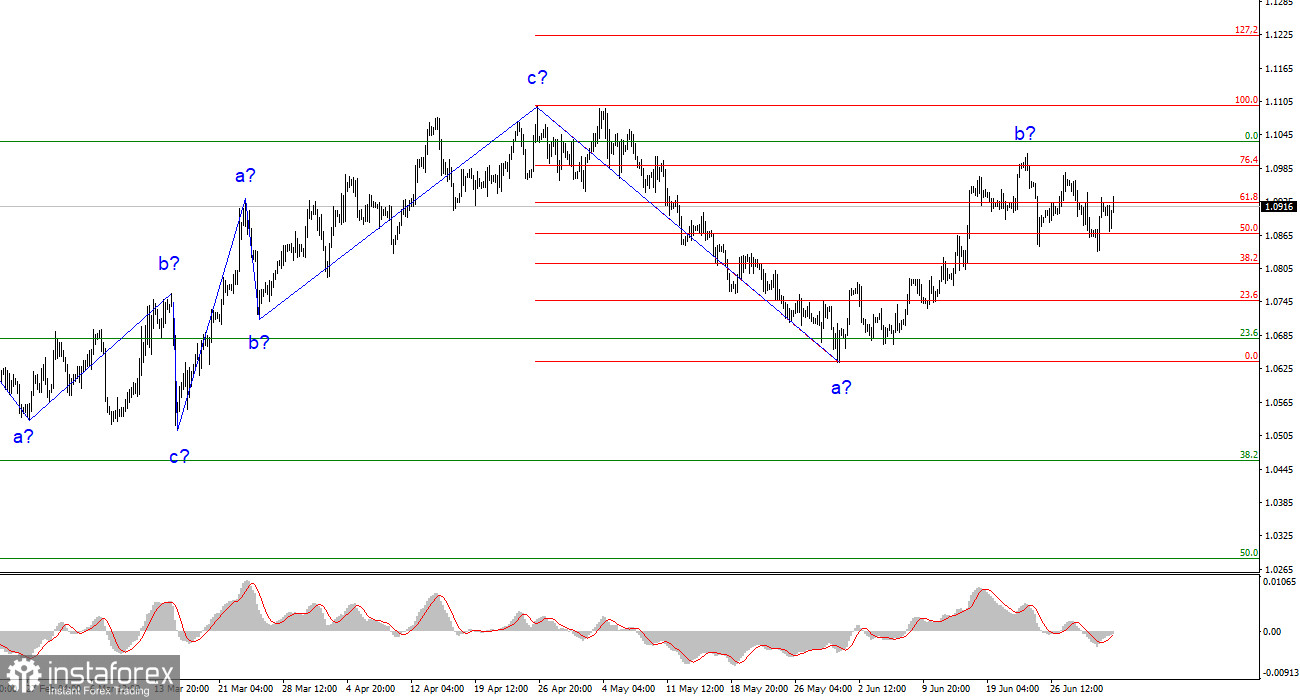

The wave analysis of the 4-hour chart for the euro/dollar pair remains somewhat standard but still quite understandable. The entire ascending section of the trend, which started on March 15, can take a more complex structure, but at this time, I expect the formation of a decreasing section of the trend, which will also be three-wave. I am waiting for the pair around the 5th figure, from where the formation of the ascending three-wave started. I still stick to my words. The assumed wave b could have completed its formation last week, indicated by the subsequent retreat of the quotes from the reached peaks.

However, in light of recent events and especially the movements of the GBP/USD pair, I have developed an alternative wave analysis, which assumes that the entire section of the trend between March 15 and April 26 is one wave a. If this is indeed the case, the next wave is b, and now we are seeing the formation of an ascending wave c. In this case, the wave analysis of the pound and the euro coincide, and everything falls into place. If this assumption is correct, the euro will resume the increase from the current position to the 11th figure and higher.

Business activity did not support the euro

The euro/dollar rate did not change on Monday. The decrease in the first half of the day was about 40 points, and in the second half, the increase was about 50. The pair's amplitude was low, although it did not stand in one place. The decrease in demand for the euro in the first half of the day is easily explained. The market is frankly tired of the daily performances of the ECB Governing Council members, who repeat the same thing each time and have started paying more attention to economic statistics. And the statistics today showed nothing optimistic. The EU manufacturing business activity index slowed down from 44.8 points to 43.4, and in Germany - from 43.2 points to 40.6. Therefore, the tightening of monetary policy works not only for the good but also for the harm. And it is still unknown what will be more.

