Analysis of Tuesday's trades:

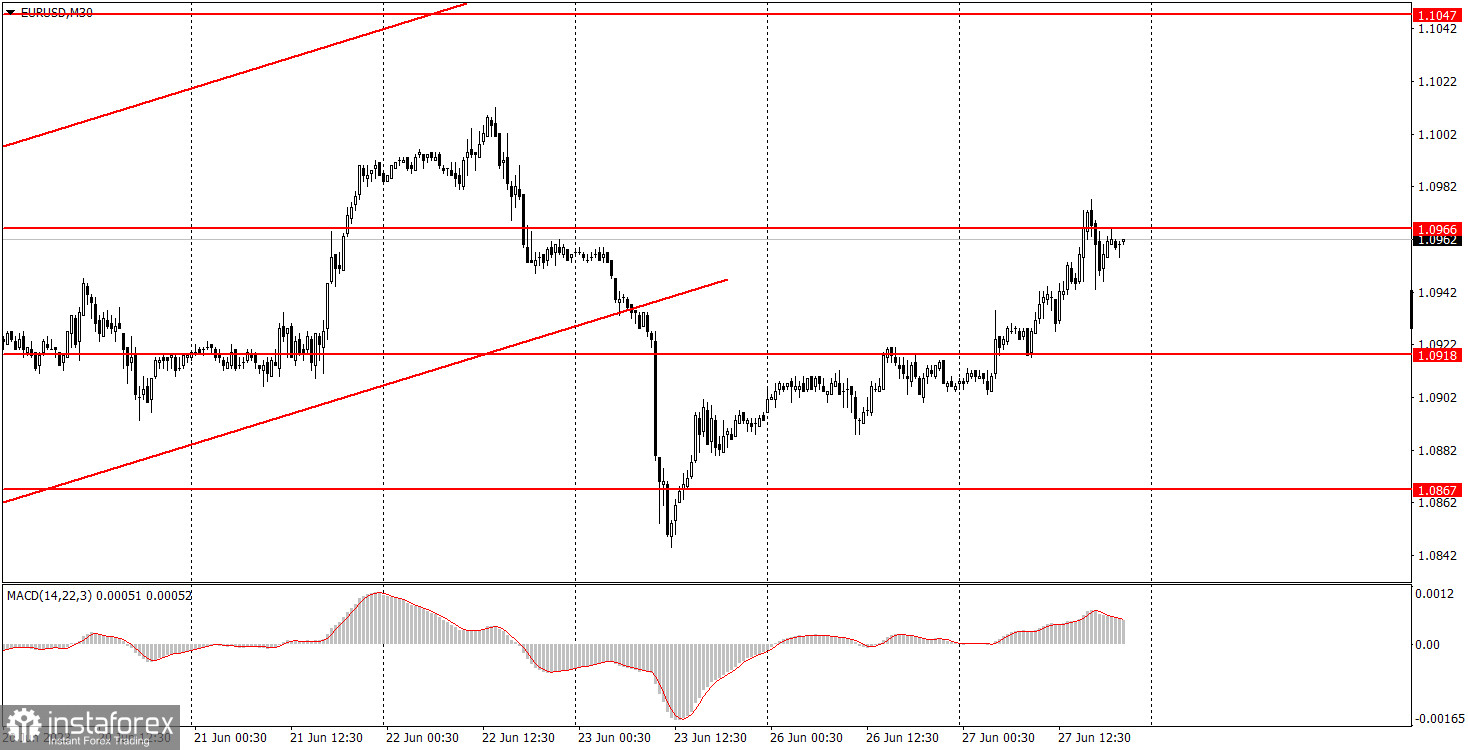

EUR/USD 30M chart

The EUR/USD currency pair traded more actively during the second day of the new week, managing to add about 60 pips. While this isn't indicative of extreme volatility, it's a notable improvement from Monday's trading activity. Several events today could have influenced the mood of traders. One of them was a speech by the ECB Chair, Christine Lagarde, at the ECB's economic forum. During her address, Ms. Lagarde stated that inflation in the European Union remains extraordinarily high, and the regulator is prepared to continue tightening the policy to an extent necessary to ensure price stability. Although the ECB Chair didn't say anything new on Tuesday, her speech can still be considered hawkish, which might have provided support to the euro.

Several not-so-crucial reports were also published in the US, and all of them turned out stronger than forecasts. However, the market did not pay any attention to these data, and the dollar only managed to briefly grow by about 20 pips before it started falling again.

