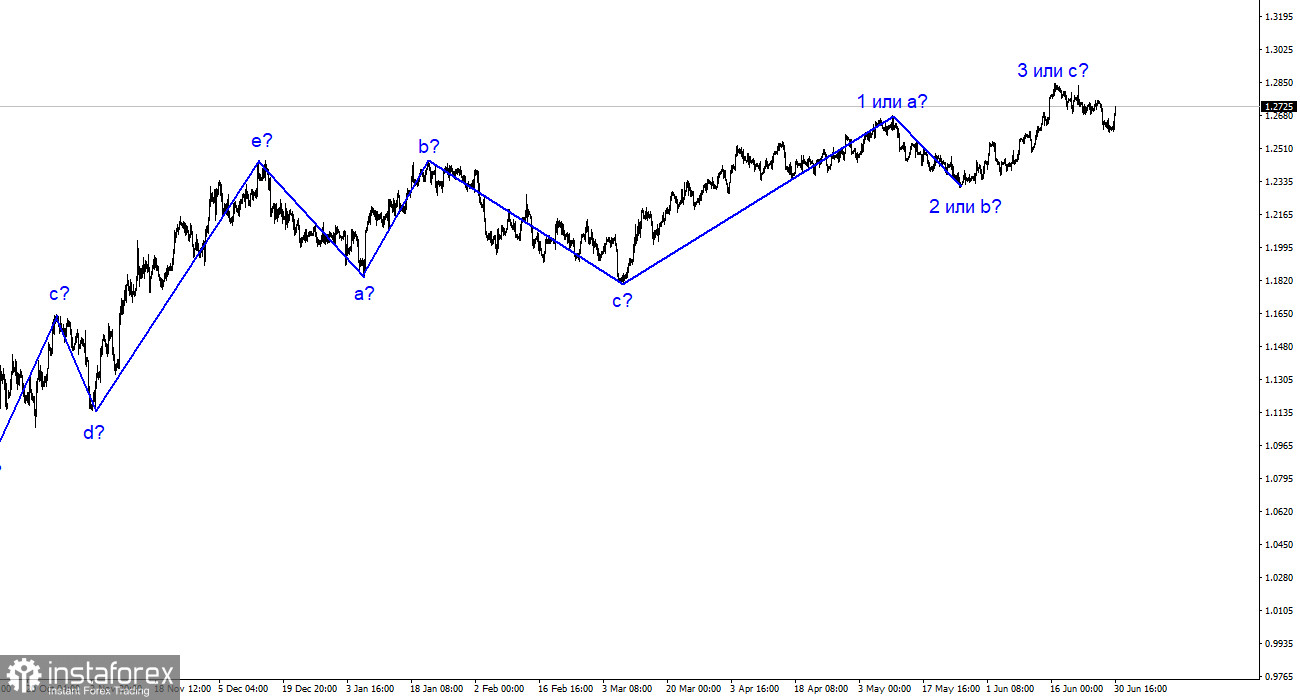

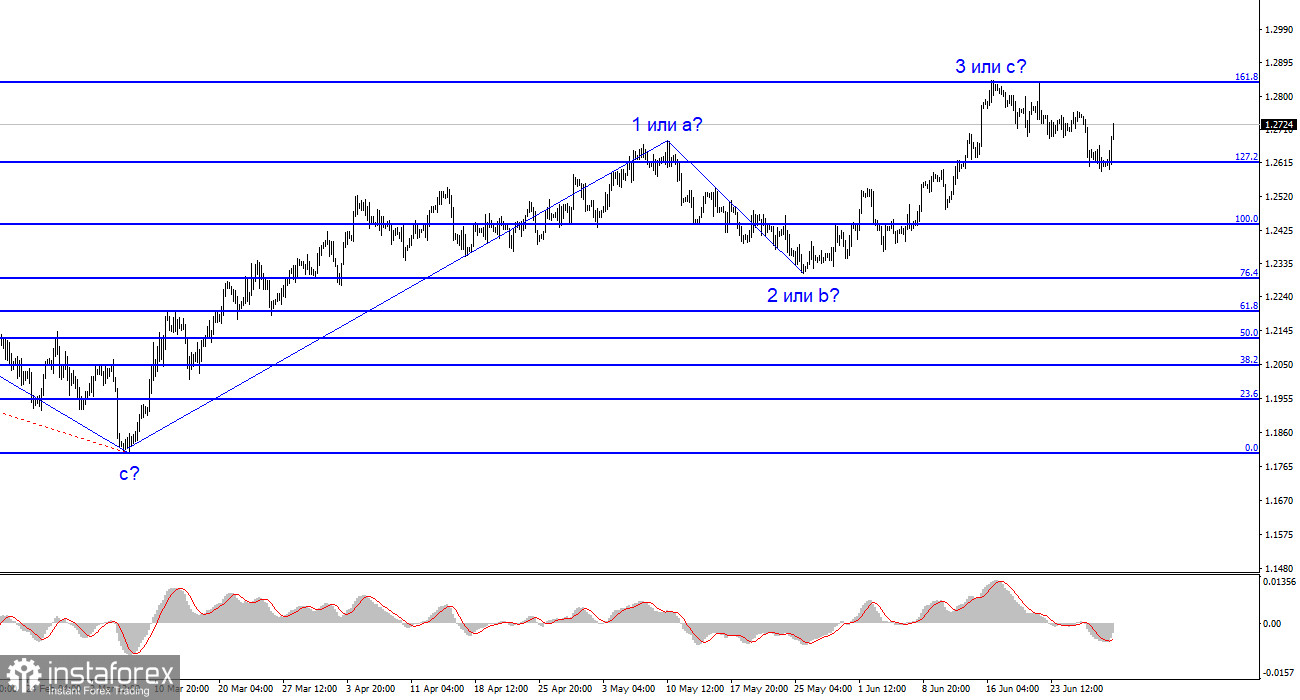

The wave analysis for the pound/dollar pair has adopted a simpler and more understandable appearance. Instead of a complex corrective trend phase, we can observe a sudden upward movement or a simpler correction. Presently, an ascending wave labeled as wave 3 or c is an ongoing development, presenting a favorable opportunity for the British pound to rise to the 30th figure. Determining if the current news background justifies this is up to you. There are no substantial grounds for the British pound to continue ascending towards the 30th or 35th figure (unless it pertains to an impulsive trend phase). The presumed wave 3 or c might have already concluded. However, wave analysis always holds the potential to transform into a more intricate pattern. The unsuccessful attempt to break the 127.2% Fibonacci level indirectly indicates the market's readiness for new buying opportunities.

Regarding the euro currency, a descending wave pattern is anticipated. However, wave analysis might transition into a similar pattern as the pound, aligning both currencies. Within wave 3 or c, a five-wave structure is plausible, suggesting the existence of at least one additional upward wave. In the near future, the pair may return to the 1.2842 level.

The market response to the UK GDP was not positive

On Friday, the pound/dollar pair experienced a decline of 110 basis points, and we must understand the underlying causes of this sharp decrease. The euro currency might have received support from the market due to the inflation report in the EU. However, this conclusion is not definitive as the inflation decrease was within expectations, which does not necessarily indicate a strengthening