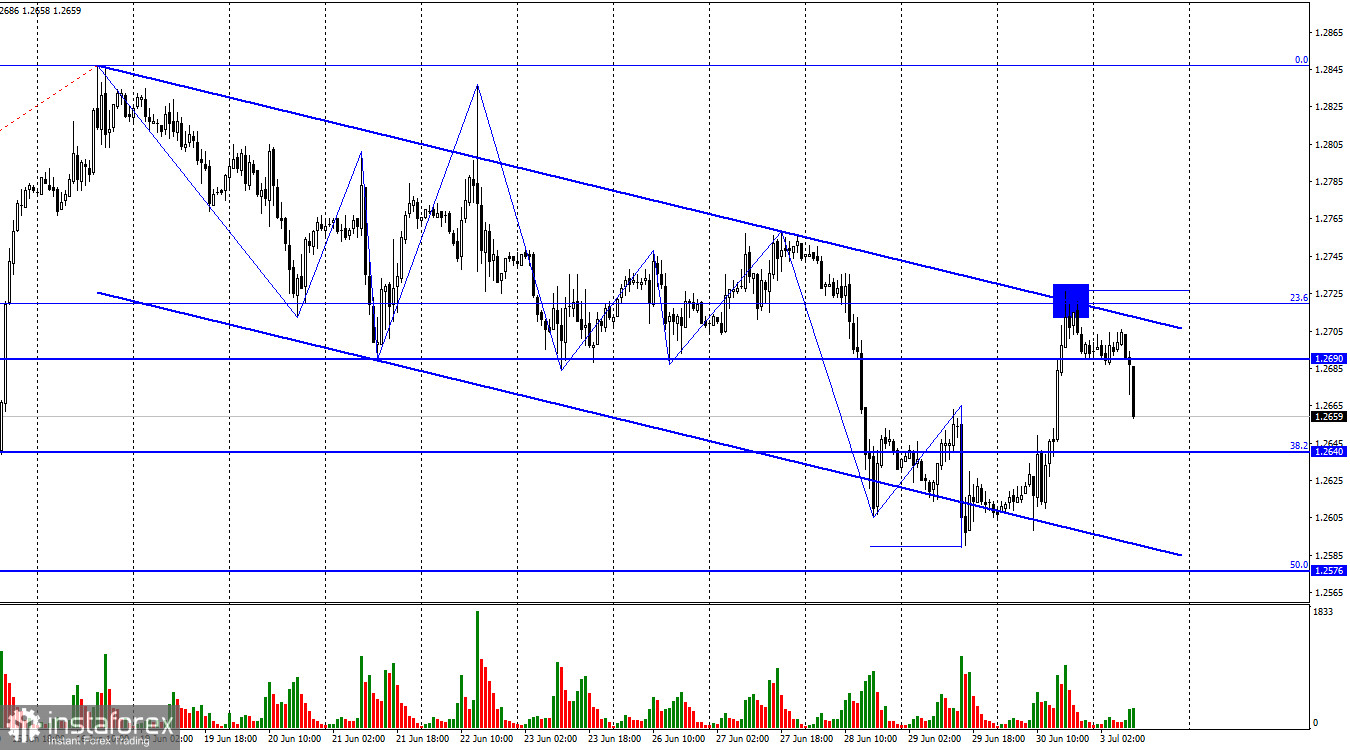

On the hourly chart, the GBP/USD pair unexpectedly rose on Friday, reaching the corrective level of 23.6% (1.2720). This level nearly aligns with the upper line of the descending trend corridor, indicating a bearish sentiment among traders. Despite breaking the peak of the previous upward wave, the bearish sentiment persists as the pair failed to close above the corridor. The rebound from the 1.2720 level favored the US dollar and led to a resumption of the decline. The pair's quotes may continue falling towards the Fibonacci level of 38.2% (1.2640), where a rebound could benefit the British pound and initiate a new upward wave.

Considering the broken peak of the previous upward wave, we can anticipate a new upward wave. If such a wave forms, it will result in a close above the trend corridor, shifting traders' sentiment to bullish. Consequently, a reversal could occur around the 1.2640 level.

The British GDP report on Friday revealed a 0.1% growth in the first quarter, a final value that will still need to be revised. Traders' expectations aligned with reality, so the pound's rise throughout the day cannot be attributed to this report. It is also unlikely that US statistics influenced it, as it started in the morning, about 6 hours before the release of reports in the US. However, the bulls still failed to seize the initiative.

