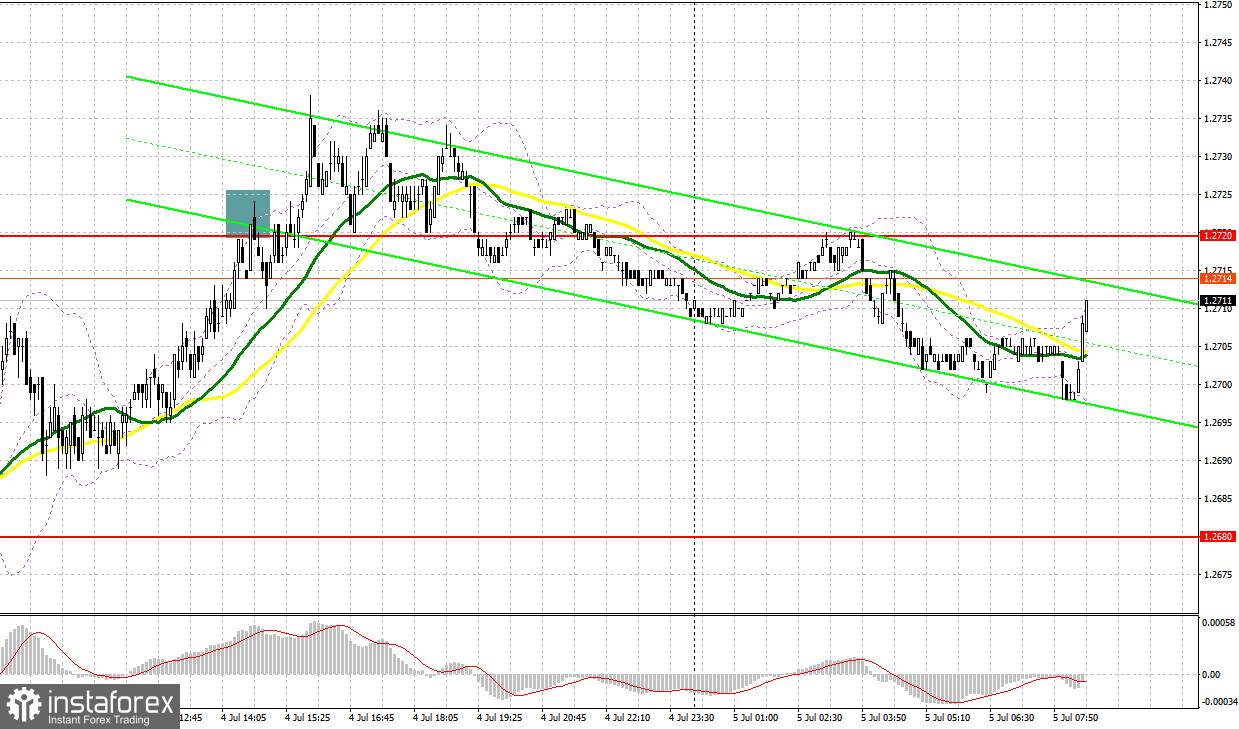

Yesterday, traders received just one signal to enter the market. Let us take a look at the 5-minute chart to figure out what happened. Earlier, I asked you to pay attention to the level of 1.2680 to decide when to enter the market. The pound sterling dropped in the first part of the day. It needed just a couple of pips to test 1.2680. Thus, it was impossible to obtain an entry point for long positions from there. A false breakout of 1.2720 in the second half of the day led to a sell signal, but the pair did not experience a significant drop. After a 10-pip decline, demand for the pound returned, allowing the pair to recoup losses.

Conditions for opening long positions on GBP/USD:

