EUR/USD

Higher timeframes

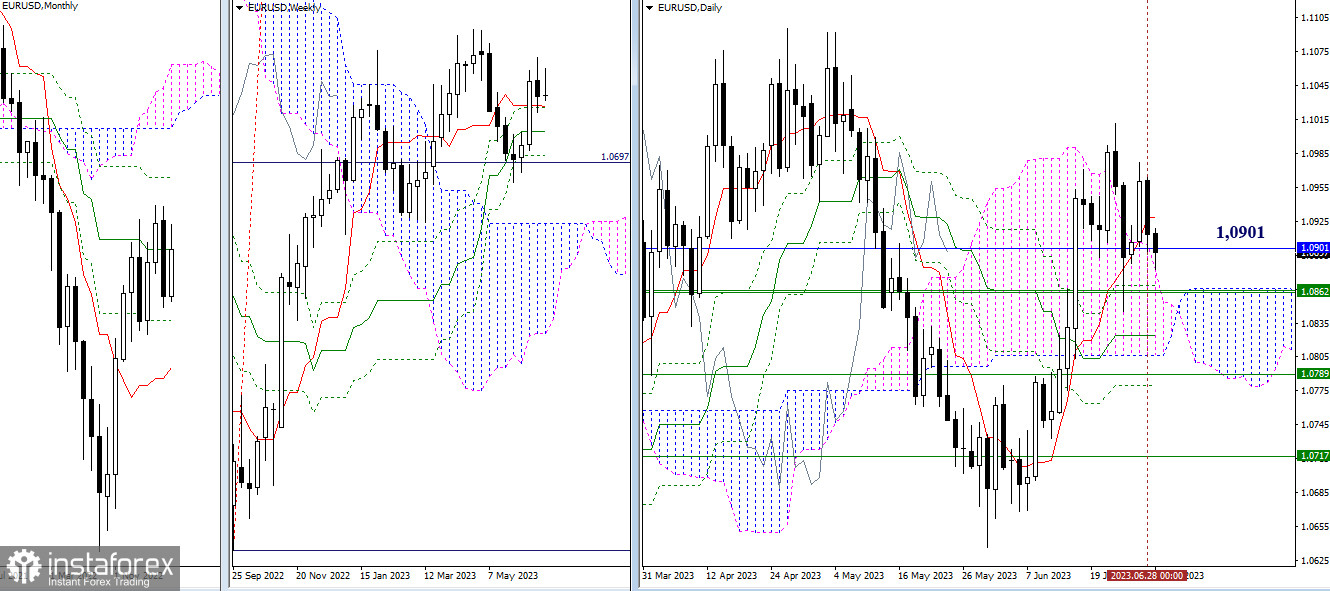

The bears once again managed to neutralize all the opponent's efforts, returning to the support and attraction zone of the monthly medium-term trend (1.0901) and the upper boundary of the daily cloud (1.0882). If the bulls fail to continue the upward move and establish a new high (1.1012) in the near future, the opposing side will set more global targets. The immediate bearish plans will include breaking the weekly supports (1.0862-66), exiting the daily cloud into bearish territory (1.0806), and eliminating the daily golden cross of the Ichimoku (1.0780), which is reinforced by the weekly medium-term trend (1.0789).