Today, the UK manufacturing business activity index was released, which turned out to be stronger than the preliminary estimate but still below 50. Based on this report, it is unlikely that the pound will experience significant growth.

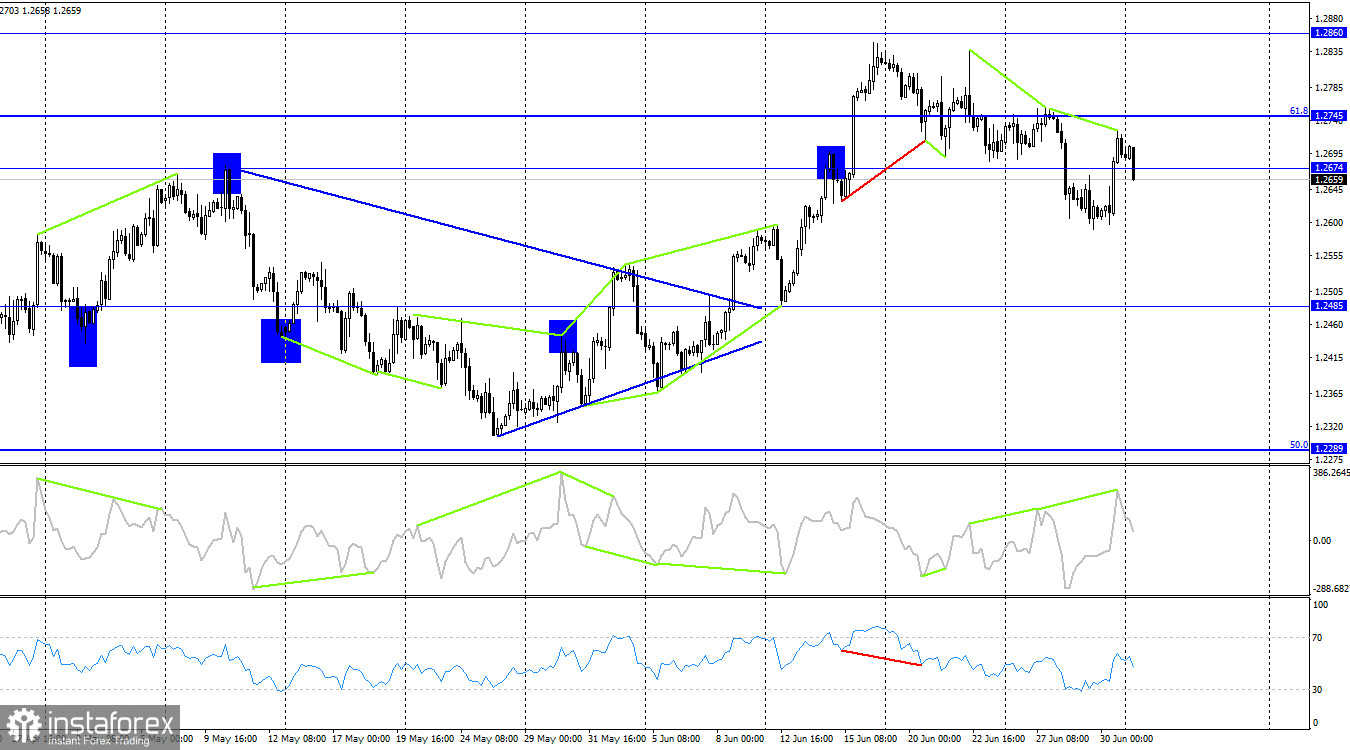

On the 4-hour chart, the pair reversed in favor of the US dollar after forming a new bearish divergence in the CCI indicator. Consolidation below the 1.2674 level increases the likelihood of further decline. Hence, the downward movement may continue towards the next level at 1.2485. No emerging divergences are observed in any of the indicators, and currently, there are no signals indicating the end of the pair's decline.

