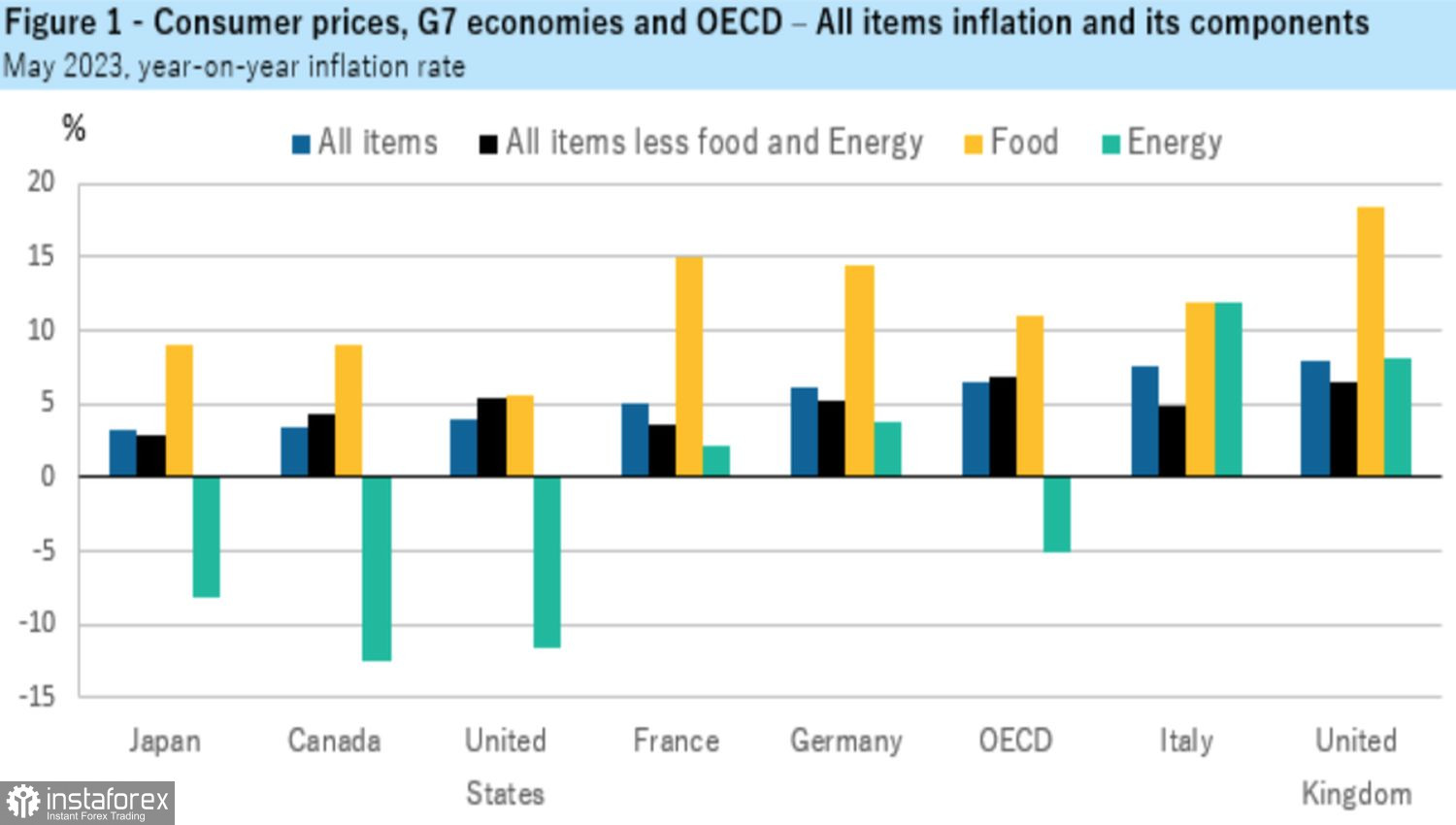

No matter how loud the hawkish rhetoric of central banks sounds, one thing is clear: inflation continues to slow down. In developed countries, it dropped to 6.5% in May, and in G7 countries, it reached 4.6%. This is the lowest rate since September 2021. It is obvious that the cycles of monetary restrictions are coming to an end, and attempts by regulators to announce future rate hikes causes mistrust in the markets. That is why the "bears" on EUR/USD cannot develop their attack.

Inflation Dynamics in Developed Countries

When central banks do not know exactly how the situation with inflation will develop, whether it will continue to slow down or a new peak will appear, the best option is to adhere to "hawkish" rhetoric. Thus, Bundesbank President Joachim Nagel noted that the ECB has not yet reached the end of the path of tightening monetary policy. The question of how much more rates will rise in the eurozone cannot be answered.

