Preliminary data on durable goods orders show a growth of 1.7% in May, marking the third consecutive month of growth, despite a predicted decrease of 1%. The overall report is positive and undoubtedly provides support to the dollar in the short term, as it alleviates concerns about the approaching recession due to aggressive rate hikes and gives the Federal Reserve additional grounds for another increase.

The risk asset sentiment is recovering today, with stock indices in Asia rising across the board except for Japan. European indices are trading near Monday's closing levels, and September Brent futures remain above $73 per barrel.

Currently, only two major banks continue to pursue easing policies - the Bank of Japan and the People's Bank of China. The yen continues to depreciate and will only stabilize when the BoJ takes action to withdraw stimulus. As for China, its slow exit from COVID-19 restrictions acts as a natural brake on the currencies of countries for which it is a major trading partner, including Australia and New Zealand.

Until China demonstrates a return to its usual sustainable growth trajectory, the currencies of Australia and New Zealand will face additional pressure due to deteriorating trade balances.

NZD/USD

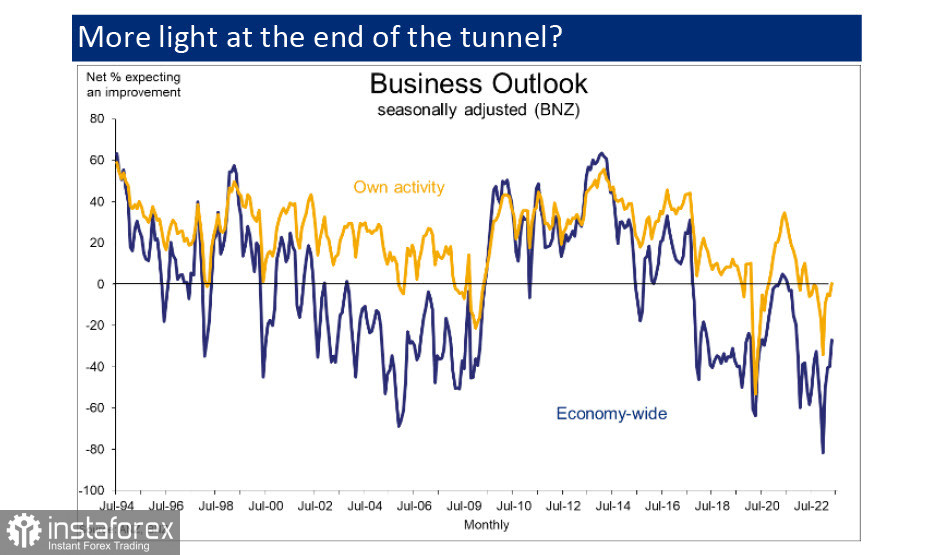

On Thursday, the activity and business optimism indexes from the Reserve Bank of New Zealand (RBNZ) will be published. In May, overall business sentiment surged, and it is likely that this growth will continue. Expectations regarding own activity have also turned positive, and intentions for housing construction have risen. This is an unpleasant sign for the RBNZ since it was anticipated that housing investments would decrease with interest rate hikes, but in practice, this has not happened, and thus, this component of rising inflation remains strong.

Overall, the situation worsens for the RBNZ as there is ample evidence that inflationary pressures remain strong and will persist for a long time. However, for the kiwi, this trend is positive, as it increases the chances of further rate hikes and yield growth, which in turn will drive demand for the currency.

On Friday, the subsidy program for public transport, roads, and gasoline prices will expire, leading to inflationary pressures in these components.