of the hawkish sentiment of the ECB. In the UK, the GDP report revealed a 0.1% growth in the first quarter, aligning with market expectations. Nevertheless, the pound exhibited a more significant strengthening compared to the dollar the day before. The market could be preparing for a new upward wave.

In the United States, all the reports for the day could have been more exciting. The Personal Consumption Expenditures Index, personal income, and spending reports align closely with market expectations. Consequently, these data were unlikely to have caused a decline in demand for the dollar to the extent of a 100-point drop within a couple of hours. Today's trading day indicates the continuation of bullish sentiment in the market following a two-week correction.

In summary, the wave pattern for the pound/dollar pair has changed, suggesting the development of an ascending wave that could conclude at any moment or might have already done so. Yesterday, I recommended buying the pair if there was an unsuccessful attempt to break the 1.2615 level, equivalent to the 127.2% Fibonacci level. In such a scenario, wave 3 or c could take on a more extended form, and the pair could return to the 1.2842 level. Currently, selling positions appear more promising, as I recommended two weeks ago, with a Stop Loss set above the 1.2842 level. However, today's signal temporarily nullified this scenario.

The pattern resembles the euro/dollar pair on a larger wave scale, albeit with some differences. The descending corrective phase of the trend has concluded, and the formation of a new ascending phase is ongoing, which could already be complete or form a complete five-wave structure. Even if it is a three-wave structure, the third wave can be extended or truncated.