Inflation is undoubtedly decreasing, which is pleasing, but the business activity indices are also falling. Soon, even the more stable service sector may go underwater, and a stronger fall in GDP, which is now balancing on the brink of the negative area, should be expected. However, the last two quarters ended at minus 0.1%. However, in the second half of the day, a no less weak ISM index in the USA came out, which restored the market balance.

General conclusions.

Based on the analysis conducted, the formation of a downward trend segment continues. The pair again has quite a large space for a decrease. I still believe that targets in the region of 1.0500-1.0600 are quite feasible, and with these targets, I advise selling the pair based on MACD "down" signals. The supposed wave b is completed. According to the alternative analysis, the ascending wave will be more extended and complex, but I wonder if it will take a more complex form. The news background does not currently support the euro to a greater extent.

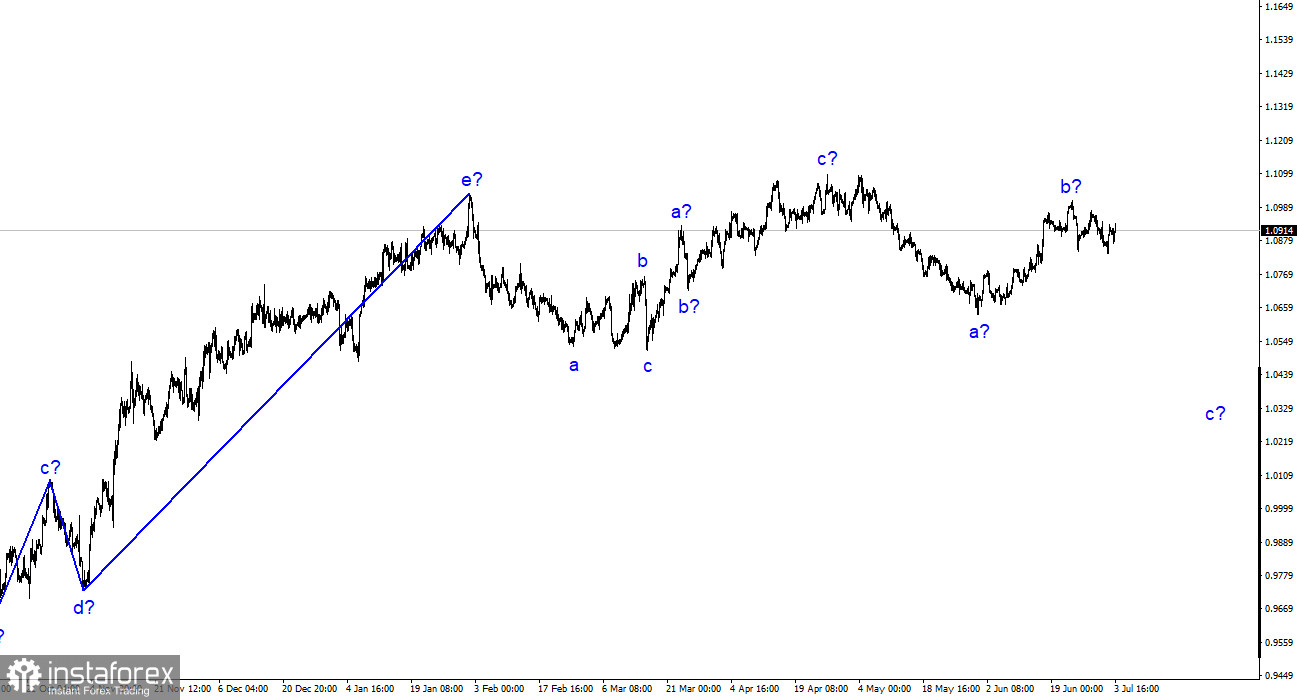

On the older wave scale, the wave analysis of the ascending trend segment has become extended but is likely completed. We saw five waves up, which most likely are the a-b-c-d-e structure. Then the pair built two three-wave segments, down and up. Now it is in the stage of building another descending three-wave structure.