Retail investors maintain a bearish bias, while Wall Street analysts exhibit evenly balanced bullish and bearish sentiments.

Christopher Vecchio, the head of Futures and Forex at Tastytrade.com, said investors turn away from gold because economic activity continues to support risky assets.

On the other hand, Bannockburn Global Forex Managing Director Mark Chandler stated optimism about gold, but mentioned that they expect a short-term bounce from $1900 to around $1930, as a rate hike and an upcoming strong employment report will likely prevent prices from rising higher.

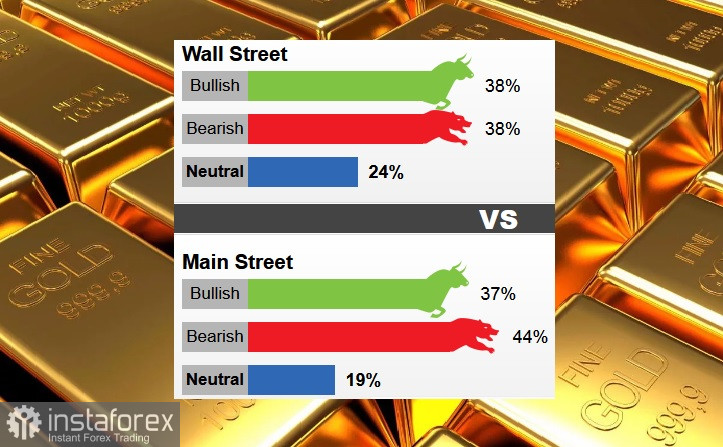

A recent survey also indicated that 38% of the reporndents voted for bulls and bears equally, while 24% believe prices will continue in a sideways trend. Online polls showed 37% anticipating price growth, 44% voted for a decline in prices, while 19% remained neutral.

However, retail investors believe that the average target price at the end of the week will hit $1941 per ounce, representing modest growth compared to current prices.

Gary Wagner, the editor of TheGoldForecast.com, said improving economic conditions will continue to weigh on gold, explaining that a robust economy, lower unemployment rate, and increasing bond yields will convince the Federal Reserve that the US economy can withstand further rate hikes. In this case, even if dollar weakens, it will not be sufficient to trigger a gold rally.

The only warning against bearish sentiment towards gold could be escalating geopolitical turmoil. Most optimistic analysts note that uncertainty and growing risks support gold as a safe-haven asset.