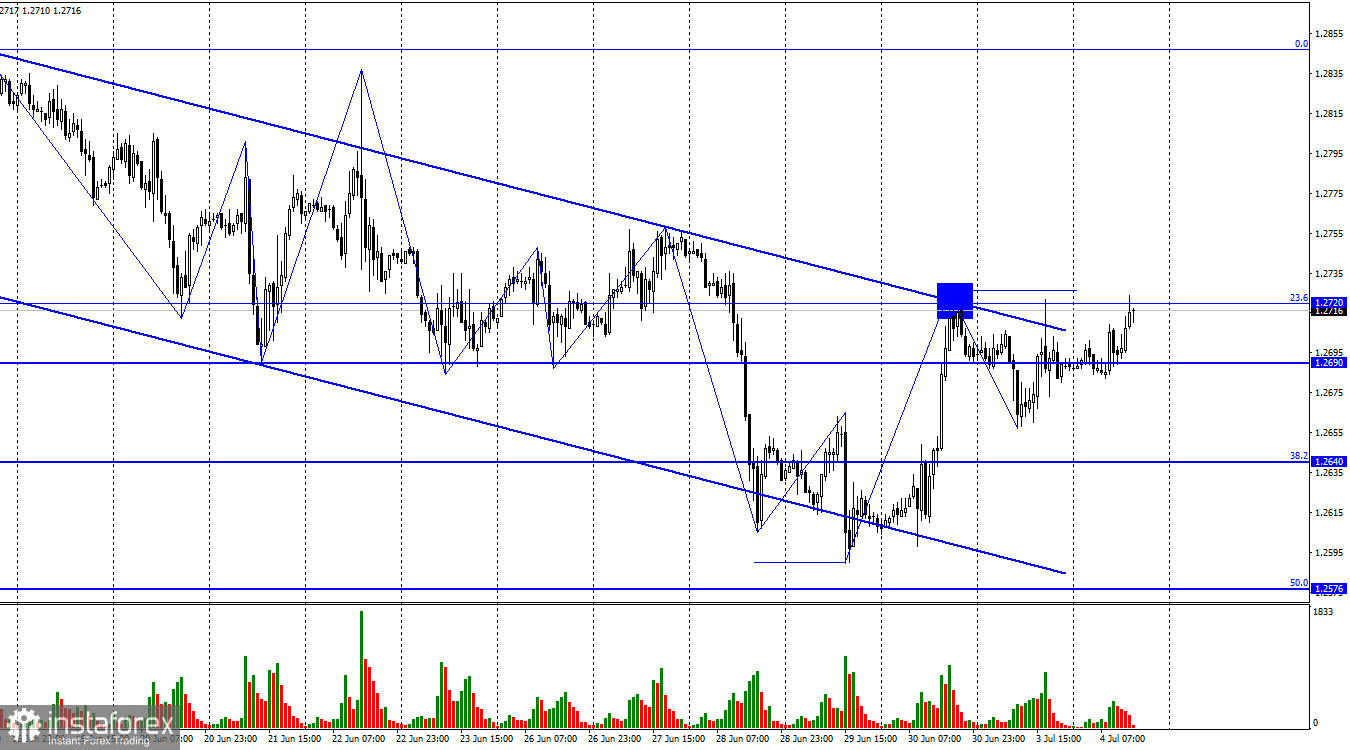

However, pay attention to the level of 1.2720, which the price has failed to break three times already. Just above this level is the peak of the last upward wave. If bulls fail to overcome these obstacles, bears may regain control of the market, leading to a new downward wave toward the levels of 1.2640 and 1.2576. Breaking the peak of 1.2726 by a few points will not be considered a bullish sentiment confirmation.

Yesterday, US statistics spoiled the pair's downward journey. The manufacturing sector's business activity index decreased from 48.4 to 46.3 points in June, and the ISM business activity index dropped from 46.9 to 46 points. The decline is slight, but it has been ongoing for several months. Notably, any value of these indexes below 50 is considered negative for the manufacturing sector or the service sector. Today the US celebrates Independence Day, and there will be a few reports on Wednesday as well. However, the last two days of the week promise to be very important, and traders should be much more active than on Monday and Tuesday. There will be a lot of significant reports in the US that could influence the US dollar's position. So far this week, it has not found solid grounds for a new rise. Until there is a clear and confident breakthrough above 1.2726 on the hourly chart, bearish sentiment remains stable and unchanged.

