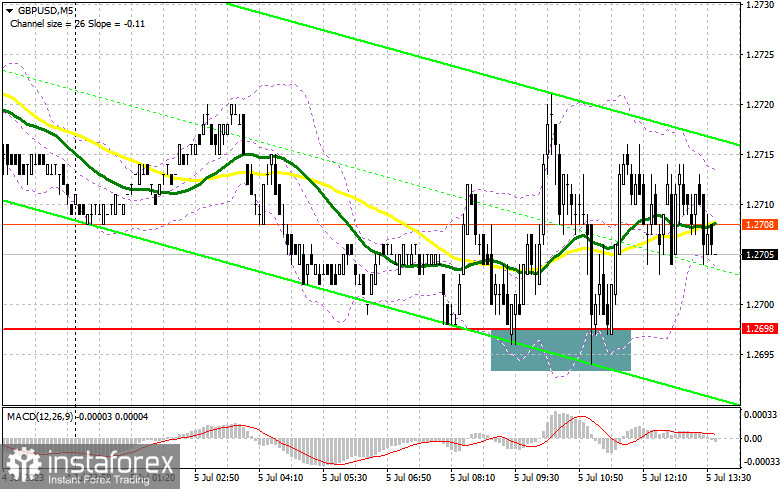

In my morning forecast, I drew attention to the 1.2698 level and recommended using it to make market entry decisions. Let's look at the 5-minute chart and figure out what happened there. The pound's drop in the morning and the formation of a false breakout at 1.2698 presented an optimal entry point for long positions, culminating in a rise of over 20 points. The technical scenario for the afternoon was left unchanged.

For opening long positions on GBP/USD:

Considering that the UK's PMI indices coincided with economists' forecasts, there were no major changes in the balance of power in the market. In the second half of the day, we are waiting for statistics on the change in the volume of manufacturing orders in the US and the publication of the minutes of the Fed meeting. We will unlikely find something in the minutes that we do not know, so everything will end with only a small spike in volatility. The speech of FOMC member John Williams will be of secondary importance so pound buyers have every chance to continue growth.

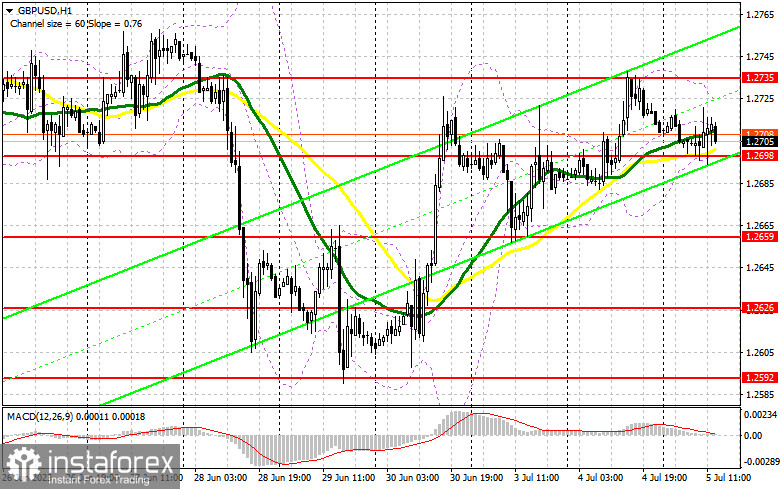

I'll consider buying the pound again only after a decrease and the formation of a false breakout near the nearest support level at 1.2698, similar to what I discussed earlier. This will provide another excellent entry point to recover and update resistance at 1.2735. But it must be understood that growth should be instantaneous after a false breakout in the second half of the day. If this does not happen, it's better to postpone purchases. A breakthrough and a top-down test of 1.2735 will form an additional signal to buy, returning strength to the pound and leading to an update of 1.2770. With this level, it will be easier for GBP/USD buyers to expect further growth.

In case of a breakout above this range, we can discuss a surge to 1.2804, where I will fix the profit. In case of a GBP/USD decline and a lack of buyers at 1.2698, where the moving averages that play on the side of the bulls are also passing, the pressure on the pound will increase. If this happens, I will postpone long positions to 1.2659. They will buy there only on a false breakout. Long positions on GBP/USD can be opened immediately on the rebound from 1.2626 with the aim of a correction of 30-35 points within the day.

