Markets continue to fluctuate as there is no clear understanding of where central banks, and the Fed in particular, are heading.

The current situation reveals a lack of a clear strategic plan amidst ambiguous behavior of the Fed, and this is reflected in the tactical behavior of investors. Their strategy seems to revolve around short-term deals based on either extreme economic statistical data or economic rumors and news.

For instance, on Tuesday, after two days of selling off risk assets, traders found a reason for purchases, latching onto positive data for new home sales and the consumer confidence index from the Conference Board in the US. The data shows that new home sales in May surged to 763,000 against the revised downward April reading of 680,000 and the forecast of 675,000. The consumer confidence index from the Conference Board also significantly increased to 109.7 from 102.5, while forecasts predicted a rise to 104.0.

Why did the market react to this overwhelmingly positive news?

The reason lies in the drastic difference between forecasts and previous values and the actual figures, which indicates the persisting strength of the US economy.

Observing the current developments, one can make a simple conclusion. Investors understand that the interest-rate hiking cycle in the US is coming to an end and may well complete by the end of this year. Given that the US remains the center of the global financial system, this fact remains decisive for investors.

Considering this, we continue to assess the probability of two more Fed rate hikes as low. Therefore, the pressure on the markets generated by the US regulator will likely weaken, paving the way for increased demand for risk assets. We should also anticipate a weakening of the dollar, especially against the sterling and the euro that will gain support amid a high probability of further interest rate hikes from the Bank of England and the ECB. However, this scenario is only realistic when inflation in the US continues to decline.

The European currency may get a new driver today following the speech by ECB President Christine Lagarde. In almost every statement, she underscores the necessity for further monetary tightening in the eurozone to combat high inflation.

Daily forecast:

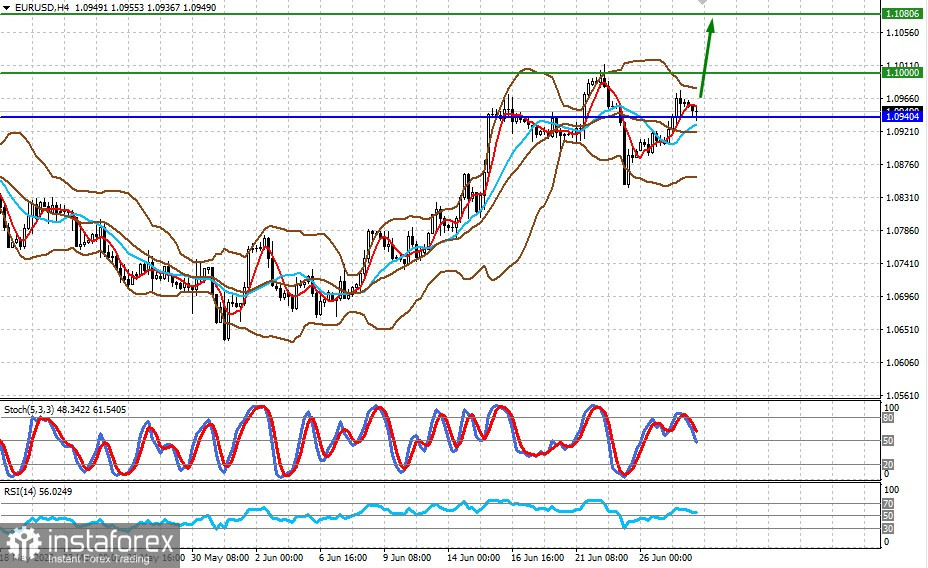

EUR/USD

The pair is currently holding above the support level of 1.0940. If Christine Lagarde signals the need to introduce more rate hikes, the price may rise to 1.1000 and then to 1.1080.

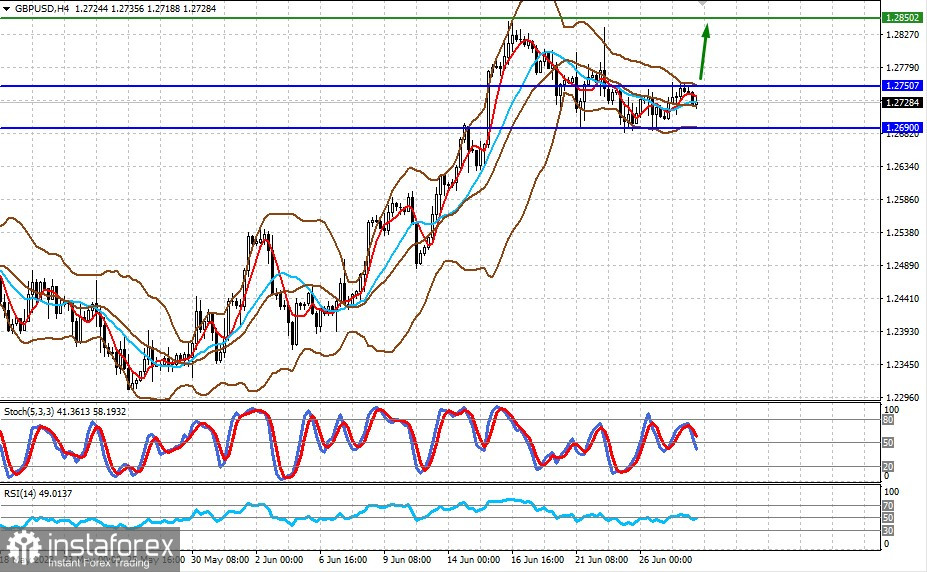

GBP/USD

The pair is trading above the support level of 1.2690 but below 1.2750. If BoE's Governor Andrew Bailey confirms that another rate increase is coming in the near future, the pair may get additional support. A breakout of 1.2750 may intensify the uptrend towards the level of 1.2850.