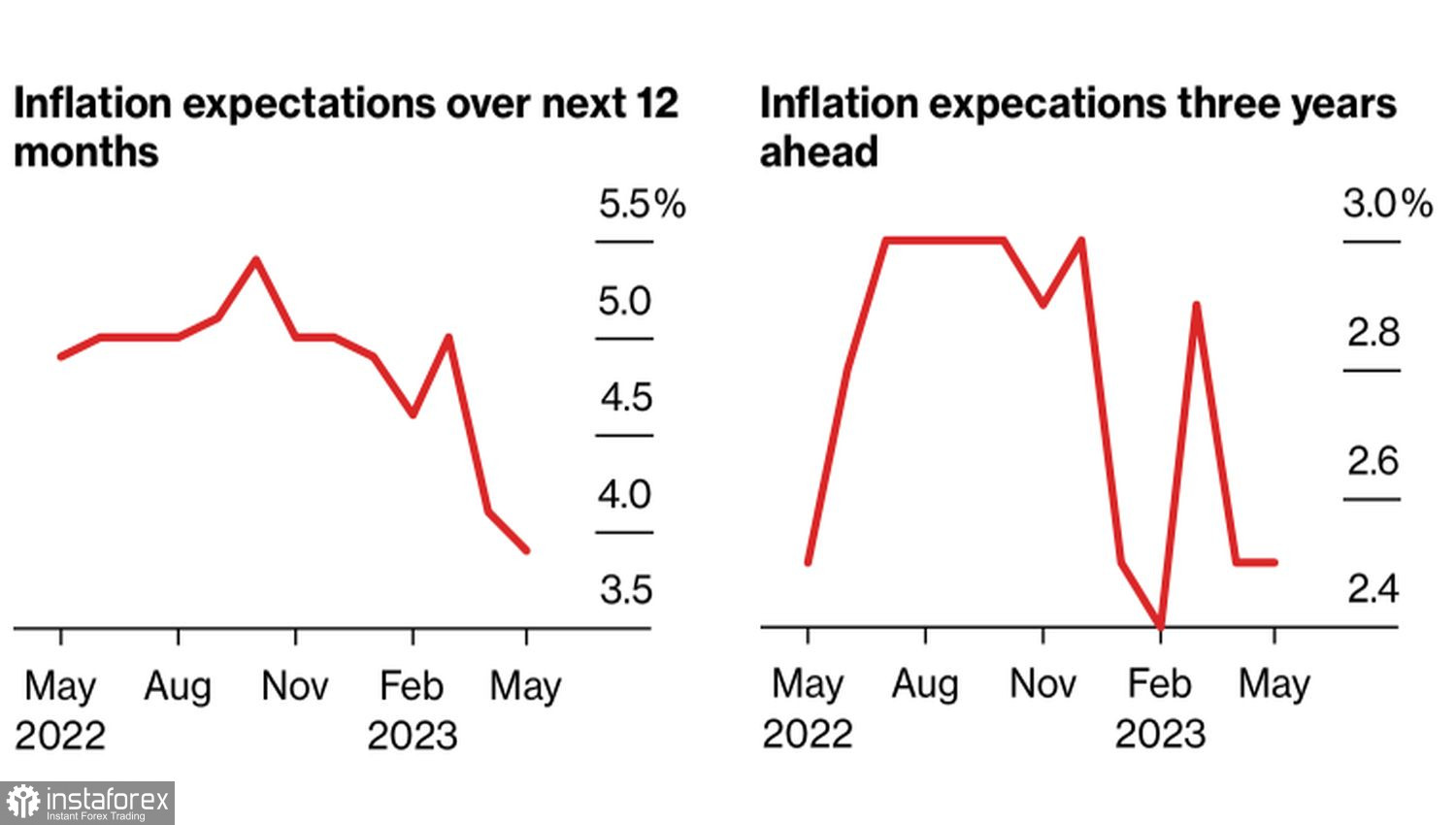

Meanwhile, the cooling of the European economy and the fall in energy prices lead to lower inflationary expectations. The annual rate fell from 4.1% to 3.9% in May, while the three-year remained at 2.5%. This is lower than in the U.S., with their 4.1% and 3%, respectively.

Inflation Expectations Dynamics in the Eurozone

Investors buying EUR/USD are guided by the fact that the ECB began to tighten monetary policy about half a year later than the Fed. This means the ECB has a longer way to go than its American counterparts. The markets believe in an increase in the deposit rate to 4% and doubt an increase in the federal funds rate to 5.75%. Perhaps the minutes of the June FOMC meeting will enlighten them.

In fact, the 25 basis points increase in borrowing costs to 5.5% in July is a settled issue. The Fed is finding it increasingly difficult to oppose the market opinion that the end of the monetary restriction cycle is near. If the central bank pauses for two consecutive meetings, it will finally convince investors of the correctness of their idea. However, another rate hike by the end of 2023 is a different matter. Derivatives have reduced the probability of its occurrence to 30%, which contradicts FOMC forecasts.