For opening short positions on GBP/USD:

Sellers tried but failed to break below 1.2698. But considering that there was no sharp upward movement of the pound in the first half of the day, pressure on the pair could return in the second half. It is still very important for sellers not to allow the pair to break out of the upper boundary of the sideways channel and the nearest resistance at 1.2735. Only the formation of a false breakout there will form a sell signal in anticipation of further decline to support at 1.2698. A breakout and a reverse test from the bottom up of this range for the third time will provide an entry point for selling to update 1.2659. The further target will be the minimum of 1.2626, where I will fix the profit.

In the event of GBP/USD growth and the absence of bears at 1.2735 in the second half of the day, the situation may shift under buyers' control, paving the way for a bullish market. In such a case, only a false breakout around the next resistance at 1.2770 will form an entry point for short positions anticipating a downward pound movement. If there is no activity, I advise selling GBP/USD from 1.2804, expecting a pair's rebound downward by 30-35 points within the day.

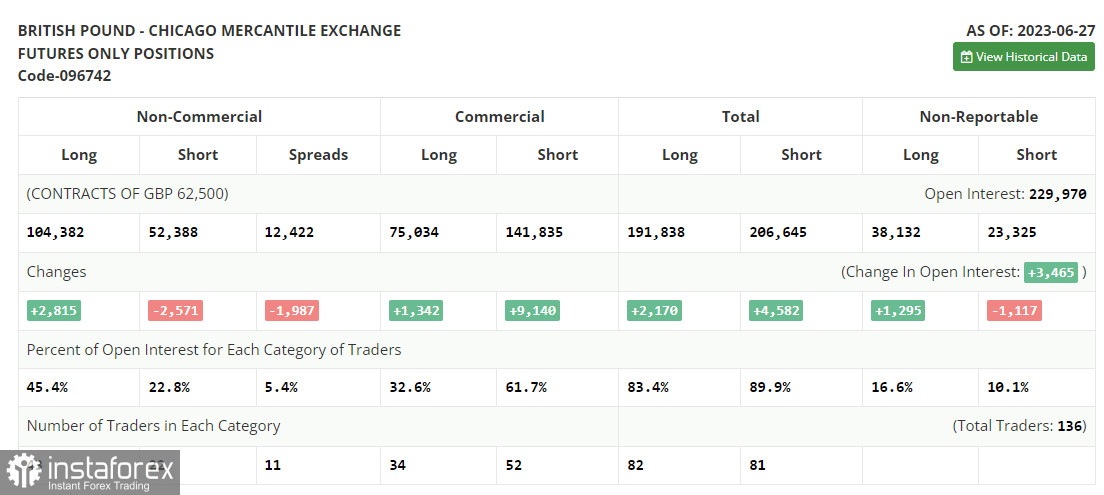

The COT report (Commitment of Traders) for June 27 showed a slight reduction in short positions and a minimal increase in long ones. Pound buyers have all the chances to act more aggressively, as the Bank of England, despite all the pressure and economic problems, will continue to adhere to high-interest rate policy due to serious inflation problems affecting household living standards. The fact that the Federal Reserve paused the cycle of tightening monetary policy last month, and the Bank of England does not intend to do so, adds even more attractiveness to the British pound. The optimal strategy remains to buy the pair on the decline. The latest COT report says that short non-commercial positions increased by 2,815 to 104,382, while long non-commercial positions decreased by 2,571 to 52,388. This led to a slight increase in the non-commercial net position to 51,994 compared to 46,608 a week earlier. The weekly price decreased and amounted to 1.2735 against 1.2798.

Indicator signals:

Moving averages

Trading occurs around 30 and 50-day moving averages, indicating market equilibrium.

Note. The author considers the moving average period and prices on the H1 hourly chart and differs from the general definition of classic daily moving averages on the D1 daily chart.

Bollinger Bands

In case of a decline, the lower border of the indicator at around 1.2698 will act as support.

Description of indicators:

• Moving average (determines the current trend by smoothing out volatility and noise). Period - 50. Marked in yellow on the chart;

• Moving average (determines the current trend by smoothing out volatility and noise). Period - 30. Marked in green on the chart;

• MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Fast EMA - period 12. Slow EMA - period 26. SMA - period 9;

• Bollinger Bands. Period - 20;

• Non-commercial traders - speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements;

• Long non-commercial positions represent the total long open position of non-commercial traders;

• Short non-commercial positions represent the total short open position of non-commercial traders;

• The total non-commercial net position is the difference between non-commercial traders' short and long positions.