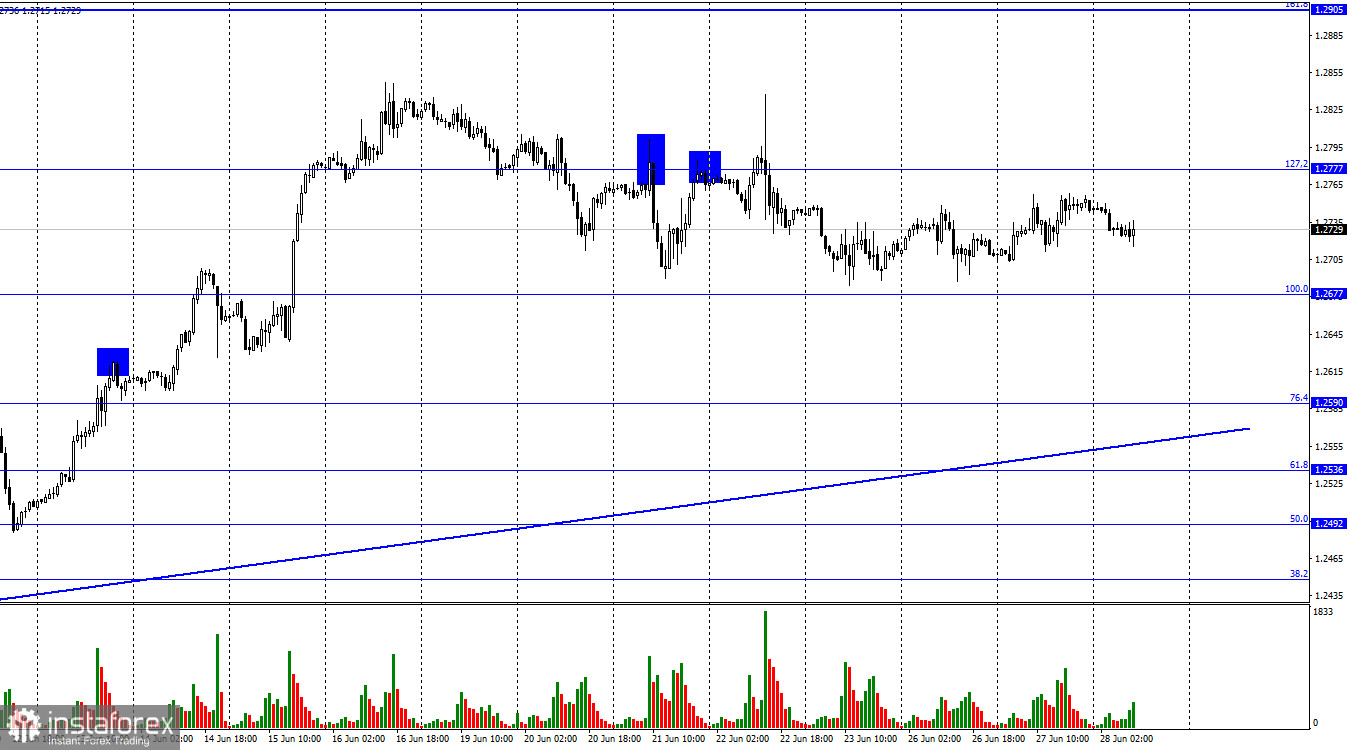

Hello, dear traders! On the 1-hour chart, GBP/USD traded horizontally between 1.2676 and 1.2777 on Tuesday. There have been no signals generated near these levels lately. Taking into account the movement itself, there is no point in opening positions now. Trader activity is at a low level, but the ascending trendline indicates bullish sentiment.

Yesterday, the US saw the release of durable goods orders data for May. Figures rose by 7.1%, while economists had expected them to come in at -1%. Durable goods orders excluding transportation increased by 0.6%, beating forecasts of a 0.1% decline. Durable goods orders excluding defense rose by 3%, well above market forecasts of 0.5%. Other reports were of secondary importance. Nevertheless, the results were not enough to boost trader activity.

Today, Christine Lagarde, Andrew Bailey, and Jerome Powell will deliver speeches. Undoubtedly, the ECB president's speech will have a greater impact on the euro. Still, there will also be significant events for the greenback and the pound. I think that Governor Bailey's speech, as well as his colleague Huw Pill's, will be the most important. Last week, the regulator surprised markets with its decision to raise the interest rate by 0.50%. Now traders need to understand how many more rate hikes to expect in 2023.

