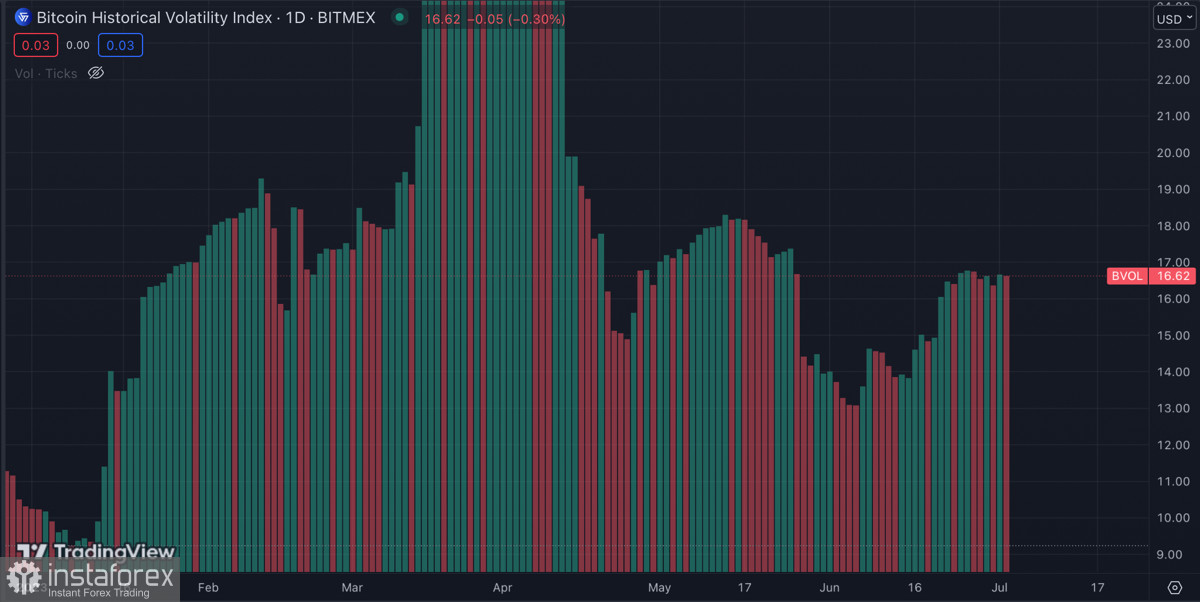

The upward momentum of Bitcoin allowed the asset to enter a new range of active trading between $29.8k and $31.5k. Subsequently, buyer volumes in the BTC market declined, and the asset ended the workweek with minimal price fluctuations. The same applies to the weekends, once again highlighting the importance of the U.S. market for Bitcoin's growth.

Bitcoin ended June on a bullish note, above the $28k level, which is a positive signal for investors to continue buying the cryptocurrency. Historically, July has often been a bullish month for BTC. However, each trading month and year is unique, so relying solely on historical context is not advisable.

Fundamental Factors

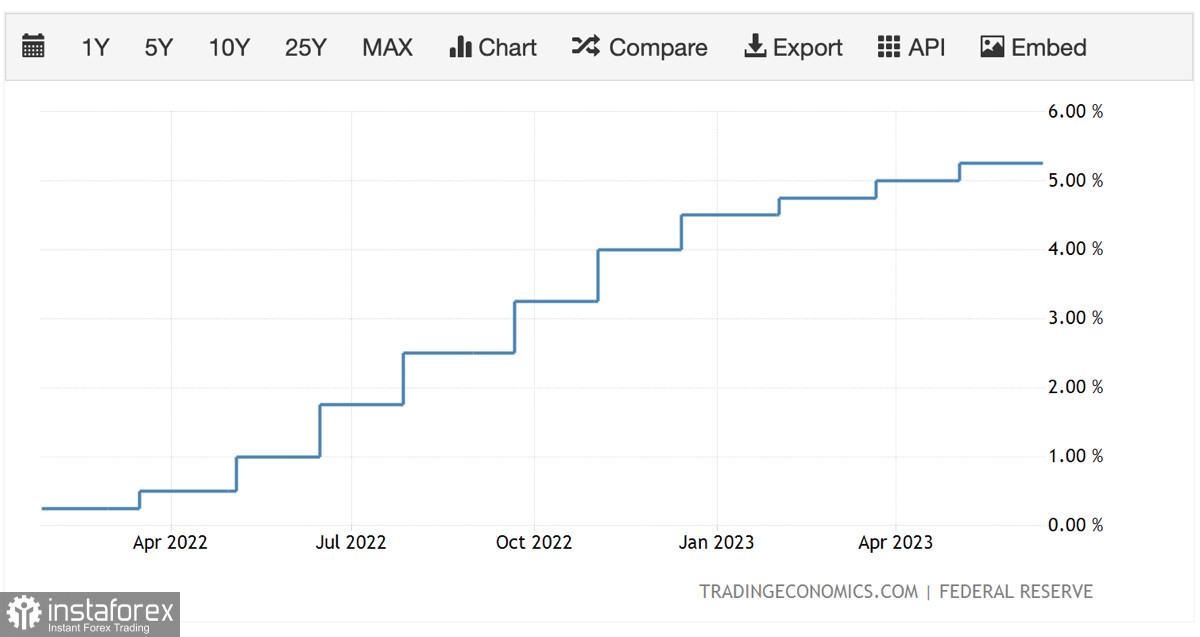

The Federal Reserve's interest rate policy and the level of inflation continue to be the key drivers of trends in the crypto market. The inflation report will be released next Wednesday. This week, the markets anticipate a shake-up due to the publication of key labor market data.