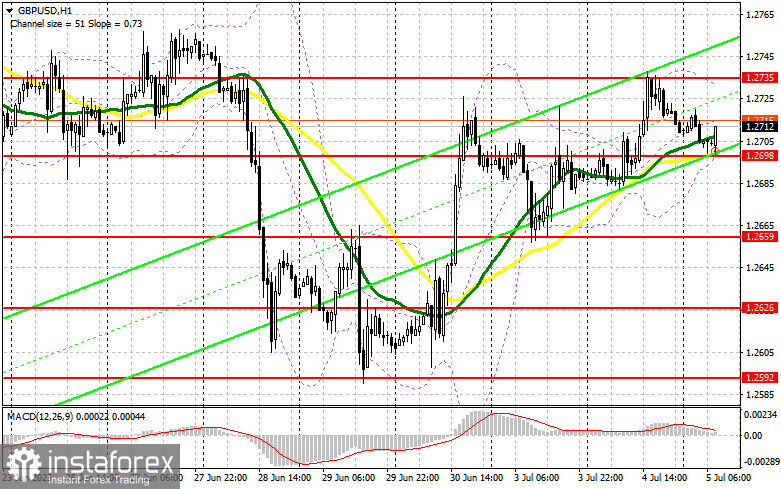

Today, the focus will be on the PMI index for the UK services sector, which can determine the direction of the pair for the entire day. Weak indicators in this segment, as well as a poor composite PMI index that includes the manufacturing sector, will hardly encourage buyers. This may result in a larger downward movement of the pair in the first half of the day. For this reason, I will focus on protecting the new support level of 1.2698, formed based on yesterday's results. Only a false breakout of this level will give a buy signal. In this case, the target for recovery will be the nearest resistance at 1.2735. If bulls plan to break through this range, it will only happen amid good PMI index data. A breakout and consolidation above 1.2735 will provide an additional buy signal with a surge toward 1.2770. The farthest target will be located around 1.2804, where I will take profit. If the pair drops to 1.2698 and buyers fail to be active, which is most likely to happen, pressure on the pound will rise, leading to a more considerable downward movement towards 1.2659. Defending this area, as well as a false breakout of this level, will provide buying opportunities. I plan to buy GBP/USD only on a bounce from 1.2626, expecting the correction of 30-35 pips within the day, but it is unlikely to reach that point.

Conditions for opening short positions on GBP/USD:

Bears failed to achieve their goals yesterday, and now the main task is not to miss the new weekly high at 1.2735. This could happen in the first half of the day after strong PMI data is released. A false breakout at this level will provide a sell signal, returning pressure on the pair with the target at 1.2698, the support level formed amid yesterday's results. A breakout and an upward test of this range will deliver a more serious blow to bullish positions, pushing GBP/USD towards 1.2659. The farthest target remains at the low of 1.2626, where I will take profit.

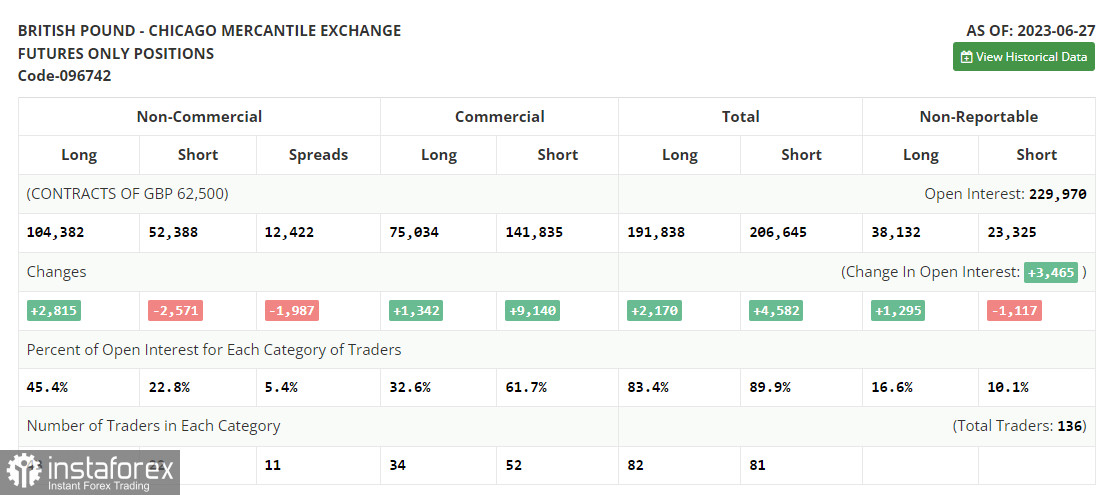

COT report

According to the COT report from June 27, there was a slight reduction in short positions and a similarly minimal increase in long positions. Buyers of the pound sterling definitely have a chance to continue acting more aggressively since the Bank of England, regardless of all the pressure and economic problems, will continue to maintain a policy of high interest rates due to serious inflation issues that are affecting household living standards. The fact that the Federal Reserve paused its cycle of tightening monetary policy last month while the Bank of England has no plans to do so. In this light, the British pound is becoming even more attractive. Buying the pair on declines remains an optimal strategy. According to the latest COT report, non-commercial short positions increased by 2,815 to 104,382, while non-commercial long positions decreased by 2,571 to 52,388. This led to a slight increase in the non-commercial net position to 51,994 compared to 46,608 in the previous week. The weekly price declined to 1.2735 compared to 1.2798.

Signals of indicators:

Moving Averages

Trading is conducted near 30- and 50-day moving averages, which points to the market uncertainty.

Note: The period and prices of moving averages are considered by the author on the one-hour chart that differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

If the pound sterling drops, the lower limit of the indicator located at 1.2698 will act as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 30. It is marked in green on the graph.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). A fast EMA period is 12. A slow EMA period is 26. The SMA period is 9.

- Bollinger Bands. The period is 20.

- Non-profit speculative traders are individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions is a total number of long positions opened by non-commercial traders.

- Short non-commercial positions is a total number of short positions opened by non-commercial traders.

- The total non-commercial net position is a difference in the number of short and long positions opened by non-commercial traders.