When it comes to the Federal Reserve and Jerome Powell, the situation is more or less clear as the chair hinted at several more rate hikes in Congress last week. It all depends on the Bank of England now. If they are ready to raise the rate to 6%, it could provide strong support for the pound in the coming months. After all, a lower interest rate will hardly be enough to bring inflation to 2%.

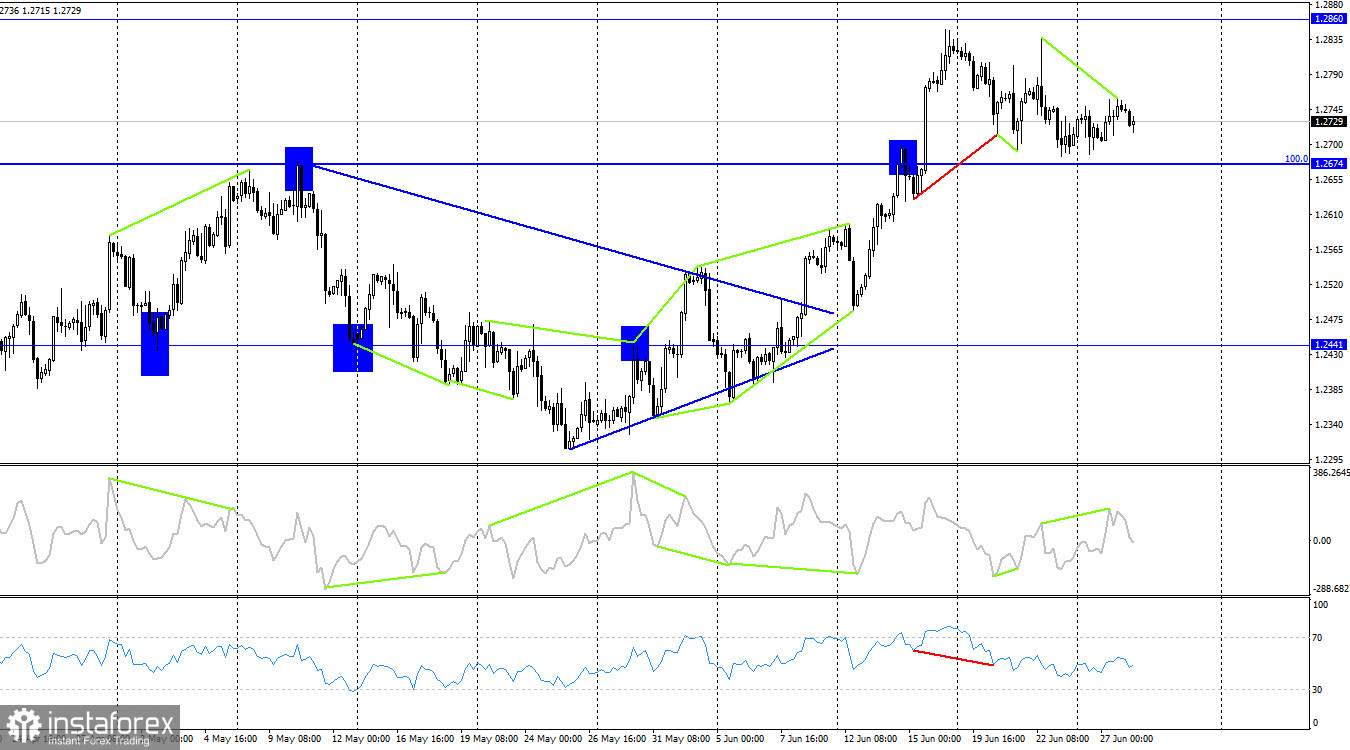

In the 4-hour time frame, a bearish reversal occurred after the CCI formed a bearish divergence. The downtrend may resume to the 100.0% retracement level of 1.2674. A rebound from this level will indicate a resumption of the uptrend to 1.2860. If quotes close below 1.2764, the fall may extend to 1.2441.

