While all market attention is currently focused on the situation surrounding the impending interest rate hike in the United States, the circumstances around the future rate-hiking cycle of the European Central Bank (ECB) have somehow taken a back seat.

As the drama unfolds around the likely rate increases by the US Federal Reserve, the possible actions of the world's second most significant central bank, the ECB, have faded into the shadows although there are things worth mentioning.

In the eurozone, much like in the US, inflation has significantly increased due to the ECB's monetary policy and its response to COVID-19, which manifested in social spending of unsupported money. Although it corrected downward from 10.6% to 6.1% since October of last year, it still remains significantly above the target of 2%.

In response to this, ECB President Christine Lagarde repeatedly expressed the need to continue raising interest rates to combat high inflation. The central bank did so, allowing the euro/dollar pair to recover significantly from its low of late September.

But why has the confident growth of the euro slowed down?

The main reason here is the Fed's promise to raise the key interest rates two more times by the end of this year, which supports the UuS dollar and puts overall pressure on demand for risk assets. On the other hand, consumer inflation in the eurozone is decreasing. Today, investors' attention will be drawn to the publication of the consumer price index in the eurozone and inflation data in the United States.

According to consensus forecasts, consumer inflation in the eurozone should decrease to 5.6% from 6.1% in annual terms in June. On a monthly basis, no increase is expected, just as in the previous month. The core indicator should rise from 5.3% to 5.5% and add 0.7% for June against May's value of 0.2%.

Meanwhile, the US will publish the Personal Consumption Expenditure Index in its headline and core readings. The annual figure is expected to increase to 4.6% from 4.4%. Its May monthly value should grow to 0.5% from 0.4% in April. At the same time, it is assumed that the core index will stay at 4.7% year-on-year and will stay at zero in May against April's increase of 0.5%.

Certainly, attention should also be paid to data on personal consumption and income, which are expected to decrease.

As we can see, forecasts suggest mixed inflation figures, and the market reaction to them can be unpredicted.

We believe that market participants will mostly focus on the consensus data for the US and the EU. If indicators suggest a slowdown in inflation, it could restrain the Federal Reserve's decision to raise rates in July. At the same time, it is unlikely to prevent the ECB from another rate hike at its July meeting. This is primarily due to the fact that inflation in the eurozone remains noticeably higher than in the United States. This means that despite the tempest in a teapot depicted by Powell and the Federal Reserve, the euro/dollar pair may receive support and could attempt to test the local high of 1.1095 next week, a level reached in April of this year. However, it could significantly depreciate on the wave of news about slowing inflation.

Daily forecast:

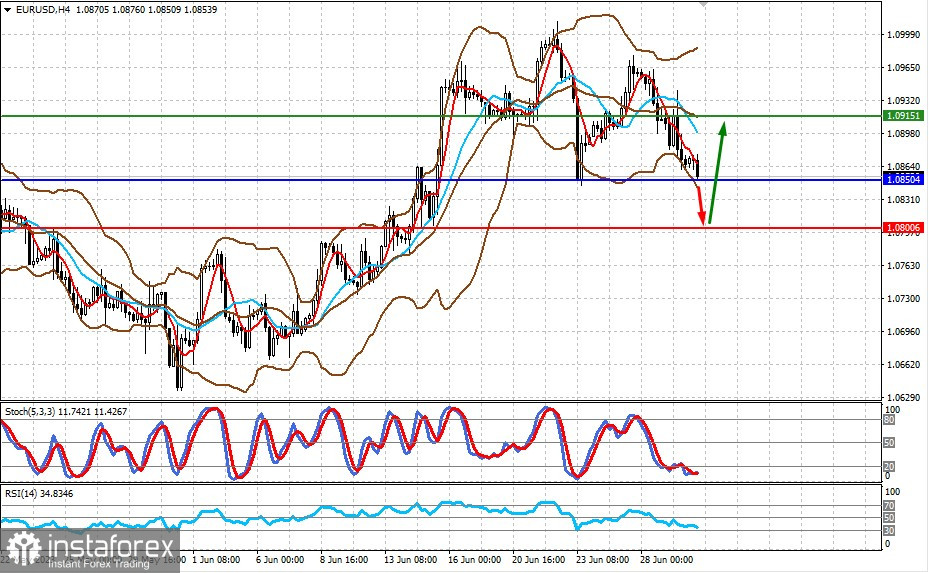

EUR/USD

The pair is testing the support level of 1.0850. A drop below this level may stretch the fall toward 1.0800. After that, traders may start to buy out the asset with an upward target at 1.0915.

USD/CAD

The pair is trading above 1.3235. If the price slides below this level following the release of the US inflation data and amid a rebound in oil prices, the pair may have a limited decline toward 1.3125.