Additionally, a detailed transcript of the Federal Reserve's meeting will be released this week, which is expected to reveal insights into the central bank's future actions. Most investors expect to see the positions of other Federal Reserve members regarding the resumption of rate hikes in July. Over 75% of investors on the CME expect an increase in the indicator in July.

All of this data can affect Bitcoin quotes positively and negatively. According to K33 Research, BTC/USD quotes show growth primarily during the American trading session due to the activity of institutional investors. Therefore, as long as there are no significant movements in stablecoin volumes in the cryptocurrency market, American financial markets should always remain in investors' focus.

Is Bitcoin preparing for growth?

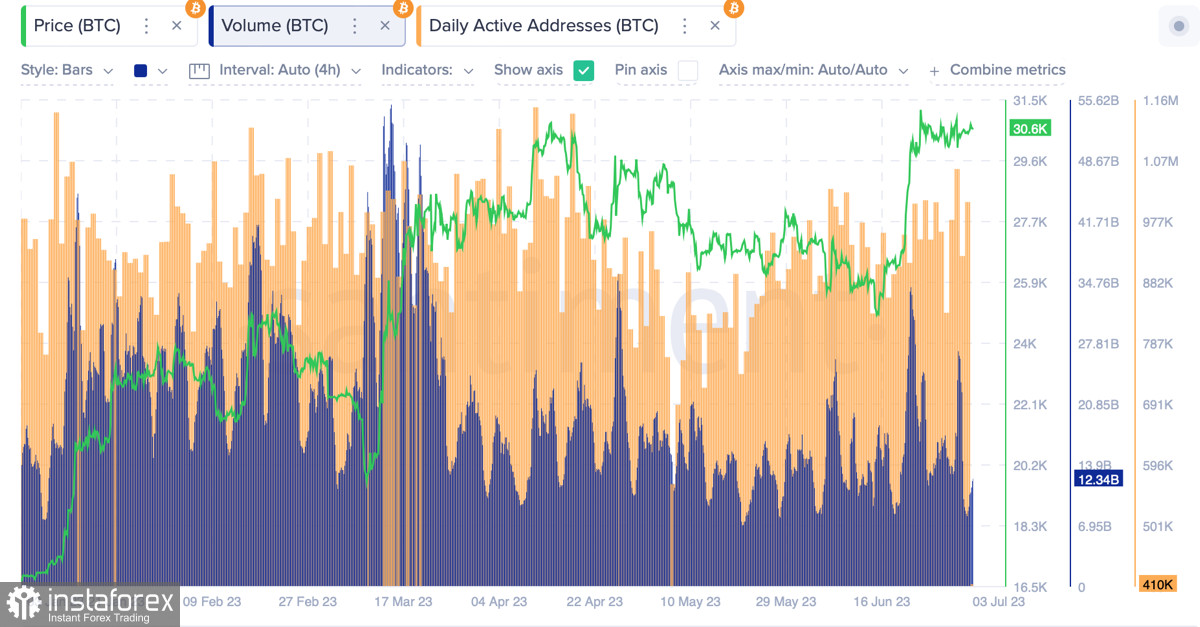

Bitcoin significantly increased its bullish potential in June due to the growth in the unique number of addresses and trading volumes in the asset's network. The combination of these factors led to BTC network users conducting 11.82 million transactions in June. This indicates an activation of investors and growing interest in BTC.

Once again, note that if we look at the statistics from 2009, July is the most bullish month for Bitcoin. Additionally, Kaiko reports a significant decrease in the correlation between U.S. stocks and BTC, which could also have a negative impact on buying volumes in the crypto market.

Despite this, overall, Bitcoin has successfully weathered local profit-taking, holding the $30k level and remaining within a bullish trend. Given this, in the near future, we can expect further attempts by the asset to establish itself above $31k. Significant trading activity is expected within the day.

BTC/USD Technical Analysis

After a volatile Friday, when Bitcoin tested the upper and lower boundaries of the current price range between $29.8k and $31.2k, the market entered a period of calm. Trading volumes dropped to a minimum and, as of 11:00 UTC, only recovered to $10 billion. The key targets for the bulls remain the levels of $31k to $31.3k, where a large order block is concentrated.

At the same time, technical metrics on the 1D timeframe remain in overbought territory. This suggests the possibility of a local decline below the $29.8k level, which is possible in the event of disappointing labor market statistics in the U.S. However, overall, the asset has taken a pause for consolidation, and the key support/resistance levels, as well as the targets for bulls/bears, remain the same.

Conclusion

Bitcoin is in an upward movement, and as long as the asset holds the range between $29.8k and $30k, the probability of continued growth is high. The main targets are the levels of $30.8k, $31k, and $31.3k. The key target for the bulls is the $31.5k level.

Bears are attempting to form a series of lower highs to try to break and establish themselves below $29.8k to $30k. However, we have not seen significant activation of sellers during the Asian session opening, so the prospects for bears are not favorable.