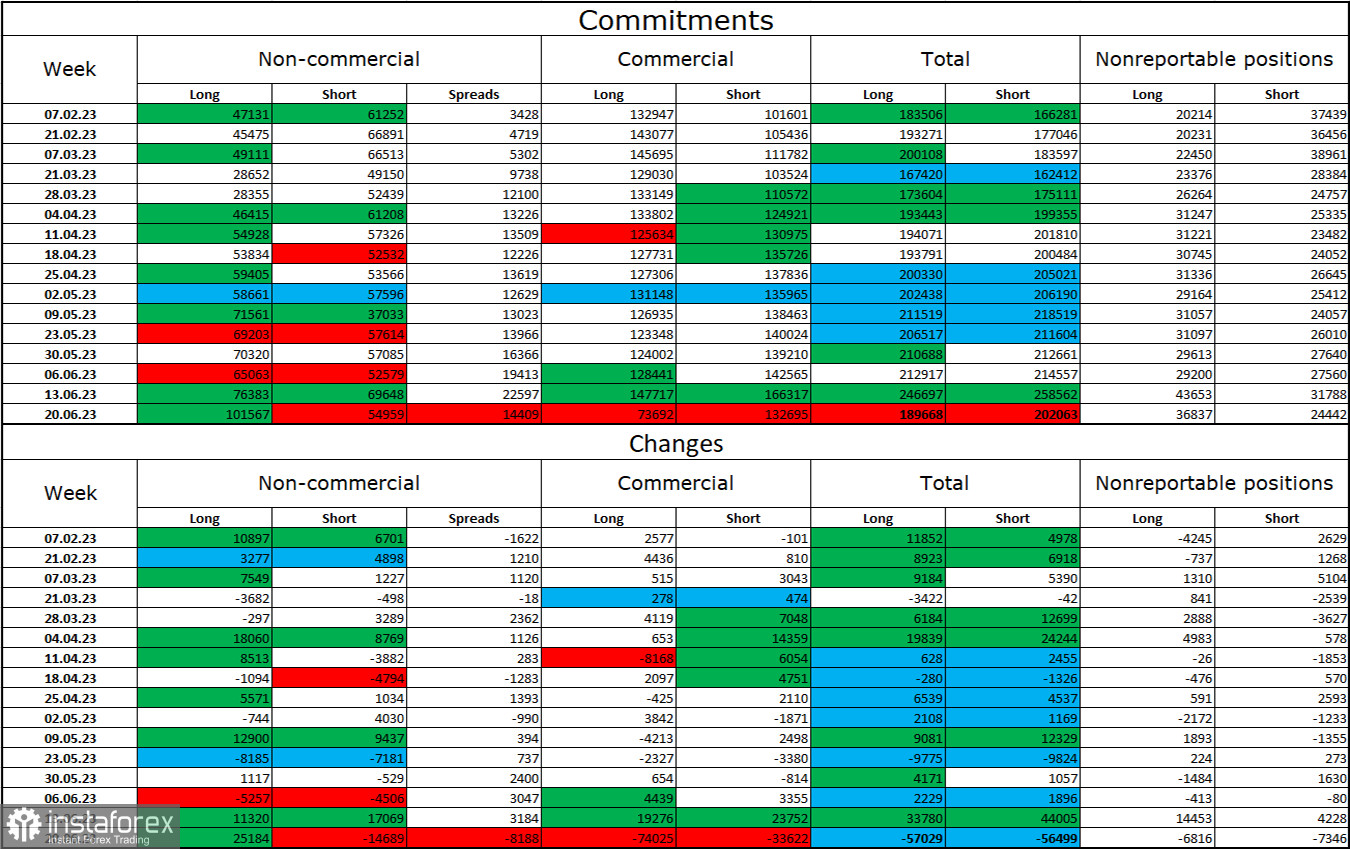

Commitments of Traders:

The sentiment of non-commercial traders has become more bullish over the reporting week. The number of long positions increased by 25,184 and that of short positions dropped by 14,689. Overall, the sentiment of large traders remains bullish. Over the past two weeks, a wide gap between the number of long and short positions has appeared: 101,000 vs 55,000 respectively. The pound sterling has enough growth potential and the fundamental backdrop is favorable for it rather than for the US dollar. Nevertheless, we do not bet on a steep increase in the sterling in the near term because the market has already priced in the BoE's 0.50% rate hike.

Macroeconomic calendar:

UK: BoE Governor Bailey speaks (13-30 UTC).

US: Fed Chair Powell speaks (13-30 UTC).

The macroeconomic calendar contains two important events on Wednesday. The fundamental backdrop may influence trader sentiment in the second half of the day.

Outlook for GBP/USD:

We sell after a bounce off 1.2777 on the 1-hour chart, with the target at 1.2677, or after closing below 1.2677, targeting 1.2590. We buy on a rebound from 1.2677 on the 1-hour chart, with the target at 1.2777.