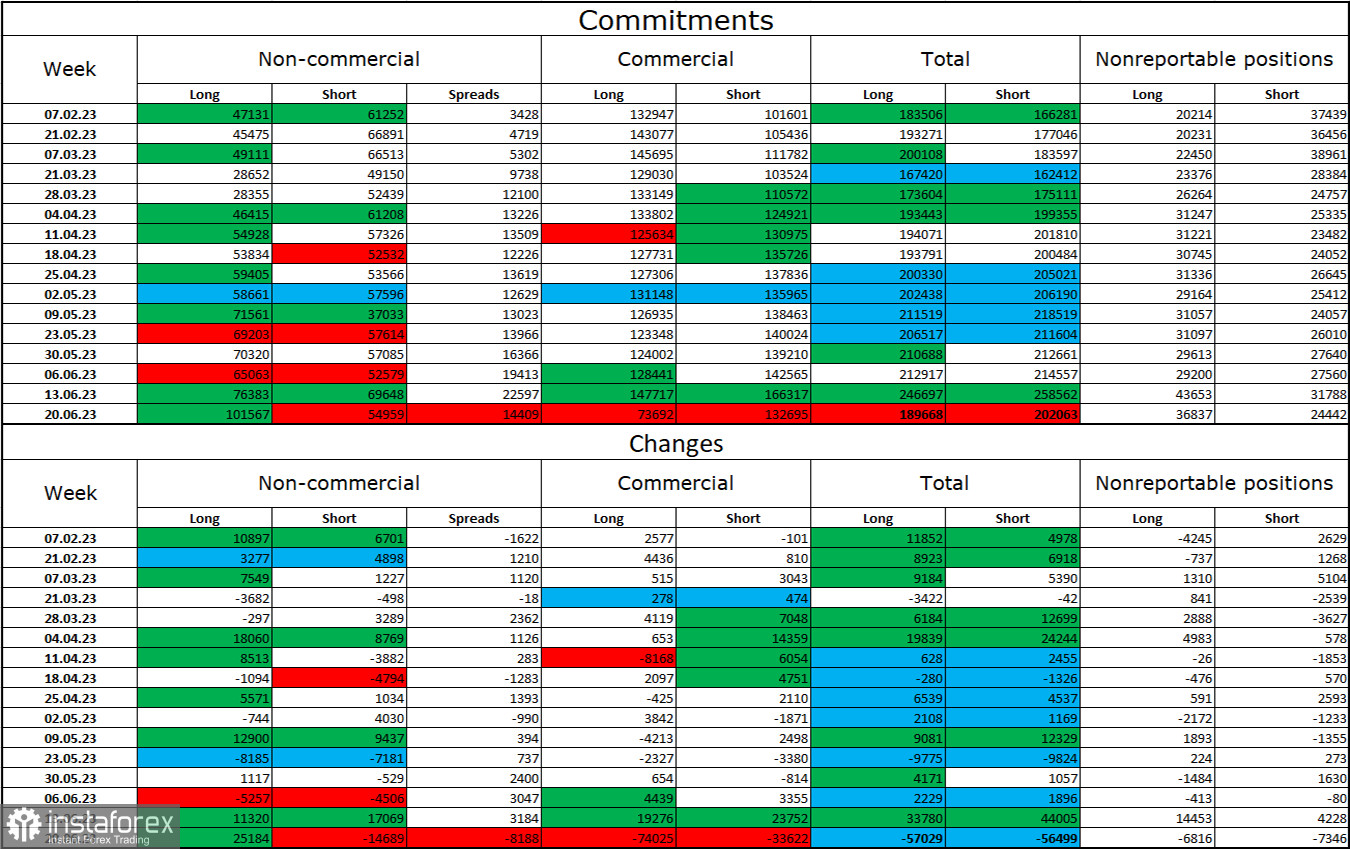

Commitments of Traders:

The sentiment of non-commercial traders has become more bullish over the reporting week. The number of long positions increased by 25,184 and that of short positions dropped by 14,689. Overall, the sentiment of large traders remains bullish. Over the past two weeks, a wide gap between the number of long and short positions has appeared: 101,000 vs 55,000 respectively. The pound sterling has enough growth potential and the fundamental backdrop is favorable for it rather than for the US dollar. Nevertheless, we do not bet on a steep increase in the sterling in the near term because the market has already priced in the BoE's 0.50% rate hike.

Macroeconomic calendar:

UK: MPC member Silvana Tenreyro speaks (08-30 UTC).

US: Building Permits (12-00 UTC); Durable Goods Orders (12-30 UTC); New Home Sales (14-00 UTC).

The macroeconomic calendar contains a row of macro reports on Tuesday. They will mostly be of secondary importance. Therefore, the fundamental backdrop will hardly influence trader sentiment in the second half of the day.

Outlook for GBP/USD:

We considered selling after a rebound from 1.2777 with the target at 1.2676 on the 1-hour chart. The target was reached. We will open new short positions after the price closes below 1.2676, targeting 1.2590 and 1.2536. We will also buy on a rebound to 1.2676 with the target at 1.2777 on the 1-hour chart.