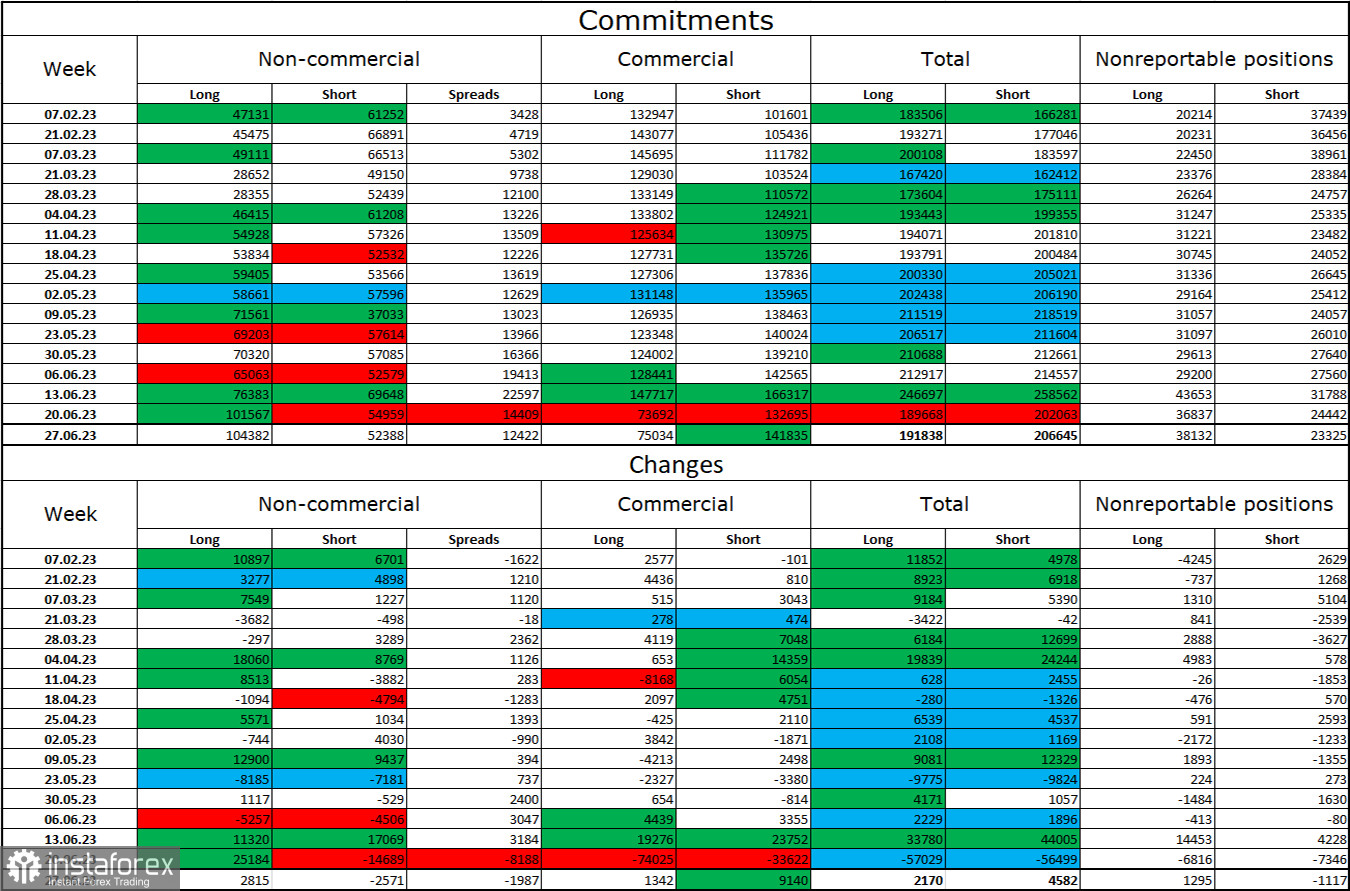

Commitments of Traders (COT) report:

The sentiment of the "Non-commercial" category of traders has become more bullish during the last reporting week. The number of long contracts held by speculators increased by 2,815 units, while the number of short contracts decreased by 2,571. The overall sentiment of major players remains fully bullish, with a twofold gap between the number of Long and Short contracts: 104 thousand versus 52 thousand. The British pound has good prospects for further growth, and the current information background supports it more than the dollar. However, I do not expect a strong rise in the pound sterling soon, as the market has already priced in the Bank of England's interest rate hike of 0.50%. There are also few graphic signals for buying at the moment.

News calendar for the US and UK:

UK - Manufacturing Purchasing Managers' Index (08:30 UTC).

US - Manufacturing Purchasing Managers' Index (13:45 UTC).

US - ISM Manufacturing PMI (14:00 UTC).

Monday's economic events calendar includes three moderately significant entries. The impact of the information background on traders' sentiment for the rest of the day can be of moderate strength.

Forecast for GBP/USD and trader advice:

Short positions on the pound could have been opened in the event of a rebound on the hourly chart from the 1.2720 level, with a target of 1.2640. If the quotes close below the 1.2640 level, we maintain the short positions until the 1.2576 level or the formation of a buy signal. For buying the pair, consider a rebound from the 1.2640 level (with small lots) or a close above the descending trend corridor on the hourly chart.