Overview of macroeconomic reports

There are five economic reports slated for release on Monday, all related to PMIs in the manufacturing sectors of different countries. Formally, each of them is important. The PMIs for Germany, the eurozone, the UK, and the US will be released. The US will release two reports, the regular index and the ISM index. All reports, except for the ISM, will be second estimates for June. Therefore, their values are unlikely to deviate significantly from the initial estimates and are unlikely to provoke a strong market reaction. The ISM index has always been an important report, but even if its value coincides with the forecast, we should not expect a strong movement afterward. We would say that trading will be calm, and only the ISM index may influence market sentiment.

Overview of fundamental events

Bundesbank President Joachim Nagel's speech stands out among the day's events. Nagel may be quite hawkish in his stance, as inflation in Germany has started to rise again, and the German economy is the strongest in the eurozone. Therefore, Nagel likely supports a more aggressive approach to European Central Bank monetary policy. Consequently, we can expect hawkish comments from him, which could support the euro.

However, take note that Germany is just one country out of 27 in the EU. The ECB will and should consider the interests of all member countries. And some members of the ECB's monetary committee doubt the appropriateness of further tightening in the autumn. In July, the interest rate will definitely increase by another 0.25%, a decision that the market has long priced in. We believe that there are no significant reasons for the euro to rise at the moment, and after Friday's rally, a bearish downward would be reasonable.

Bottom line

On Monday, we can only highlight the ISM index in the US manufacturing sector. It is expected to slightly increase from the current value of 46.9 to 47-48 points. If this forecast does not materialize and the index declines again, the USD may extend its downward movement from Friday.

Main rules of the trading system:

- The strength of the signal is calculated by the time it took to form the signal (bounce/drop or overcoming the level). The less time it took, the stronger the signal.

- If two or more trades were opened near a certain level due to false signals, all subsequent signals from this level should be ignored.

- In a flat market, any currency pair can generate a lot of false signals or not generate them at all. But in any case, as soon as the first signs of a flat market are detected, it is better to stop trading.

- Trades are opened in the time interval between the beginning of the European session and the middle of the American one when all trades must be closed manually.

- On the 30-minute timeframe, you can trade based on MACD signals only on the condition of good volatility and provided that a trend is confirmed by the trend line or a trend channel.

- If two levels are located too close to each other (from 5 to 15 points), they should be considered as an area of support or resistance.

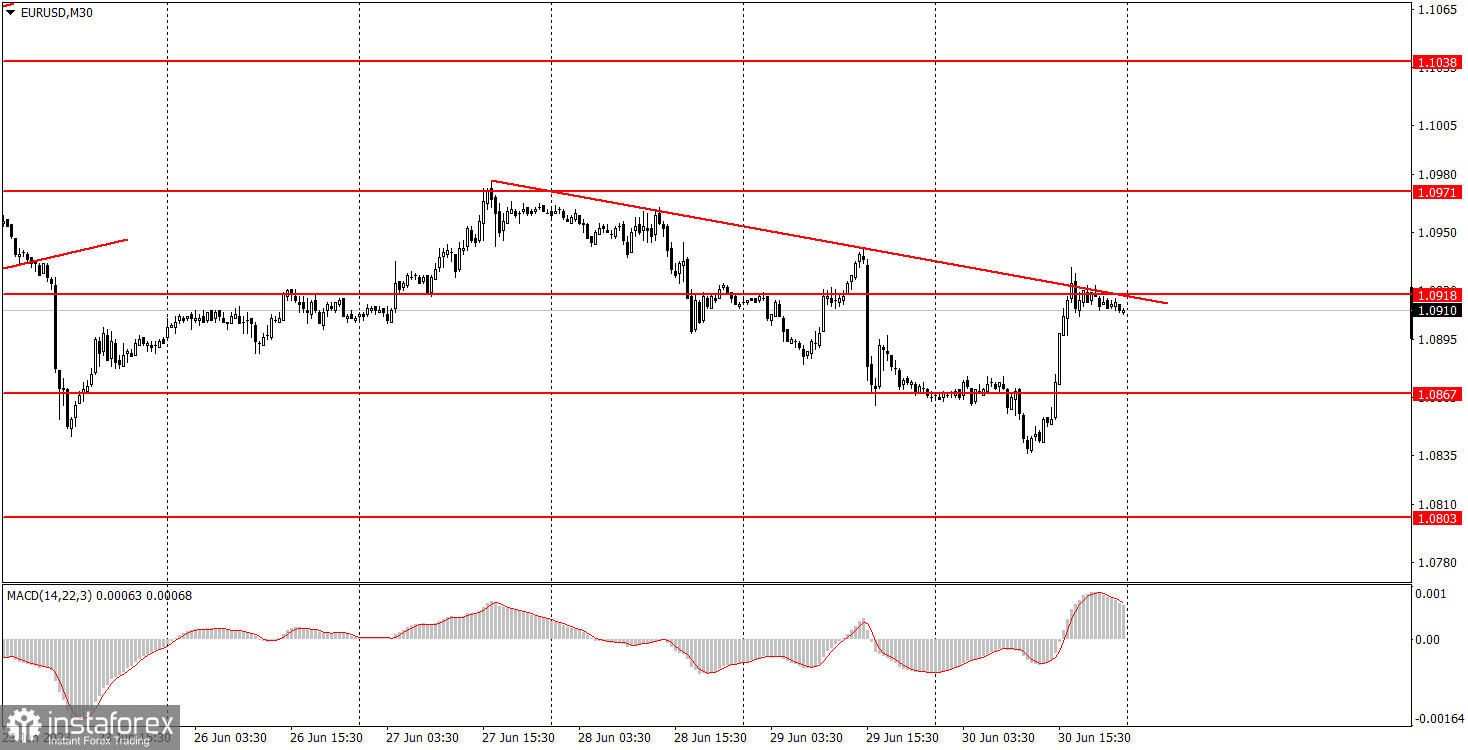

Comments on charts

Support and resistance levels are levels that serve as targets when opening long or short positions. Take Profit orders can be placed around them.

Red lines are channels or trend lines that display the current trend and show which direction is preferable for trading now.

The MACD (14,22,3) indicator, both histogram and signal line, is an auxiliary indicator that can also be used as a source of signals.

Important speeches and reports (always found in the news calendar) can significantly influence the movement of a currency pair. Therefore, during their release, it is recommended to trade with utmost caution or to exit the market to avoid a sharp price reversal against the previous movement.

Beginners trading in the forex market should remember that not every trade can be profitable. Developing a clear strategy and money management is the key to success in trading over a long period of time.