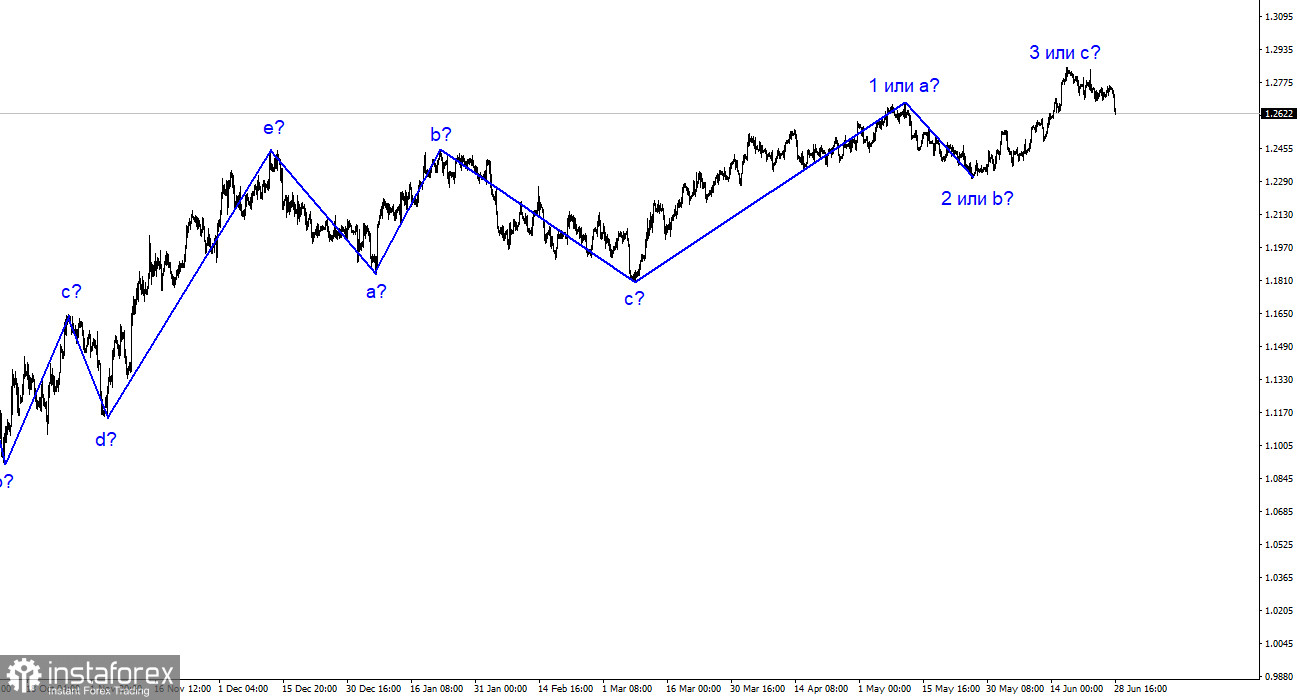

The wave analysis for the pound/dollar pair has changed to a simpler and clearer pattern. Instead of a complex corrective trend segment, we may observe an impulsive ascending wave or a simpler corrective one. Forming an upward wave 3 or c is ongoing, providing the British currency a potential opportunity to rise to the 30 figure. However, the justification for this rise in the current news background is subjective. There is no basis for the British currency to continue rising to the 30 or 35 figure (which is possible if it involves an impulsive segment of the trend). The presumed wave 3 or c may have already been completed. While wave analysis can become more complex, I prefer to rely on simpler manifestations as they are easier to work with.

