Analysis of the market situation

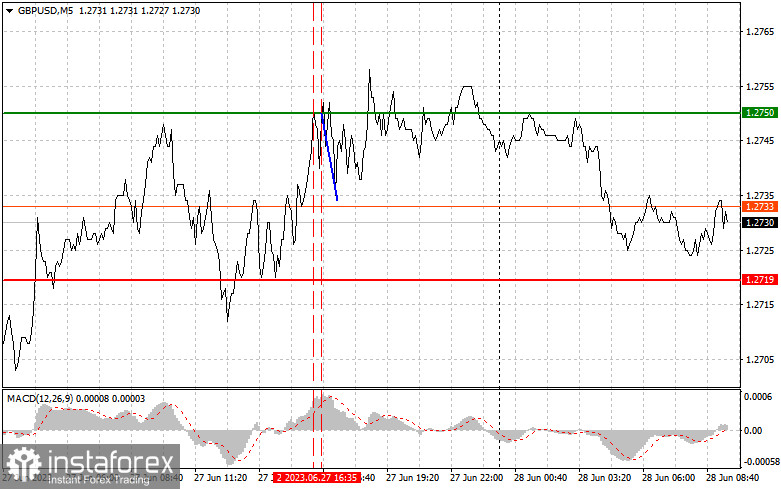

The price tested the level of 1.2750 when the MACD indicator was slightly above zero, which capped the upward potential of the pair. The test of 1.2750 became a reason for selling GBP/USD after a short period of time. However, there was no significant downward movement.

Today, there is no important fundamental data from the UK. Thus, traders will focus on the speech of the BoE Governor, Andrew Bailey. He may touch on the prospects of monetary policy. Aggressive statements on high inflation and the need to combat it will certainly boost demand for the pound. In this case, the pair may go above the sideways channel where it has been trading since the end of last week. For this reason, it is better to take into account scenario №1.

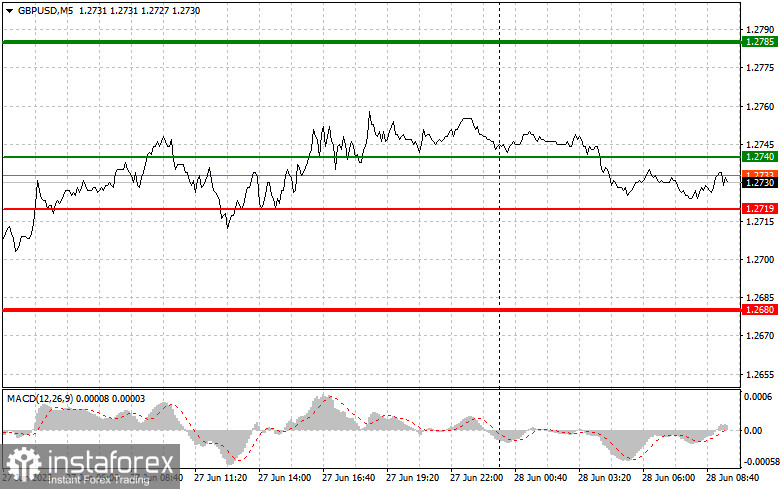

Signals to buy GBP/USD:

Scenario №1: You can buy the pound today after the price touches the entry point in the area of 1.2740 (green line on the chart). In the event of this, the pair may rise to the level of 1.2785 (thicker green line on the chart). I recommend closing buy orders and opening sell ones around 1.2785, expecting a decline of 30-35 pips. You can count on the rise in the pound, but only after it leaves the sideways channel. Important! Before buying, make sure that the MACD indicator is above the zero level and is just beginning to rise from it.

Scenario №2: You can also buy the pound today in the event of two consecutive tests of 1.2719 at a time when the MACD indicator will be in the oversold area. This will limit the pair's downward potential and lead to an upward reversal. You can expect a rise to the levels of 1.2740 and 1.2785.

Signals to sell GBP/USD:

Scenario №1: You can sell the pound today only after the price drops below the level of 1.2719 (red line on the chart), which will lead to a rapid decline in the pair. The key target for sellers will be at 1.2680, where I recommend closing sell orders and immediately opening buy orders, expecting an increase of 20-25 pips. Pressure on the pound will return in the event of a breakout of the lower boundary of the channel. Important! Before selling, make sure that the MACD indicator is below the zero mark and is just beginning to decline from it.

Scenario №2: You can also sell the pound today in the event of two consecutive tests of 1.2740 at a time when the MACD indicator will be in the overbought area. This will limit the pair's upward potential and lead to a downward reversal. You can expect a decrease to 1.2719 and 1.2680.

What we see on the trading charts:

A thin green line is the entry price at which you can buy a trading instrument.

A thick green line is the estimated price where you can place a take-profit order or lock in profits by yourself since the price will hardly go above this level.

A thin red line is the entry price at which you can sell the trading instrument.

A thick red line is the estimated price where you can place a take-profit order or lock in profits by yourself since the price is unlikely to decline further.

The MACD indicator. When entering the market, it is important to take into account overbought and oversold zones.

Beginning traders should be very cautious when making decisions to enter the market. It is better to open positions ahead of the publication of important reports in order to avoid price fluctuations. If you decide to enter the market amid the news release, place stop orders to minimize losses. Otherwise, you may lose all your funds, especially if you do not use money management and trade big volumes.

Please remember that successful trading requires an accurate trading plan similar to the one described above. Knee-jerk decisions made amid the current market situation are a losing strategy of an intraday trader.