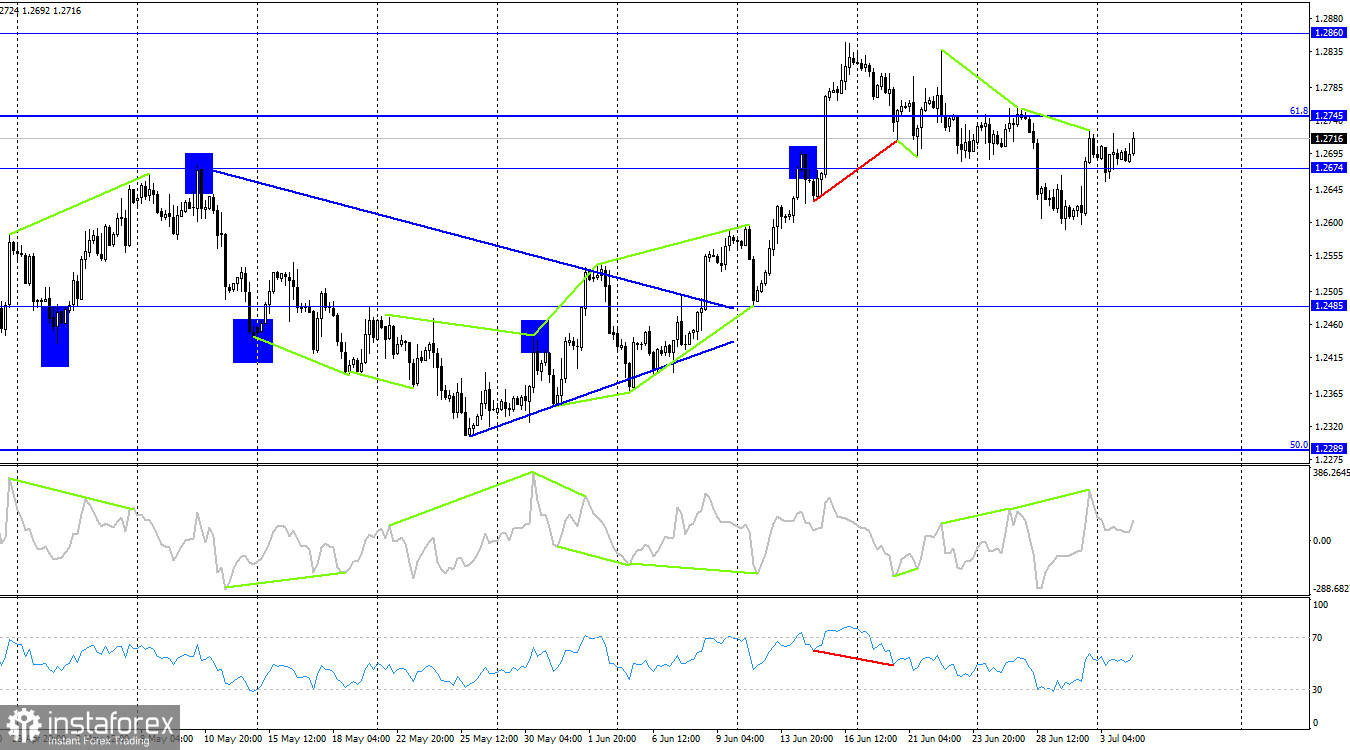

On the 4-hour chart, the pair reversed in favor of the American after forming a new bearish divergence with the CCI indicator, but it did not manage to settle below 1.2674. Thus, the downward movement may continue towards the next level of 1.2485, but only after closing below 1.2674. The hourly chart provides a more eloquent and informative picture, so it is better to pay closer attention to it. The trend on it may change in the next few hours.