Investors are waiting for clarification from the minutes. Chairman Jerome Powell spoke rather cryptically at the press conference, indicating the difficulty of finding a compromise within the FOMC. Only a few days later, Powell mentioned that officials were counting on two or more rate hikes. The market needs evidence that this will indeed happen. If it doesn't receive them, EUR/USD risks returning to growth.

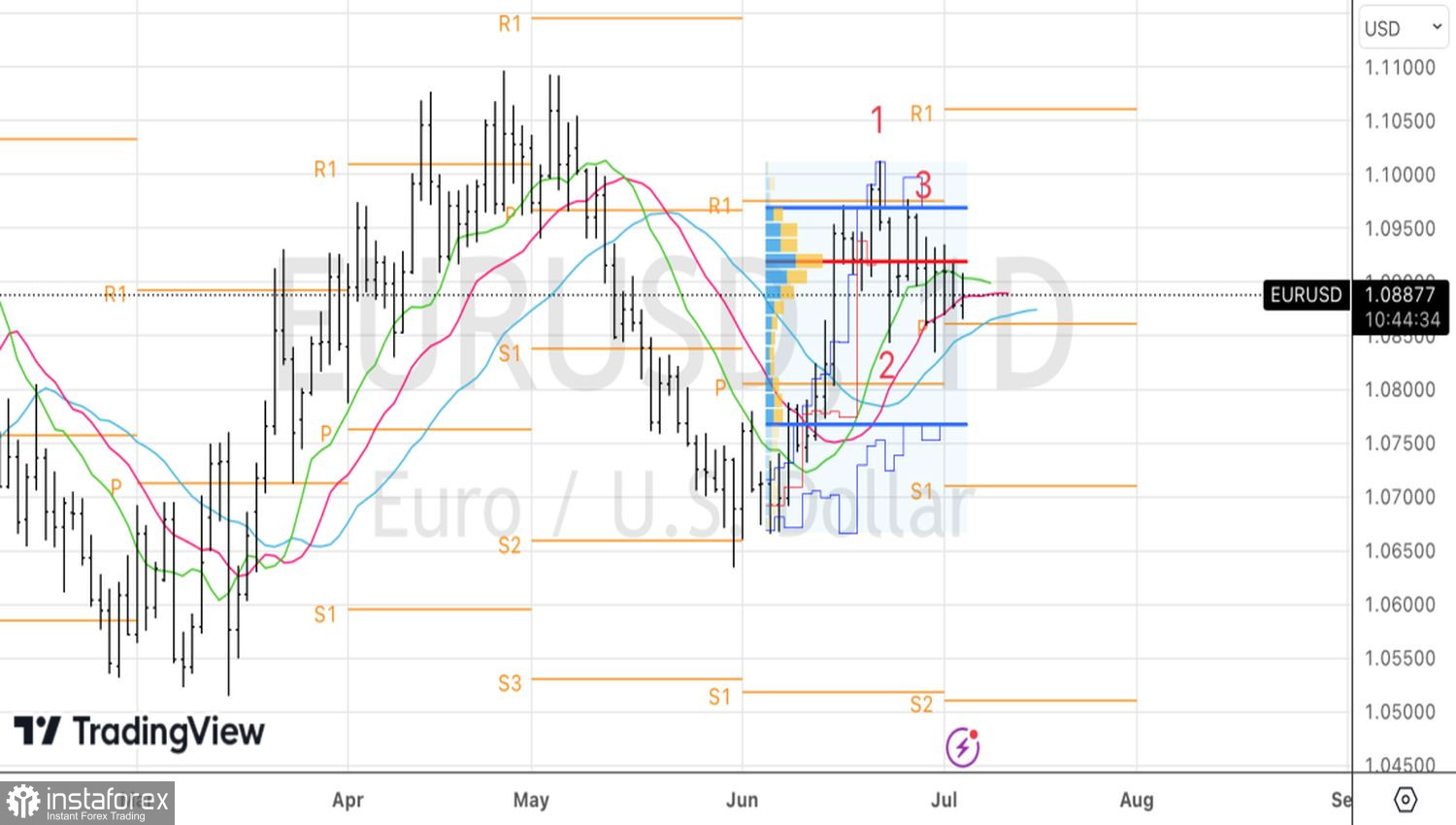

The chances of moving the main currency pair from its current levels with the minutes are small. The U.S. labor market report for June is a more significant event, so I expect fluctuations but not the exit of EUR/USD from consolidation.

Technically, on the EUR/USD daily chart, the "Spike and Ledge" pattern continues to form. A reason for purchases will be the return of EUR/USD to its upper boundary at 1.0965. The basis for sales will be a drop in euro quotes below $1.084. Meanwhile, the focus should be on intraday trading.