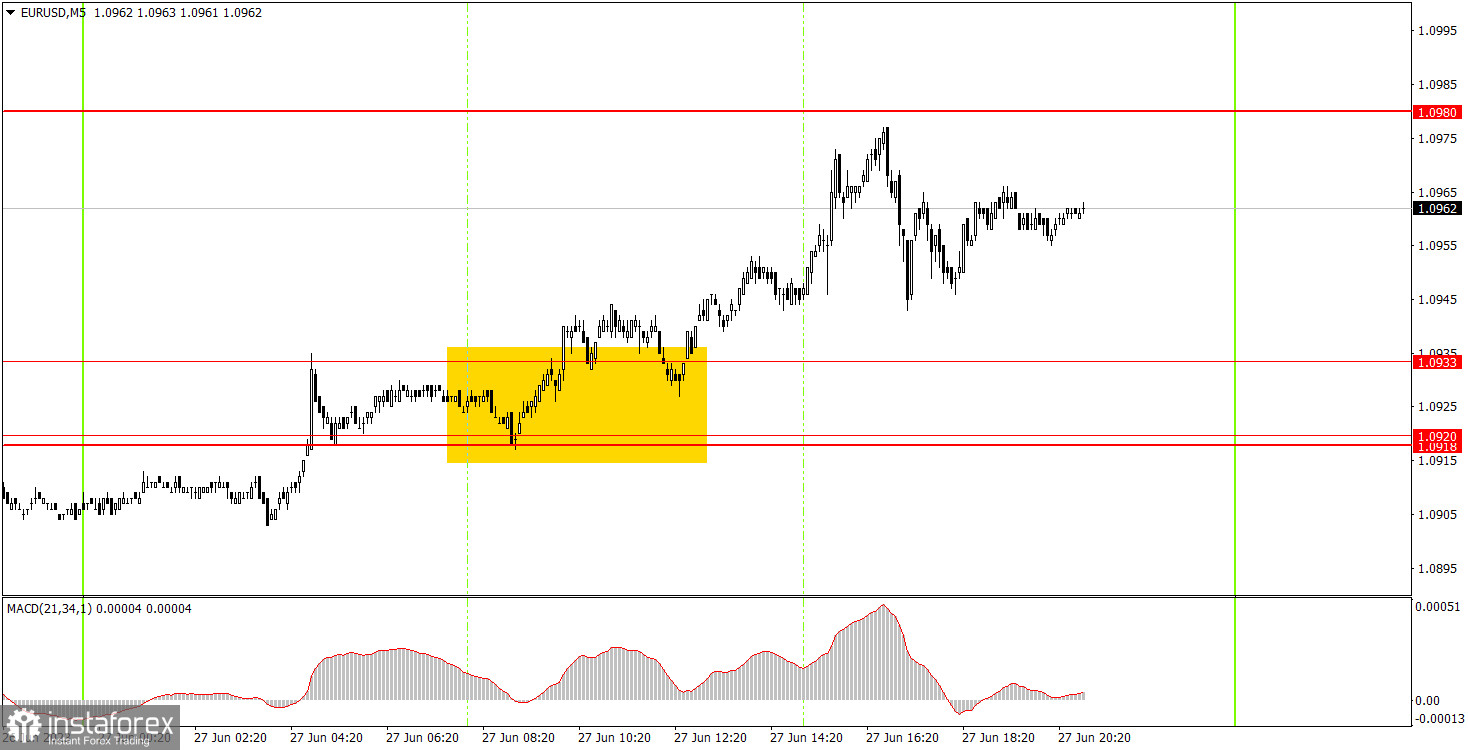

EUR/USD 5M chart

Only one trading signal was formed on the 5-minute timeframe today. The pair first breached the 1.0918-1.0933 area during the European trading session, and then rebounded from above. Therefore, novice traders had an opportunity to open a long position. Afterward, the euro rose almost to the 1.0980 level, falling short by only 3 pips. This is a significant deviation for the European currency, so the trade should have been closed virtually anywhere closer to the evening. It was profitable in any case, yielding about 20 pips.

Trading plan for Wednesday:

On the 30-minute timeframe, the pair has secured a position below the ascending channel, so the trend has formally switched to a downward one. However, we are once again observing an increase in the euro. Recently, the tone of the ECB has turned more hawkish, and the market has started to believe that the rate will continue to rise for an extended period, which could support the euro. On the 5-minute timeframe tomorrow, the levels to consider are 1.0733, 1.0761, 1.0803, 1.0857-1.0867, 1.0918-1.0918, 1.0980, 1.1038, 1.1091, and 1.1132. If you see a movement of 15 pips in the right direction, you can set your Stop Loss to break even.

On Wednesday, there will be a new speech by Christine Lagarde, as well as other representatives of the ECB's Monetary Committee, including Luis de Guindos and Philip Lane. At the same event in Sintra, Jerome Powell will also speak, so these events could potentially provoke market reactions.

The basic rules of the trading system:

1) The strength of the signal depends on the time period during which the signal was formed (a rebound or a break). The shorter this period, the stronger the signal.

2) If two or more trades were opened at some level following false signals, i.e. those signals that did not lead the price to Take Profit level or the nearest target levels, then any consequent signals near this level should be ignored.

3) During the flat trend, any currency pair may form a lot of false signals or do not produce any signals at all. In any case, the flat trend is not the best condition for trading.

4) Trades are opened in the time period between the beginning of the European session and until the middle of the American one when all deals should be closed manually.

5) We can pay attention to the MACD signals in the 30M time frame only if there is good volatility and a definite trend confirmed by a trend line or a trend channel.

6) If two key levels are too close to each other (about 5-15 pips), then this is a support or resistance area.

How to read charts:

Support and Resistance price levels can serve as targets when buying or selling. You can place Take Profit levels near them.

Red lines are channels or trend lines that display the current trend and show which direction is better to trade.

MACD indicator (14,22,3) is a histogram and a signal line showing when it is better to enter the market when they cross. This indicator is better to be used in combination with trend channels or trend lines.

Important speeches and reports that are always reflected in the economic calendars can greatly influence the movement of a currency pair. Therefore, during such events, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginning traders should remember that every trade cannot be profitable. The development of a reliable strategy and money management are the key to success in trading over a long period of time.