H4 - H1

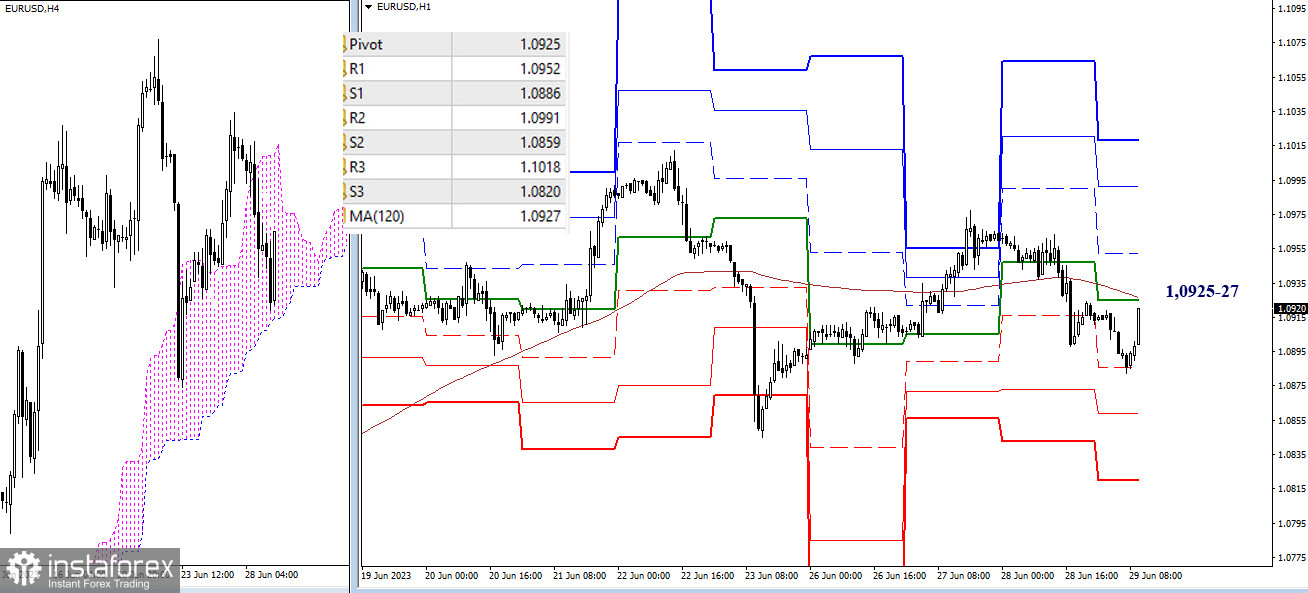

On the lower timeframes, the advantage has again shifted in favor of the bears. However, the bulls are currently rising to retest the key levels of 1.0925-27 (central pivot point of the day + weekly long-term trend) in order to once again question the prevailing advantage. Classic pivot points may have significance for intraday work, which today are at the following levels: 1.0886 - 1.0859 - 1.0820 (supports) and 1.0952 - 1.0991 - 1.1018 (resistances).

