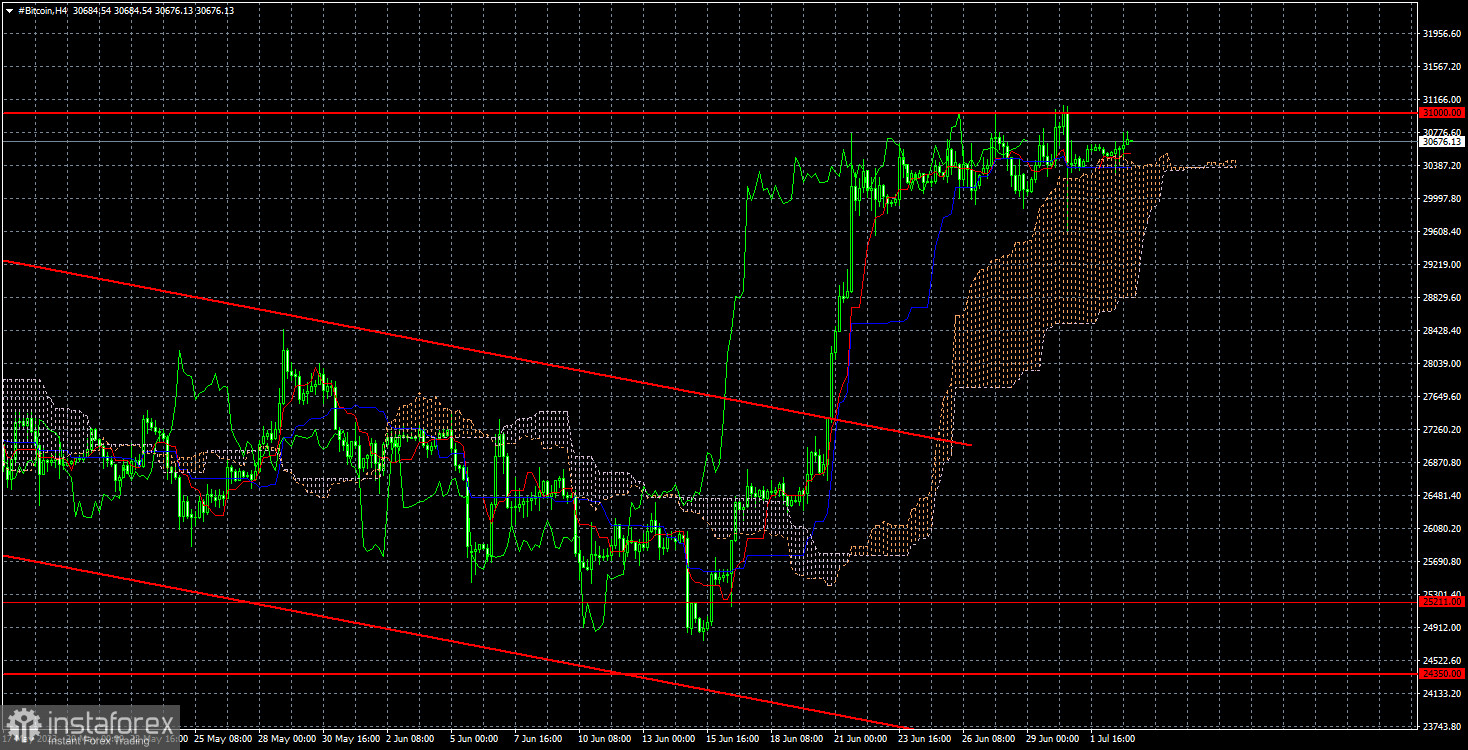

Bitcoin has perfectly worked out the $31,000 level and is now in a phase of strategic thinking about its next steps. Interestingly, the absence of a sharp downward rebound after this level indicates that the market remains "bullish." Nevertheless, further growth can be expected if it surpasses the $31,000 level. It's worth mentioning that Bitcoin has ascended too rapidly and drastically. Establishing an ascending trend line supporting the ongoing upward movement is not feasible. Consequently, there is a greater likelihood of a correction phase now. Given that the entire activity in recent months could be interpreted as an upward correction, we anticipate a more substantial downward movement (below $25,000) soon.

In the meantime, a company formerly known universally as a software developer has once again acquired a substantial number of Bitcoin coins. Between April 29 and June 27, MicroStrategy invested an additional $347 million into purchasing 12,333 Bitcoin coins at an average price of $28,100. As a result, its balance sheet now holds more than 152 thousand coins, currently valued at approximately $4.6 billion. The average buying price for all coins is close to $30,000. The company has yet to realize any profit from its long-term investments. Despite this, the guidelines set forth by Michael Saylor, who no longer leads the company, remain in effect. It should be remembered that the company even resorted to loans to procure Bitcoin, which now can be deemed a core aspect of its operational strategy.

Simultaneously, the U.S. Securities and Exchange Commission voiced its opposition to the launch of a Bitcoin ETF, deeming the project "inadequate." It should be noted that the SEC and its leader Gary Gensler currently pose the greatest challenge to Bitcoin investors, as they clearly don't envision a future dominated by Bitcoin and are vigorously opposing crypto companies and exchanges by imposing heavy regulatory measures. The fundamental market conditions don't favor the further strengthening of Bitcoin.

The $31,000 level was achieved within a 4-hour timeframe. This level presents potential selling opportunities with a target of $25,211 and a Stop Loss set above the $31,000 level. However, consolidating above $31,000 could enable new long positions with a target of $34,267. While Bitcoin has experienced a significant upsurge, and the trend has officially shifted upward, we currently see no new growth stimuli. At the very least, a downward correction should occur, facilitating the formation of an ascending trend line.