The report on inflation growth in the eurozone did not favor the euro. The data came out in the "red zone," although it reflected an increase in the core consumer price index. Yet, EUR/USD buyers are clearly disappointed, especially after the rather robust "German preview." Yesterday's release of the inflation growth report in Germany surprised with its green color, strengthening traders' expectations regarding the dynamics of overall European inflation. However, these expectations were not met.

Today's release will not cancel the ECB's rate hike in July, but it clouds the prospects for further monetary policy tightening. Especially considering Christine Lagarde's recent speech, which was not hawkish in nature. She began using more cautious formulations, particularly when it came to the post-July period. Therefore, today the EUR/USD bears can celebrate a tactical victory. At the end of the week, many fundamental factors turned in their favor.

In the language of numbers

The data on inflation growth in Germany played a cruel joke on EUR/USD buyers. It turned out that inflation in the country was rising at a higher pace than previously expected. For example, the overall consumer price index in annual terms reached 6.3% in June, surpassing the forecast of a decline to 6.2% (the May value was 6.1%). The annual Harmonized Index of Consumer Prices (HICP), which the European Central Bank prefers to use for measuring inflation, reached 6.8%, while in May, this indicator stood at 6.2%.

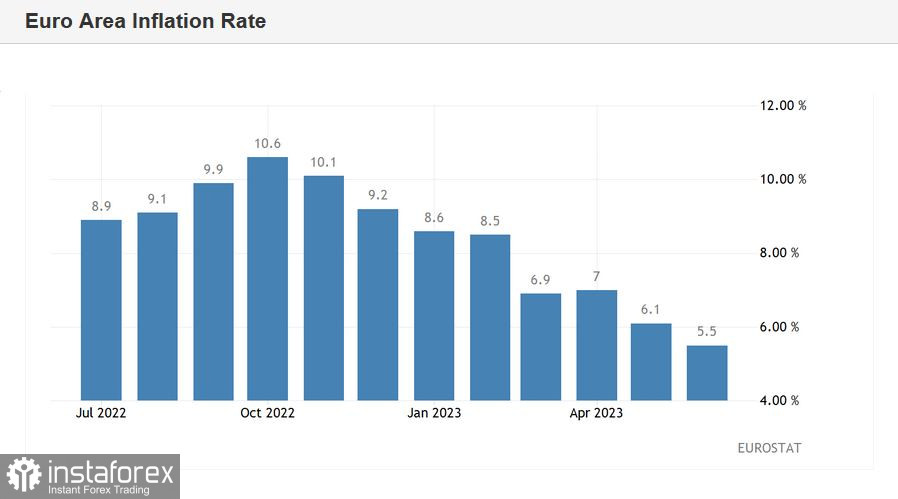

German data usually correlates with the overall European data, so market expectations were of a corresponding nature. But the expectations were not met. Thus, the overall consumer price index in the eurozone decreased to 5.5% against a forecasted decline to 5.6% and the previous value of 6.1%. This is the slowest growth rate of the indicator since March of last year. The core index, excluding volatile energy and food prices, slightly increased after a two-month decline (5.4%), although experts predicted a more significant increase to 5.7%.

Recall that ECB President Christine Lagarde, during her recent speech at the Forum on Sintra, Portugal softened her rhetoric, puzzling EUR/USD buyers. Although she once again stated that the central bank will likely raise rates by 25 basis points at the July meeting, she refrained from confirming any further steps later this year. Previously, her rhetoric had a bolder character, as she transparently hinted at further rate hikes after the July meeting.

Consequences of the release

Today's release is viewed by the market through the lens of Lagarde's statements, and it is evident that further steps towards tightening monetary policy have come into question. Against such a fundamental backdrop, the euro came under pressure.

On the other hand, the dollar has been reaping the benefits lately, taking advantage of favorable moments. Firstly, Fed Chairman Jerome Powell, mirroring his colleague from the ECB, tightened his rhetoric by stating that most members of the regulator expect "two or more" rate hikes within the current year. Secondly, the GDP growth data published yesterday in the United States turned out to be in the "green zone." According to the final assessment, the country's GDP increased in the first quarter not by 1.3%, but by 2%. The indicator of initial jobless claims growth also pleased as it hit a four-week low yesterday, although most experts predicted further growth.

Thus, at the end of the past week, sellers of EUR/USD undoubtedly became the beneficiaries of the current situation. However, let's stess that bears have achieved a tactical victory but not a strategic one. Recent events and macroeconomic reports only confirmed market participants' assumptions regarding the prospects of the July meetings of the Fed and the ECB. According to the CME FedWatch Tool, the probability of a 25 basis point rate hike in July is 90%. As for the ECB, the markets are also pricing in a 90% probability of a 25 basis point rate increase at the next meeting.

However, the future prospects are still uncertain. For example, the same CME FedWatch Tool estimates the probability of a rate hike in September (assuming a July hike) at only 24%. For November, it is 34%. The European Central Bank has also not yet determined its further actions after the July hike. Therefore, the current downward price pullback may be temporary, and thus, caution should be exercised regarding selling positions.

Despite a fairly strong downward momentum, the pair has not yet established itself below the support level of 1.0850 (the middle line of the Bollinger Bands indicator, coinciding with the upper boundary of the Kumo cloud on D1). Therefore, short positions are risky, especially considering the "Friday factor."

If sellers do not break the mentioned price barrier, buyers will again take the initiative, bringing the pair back to the area of the 9th figure.