***

GBP/USD

Higher timeframes

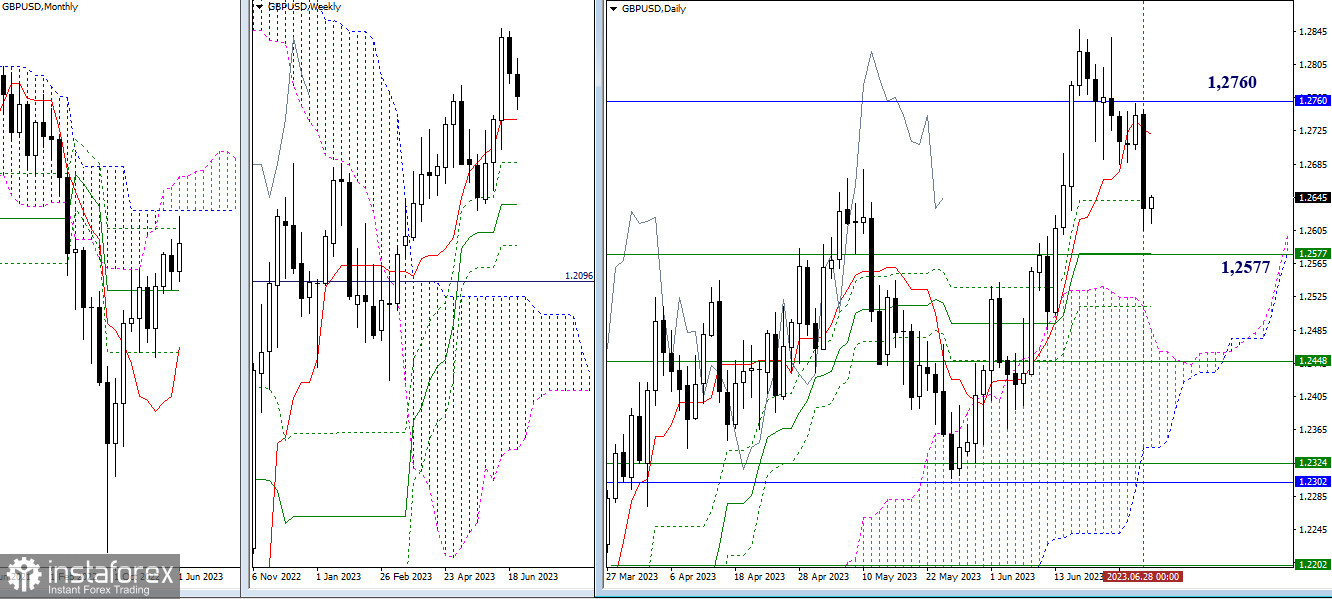

After retesting the zone of influence of the monthly level (1.2760), the bears resumed the decline, closing the previous day below the daily support of 1.2641. The next important level on the path of the bears is 1.2577 (daily medium-term trend + weekly short-term trend). Breaking beyond the mentioned boundaries can strengthen the winner's sentiment and bring about new prospects.

H4 - H1

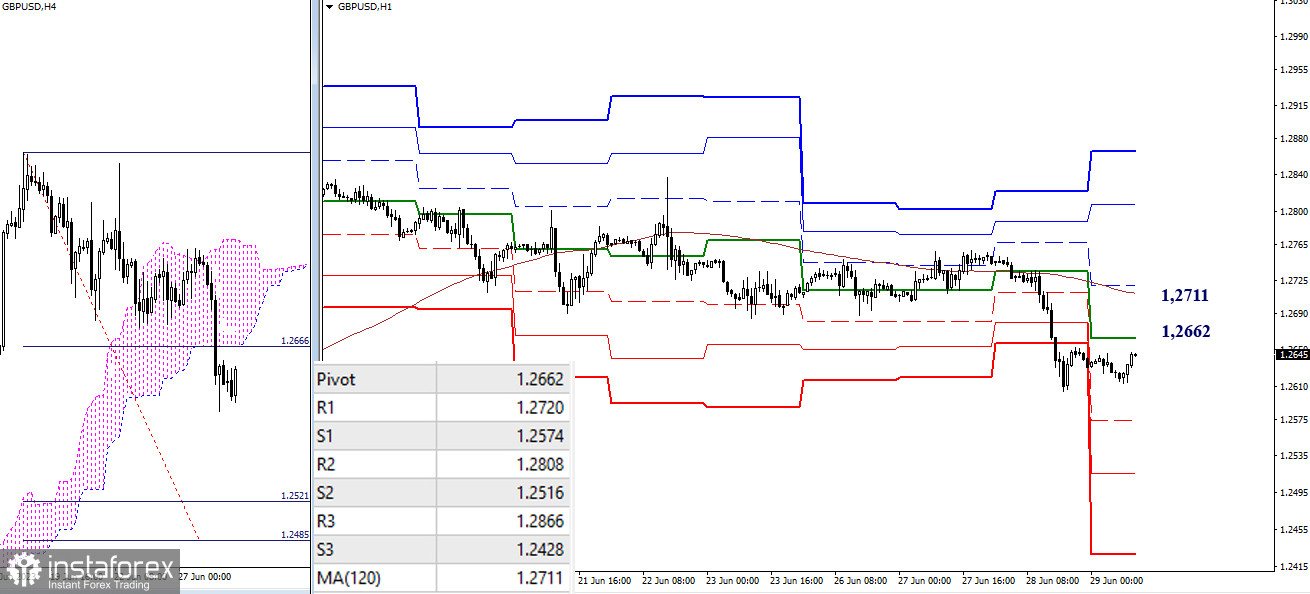

The main advantage on the lower timeframes currently belongs to the bears. Their reference points are the supports of the classic pivot points (1.2574 - 1.2516 - 1.2428) and the target for breaking the H4 cloud (1.2521 - 1.2485). Today, the key levels 1.2662 (central pivot point of the day) and 1.2711 (weekly long-term trend) serve as resistances. Establishing a foothold above them will change the current balance of power and open the way to intraday targets of 1.2720 - 1.2808 - 1.2866 (resistances of the classic pivot points).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)