To initiate long positions on EUR/USD, the following conditions should be met:

The ECB economic bulletin did not have a significant impact on traders, so now the focus is on inflation data from Germany. If inflation increases, it could lead to higher demand for the euro. Additionally, it's important to consider US statistics such as the weekly number of initial jobless claims and the change in GDP for the first quarter of this year, which could further alleviate the selling pressure on the US dollar observed earlier. However, if the numbers surprise and inflation in Germany slows down sharply, there would be less reason to buy the euro.

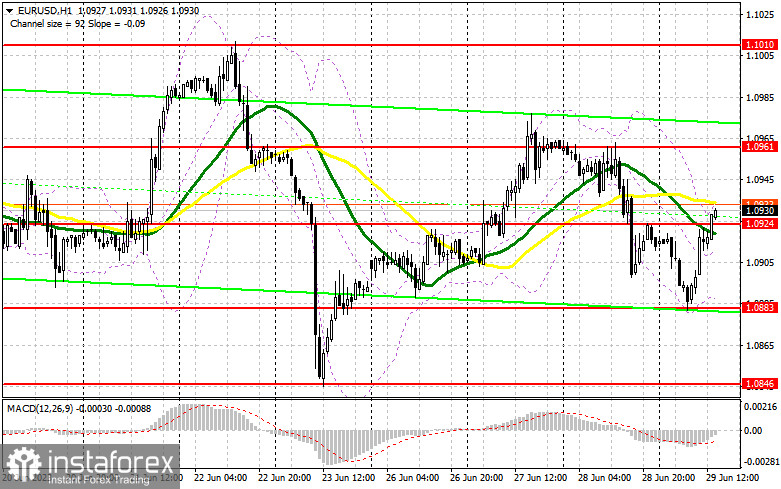

In such a case, I will only consider a downside move and wait for a false breakout around the 1.0924 area, which is expected to happen soon. This would provide a new buying signal, allowing the pair to resume its growth with a revised target of 1.0961. A breakthrough and test below this range would strengthen the demand for the euro, opening up the possibility of reaching the monthly high of 1.1010. The ultimate target remains the area around 1.1060, where I would take profit. If the scenario involves a decline in EUR/USD due to strong labor market statistics in the US and the absence of buyers at 1.0924, the pressure on EUR/USD would increase. Therefore, a euro buy signal would only be triggered if a false breakout occurs around the next support level of 1.0883, based on yesterday's results. I would enter long positions immediately on the rebound from the minimum of 1.0846, with a target of a 30-35 point upward correction within the day.

To initiate short positions on EUR/USD, the following conditions should be met:

Sellers showed limited activity around 1.0924 in the first half of the day, so I don't recommend placing too much emphasis on this level. If the euro continues to rise, as seems likely, I will only consider a false breakout near the resistance level of 1.0961, which was established based on yesterday's results. A failed consolidation in that area would provide a selling signal capable of pushing EUR/USD back to 1.0924. A breakthrough below this range and a subsequent test from below to above would pave the way towards 1.0883. The ultimate target would be the minimum of 1.0846, where I would take profit.

If there is an upward movement in EUR/USD during the US session and no bearish pressure is seen at 1.0961, the bulls will regain control of the market. In that scenario, I would postpone short positions until the next resistance level of 1.1010. Selling would also be possible there, but only after a failed consolidation. I would enter short positions immediately on the rebound from the maximum of 1.1060, with a target of a 30-35 point downward correction.

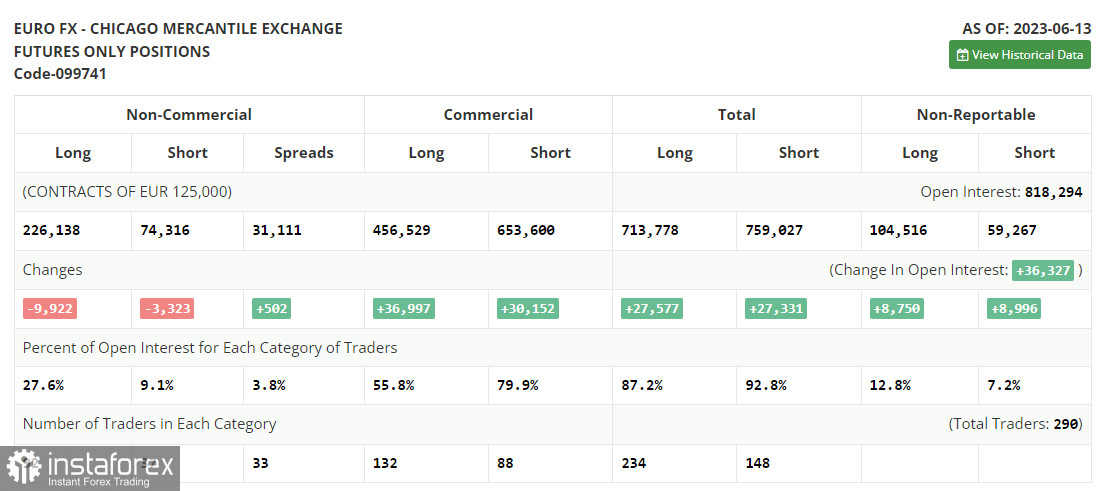

Regarding the COT (Commitment of Traders) report for June 13, there was a decrease in both long and short positions. However, it's important to note that the report was released before the Federal Reserve's decision on interest rates, which remained unchanged in June and significantly impacted the market dynamics. Therefore, the current report should not be given excessive attention. What matters is that demand for the euro remains strong due to the ECB's continued aggressive policy and is expected to persist. The optimal medium-term strategy in the current conditions would be buying on dips. The COT report indicates that non-commercial long positions decreased by 9,922 to 226,138, while non-commercial short positions fell by 3,323 to 74,316. The overall non-commercial net position decreased to 151,822 from 158,224 at the end of the week. The weekly closing price increased to 1.0794 from 1.0702.

Indicator signals:

Moving Averages

Trading around the 30-day and 50-day moving averages indicates market uncertainty.

Note: The period and prices of the moving averages considered by the author are based on the H1 hourly chart and differ from the general definition of classical daily moving averages on the D1 daily chart.

Bollinger Bands

In case of an uptrend, the upper boundary of the indicator around 1.0930 will act as resistance.

Description of indicators:

• Moving Average (determines the current trend by smoothing volatility and noise). Period - 50. Marked in yellow on the chart.

• Moving Average (determines the current trend by smoothing volatility and noise). Period - 30. Marked in green on the chart.

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA - period 12. Slow EMA - period 26. SMA - period 9.

• Bollinger Bands. Period - 20.

• Non-commercial traders - speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting specific requirements.

• Long non-commercial positions represent the total long open position of non-commercial traders.

• Short non-commercial positions represent the total short open position of non-commercial traders.

• The overall non-commercial net position is the difference between non-commercial traders' short and long positions.