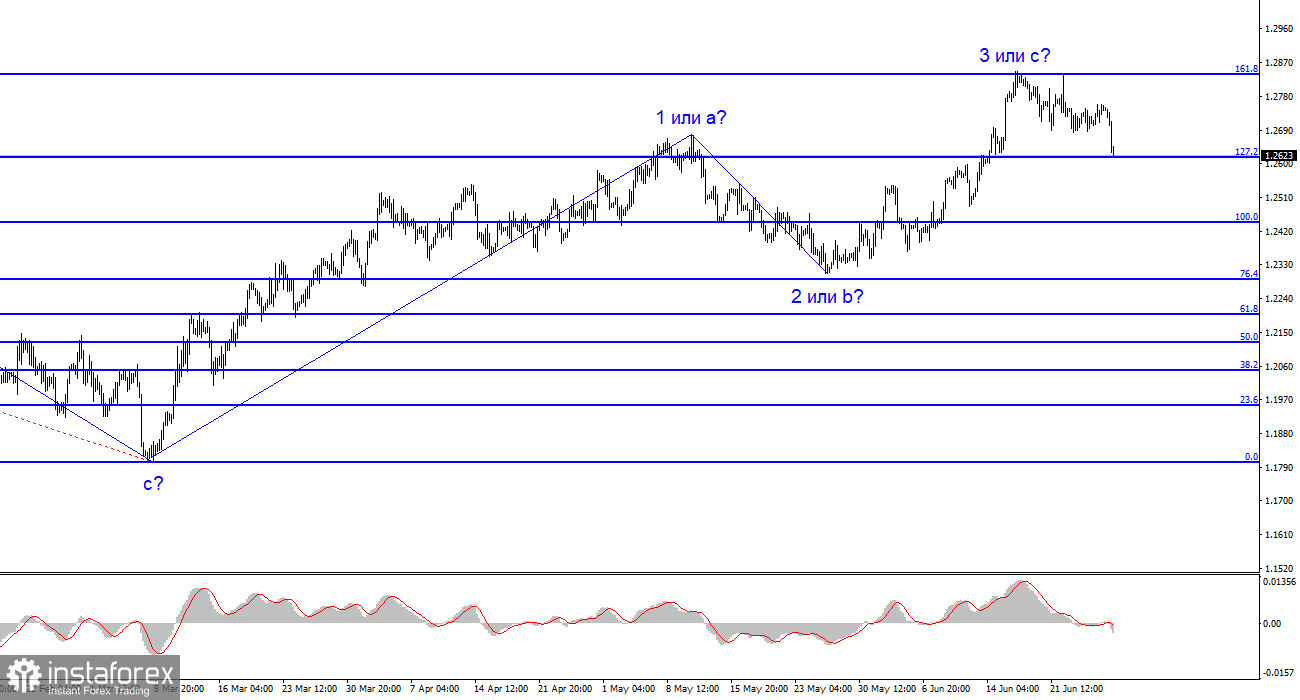

Regarding the euro currency, a descending wave set is expected to form, but the wave analysis may transform into a pattern similar to that of the pound. The presence of the 161.8% Fibonacci level and two unsuccessful attempts to break through it suggest a readiness for a decline. However, within wave 3 or c, there should be a five-wave structure, indicating the possibility of at least one more upward wave.

The demand for the pound continued to decline despite signals from all three central banks about the continuation of a tightening policy. Powell and Bailey expressed their readiness to raise interest rates further, but this does not necessarily provide an advantage for the dollar or the pound in the short term. Powell explicitly stated that two more 25 basis points should be expected, while Bailey mentioned the Bank of England's commitment to bringing inflation back to 2%. Despite similar rhetoric from central bank heads, the pound experienced a significant decrease in demand.

In previous discussions, I highlighted the influence of wave analysis over fundamental analysis. Two unsuccessful attempts to break the 161.8% Fibonacci level, which I emphasized as a crucial point a few days ago, serve as the starting point. The pair's decline continues, indicating that wave 3 or c may have already been completed. This suggests a new descending wave set is currently being constructed. If the 1.2615 level, equivalent to 127.2% Fibonacci, is not successfully broken, the pair may return to the ascending trend segment. In such a scenario, the presumed wave 3 or c may take on a five-wave structure, with another test of the 1.2842 level.

In summary, the wave pattern of the pound/dollar pair has changed, suggesting the formation of an upward wave that could be completed soon or may have already concluded. Consider buying the pair only if the 1.2842 level is successfully broken. Sales appear more promising, and I recommend implementing them with a Stop Loss above the 1.2842 level. A successful attempt to break 1.2615 will indicate the market's readiness to continue selling, with targets located near the low of wave 2 or b.

On a larger wave scale, the pattern in the euro/dollar pair is similar, but there are still some differences. The descending corrective trend segment has been completed, and the formation of a new ascending segment is ongoing, which could be completed as early as tomorrow or may develop into a full-fledged five-wave structure. Even if it takes on a three-wave structure, the length of the third wave can vary, being either extended or shortened.