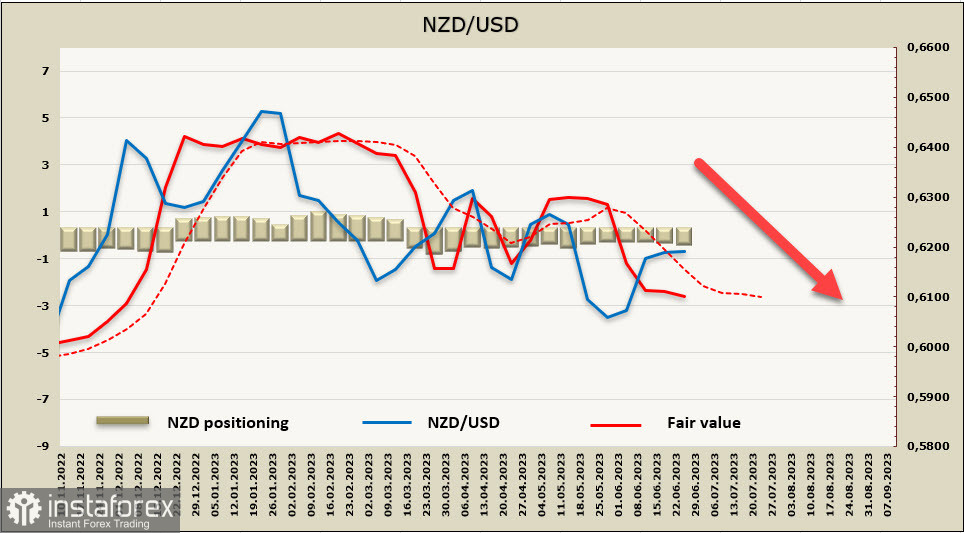

Regarding RBNZ's position, it currently leans more toward bearish factors for the kiwi. Several central banks have raised interest rates in the past two weeks, while the RBNZ adheres to a "watch and wait" strategy. At least that's what the bank's Governor Orr has expressed regarding future actions. Consequently, as long as the RBNZ doesn't indicate its readiness to continue raising rates if inflation slows down more slowly than forecasted, the kiwi will remain under additional pressure, and the chances of growth will be low.

Positioning on NZD remains neutral. In the reporting week, the short position increased by NZ$113 million to -NZ$164 million. The calculated price is below the long-term average and pointing downwards.

The kiwi is trading within a bearish channel, with a low probability of retesting the local high at 0.6244. Attempts at upward movement can be used to identify potential short positions. The nearest target is the mid-channel at 0.6075/90, while the long-term target is the lower boundary of the bearish channel at 0.5890/5910.

AUD/USD

The RBA meeting will take place next week, with the latest data being the focal point that could influence the Bank's stance on interest rates, particularly the May Consumer Price Index, which will be published on Wednesday morning. Caution should be exercised with regard to this indicator, as some parameters are measured quarterly and will not be included in the May index. In addition, inflation-base effects will be distorted due to a sharp decrease in fuel components (an 11% increase in May 2022 will be replaced by a 5% decrease in May 2023).

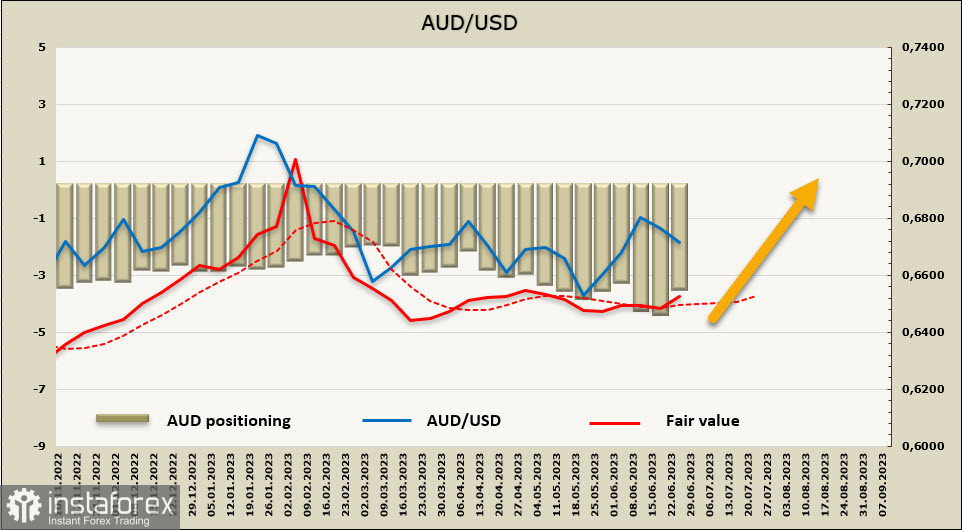

NAB Bank predicts high inflation for an extended period, and even if inflation for goods decreases due to supply chain reductions and stabilizing energy prices, it will remain very high in the services sector for a long time. There are increasing signs of economic activity slowing down, with GDP expected to grow by only 0.5% this year, and unemployment reaching 5% by the end of 2024. The RBA's peak interest rate forecast is currently at 4.6%, lower than the Fed's rate, and the yield spread is also not in favor of the Aussie.

On Thursday, data on job vacancies for May and retail sales will be published. Market reaction could be significant and lead to increased AUD volatility.

The net short position on AUD decreased by $812 million to -$3.3718 billion during the reporting week, maintaining a bearish positioning. However, there are signs that buying pressure may strengthen.

The aussie still lacks a clear direction, with any movements quickly being reversed. There is no evident driver that could provide a sustained momentum for a significant move. Support is seen near the technical level of 0.6629, and a deeper decline is unlikely, but an upward retest of the local high at 0.6902 is also unlikely. Trading within a range with a slight bias towards growth is expected.