European stocks have seen growth in early trading, following the lead of US futures. The demand for risk assets continues as the end of the second quarter draws closer, with expectations high for positive corporate reports to start arriving soon. Bonds have stabilized after a sell-off spurred by robust economic growth in the US and employment data that has fueled the market's expectations of further interest rate hikes.

Today, the focus will be on a range of fundamental statistics, set to either confirm or debunk investors' expectations. We are anticipating various price indicators, including inflation in the Eurozone and US personal income and spending data, as well as the PCE index, which is the Federal Reserve's preferred measure for determining core price pressures. US data is expected to show some easing, which could spur growth in stock indices.

However, any sign that inflation is strengthening, particularly regarding core prices, may bring pressure back to the stock market at the end of the month. This is because of lingering concerns about further interest rate hikes by the Federal Reserve in the fall of this year. The latest data on swap contracts related to future Federal Reserve monetary policy meetings suggests a 50% probability that the US central bank will raise the target range for federal funds by a quarter percentage point in September and an additional 15 basis points by the end of the year.

The Stoxx Europe 600 index rose by 0.3% at the opening of the session, on track for ending the quarter without changes. Engie SA stocks added more than 2% after the French energy company raised its profit forecast for the entire year. The S&P 500 futures remained unchanged, while the Nasdaq 100 futures increased by 0.2%. The yield on two-year US Treasury bonds rose by about 3 basis points after a 16-point jump on Thursday, while the yield on 10-year bonds increased by two points.

The yen has weakened to 145 against the US dollar for the first time since November and fell to 144.70 after Japan's Finance Minister Shunichi Suzuki told reporters that the government will appropriately respond to any excessive movements in the currency market. Earlier this week during the meeting of central bank officials, the BOJ Governor stated that he had no intention of intervening in the current monetary policy.

The yuan remained in the spotlight following its recent fall to a seven-month low. On Friday, it rose for the first time in three days after the People's Bank of China once again intervened in currency regulation.

In other markets, oil stabilized as traders evaluated hawkish rate forecasts against positive signals from the US economy. Gold remained almost unchanged.

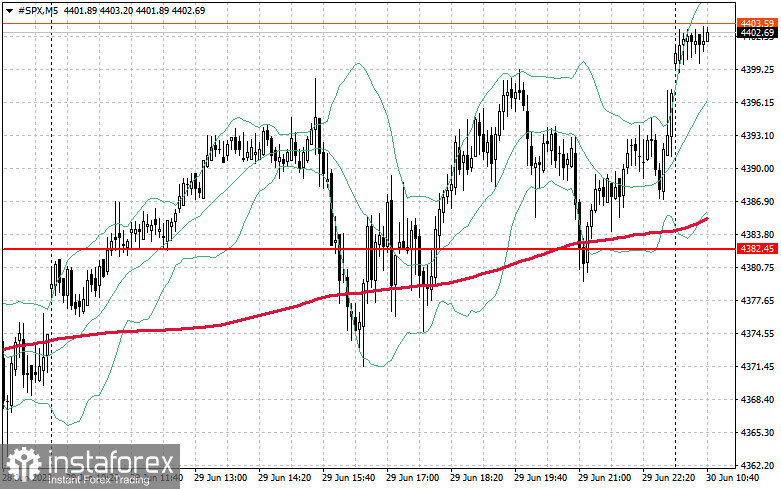

As for the technical picture of the S&P 500, the demand for the index remains strong. Buyers have a chance to continue the uptrend but they need to defend the $4,383 level which is very likely to be tested today. From this level, the price can surge to $4,405. Another task for bulls is to control the $4,427 level, which will strengthen the bullish market. In case of a downward movement due to a decrease in risk appetite, buyers will have to assert their strength around $4,383. A breakout would quickly push the trading instrument back to $4,357 and open the road to $4,332.