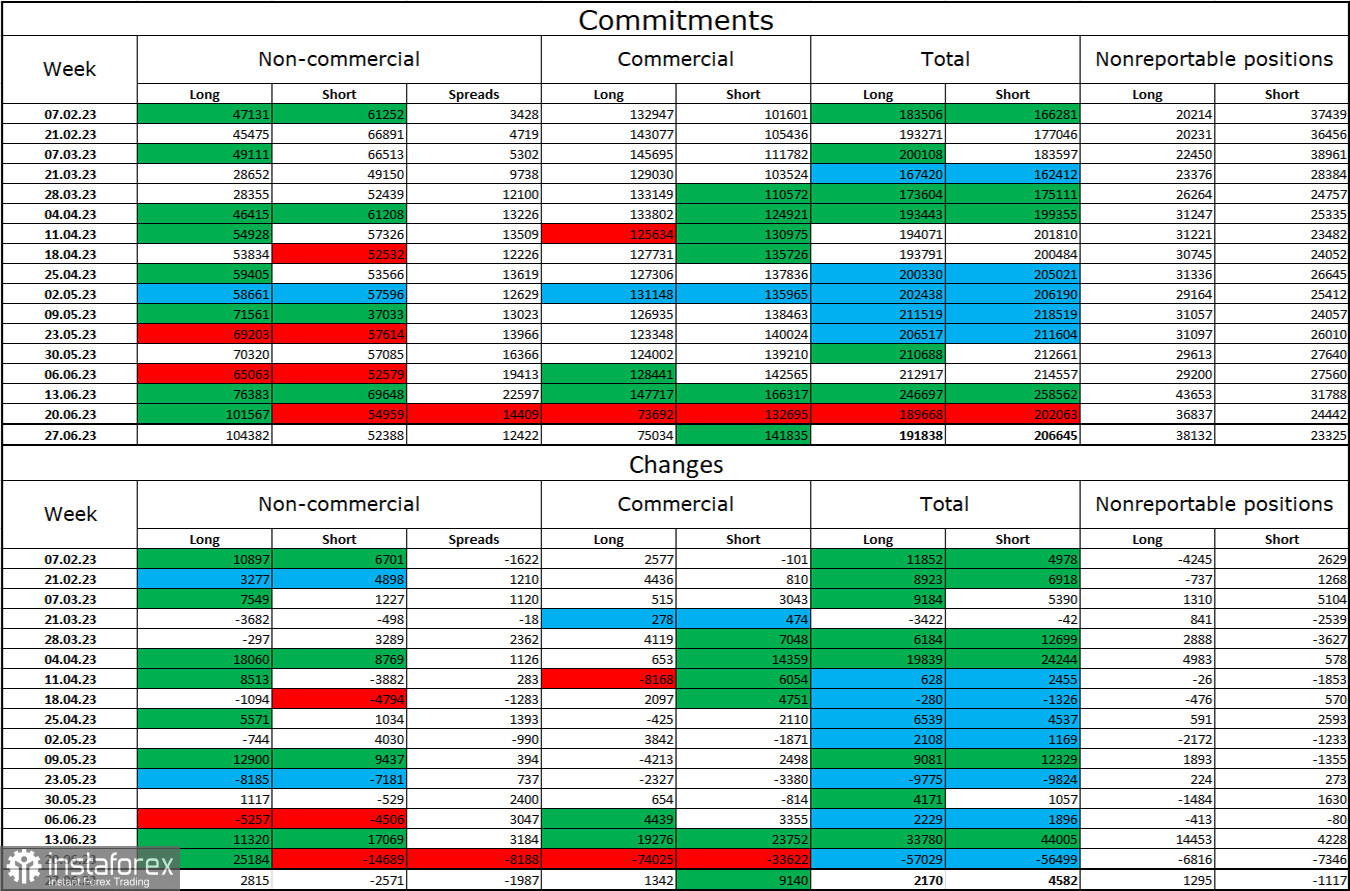

COT report:

The sentiment of the non-commercial traders became more bullish over the last reporting week. The number of long contracts held by speculators increased by 2,815, while the number of short contracts decreased by 2,571. The overall sentiment of major players remains bullish, with a twofold gap between the number of long and short contracts: 104,000 against 52,000. The British pound has good prospects for further growth, and the current information background supports it more than the US dollar. However, a strong rise in the pound sterling is not expected in the near future, as the market has already factored in the Bank of England's 0.50% interest rate hike. There are also several graphical signals for buying.

US and UK economic calendars:

On Tuesday, the economic events calendar does not contain any important events. The information background is unlikely to affect market sentiment.

Forecast for GBP/USD and recommendations for traders:

One may sell the British pound if the pair rebounds from 1.2726 on the hourly chart with a target of 1.2640. You may consider long positions if the price settles above 1.2720 on the hourly chart and breaks through 1.2726 with targets in the range of 1.2750-1.2800.