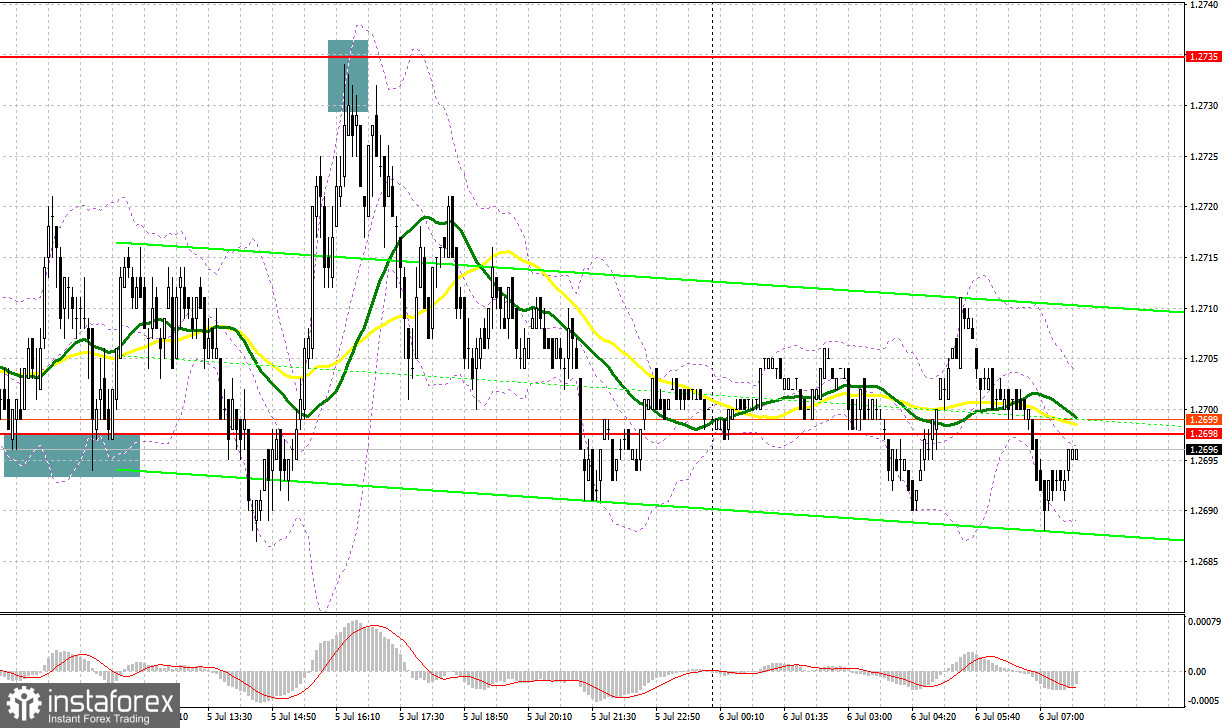

Yesterday, there were several entry points. Now let's look at the 5-minute chart and try to figure out what actually happened. Previously, I considered entering the market from the level of 1.2698. A decline and false breakout on this mark produced a buy signal. As a result, the pair grew by more than 40 pips. In the second half of the day, failed consolidation above 1.2735 gave a sell signal that brought the pound back to 1.2690 to close the day.

For long positions on GBP/USD:

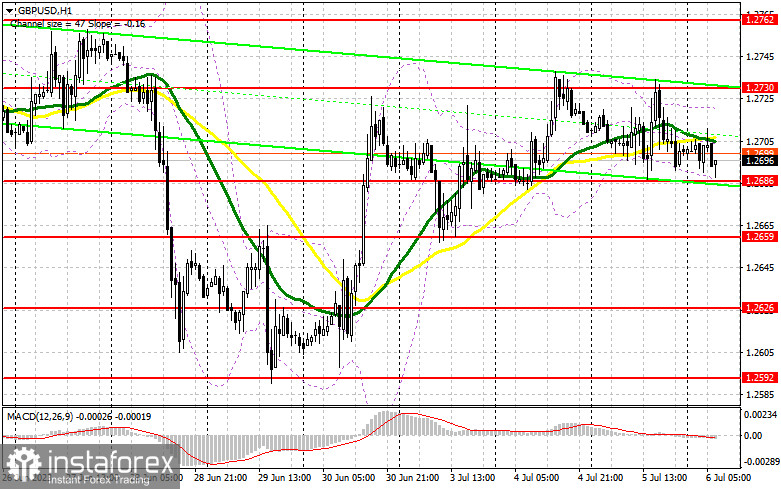

The UK services PMI matched economists' forecasts, which maintained balance in the market, while the Federal Reserve's minutes remained unnoticed. Today, we are only expecting the construction PMI, so buyers will have every chance to extend the pair's growth in the first half of the day. For this reason, I will focus on protecting the major level of 1.2686. Only a false breakout of this level will give a buy signal. In this case, the target for recovery will be the nearest resistance at 1.2730. If bulls plan to break through this range, it will only happen amid bad US data. A breakout and consolidation above 1.2730 will provide an additional buy signal with a surge toward 1.2762. The farthest target will be located around 1.2798, where I will take profit.

If the pair drops to 1.2686 and buyers fail to be active, which is most likely to happen, pressure on the pound will rise, leading to a more considerable downward movement towards 1.2659. Defending this area, as well as a false breakout of this level, will provide buying opportunities. I plan to buy GBP/USD only on a bounce from 1.2626, expecting the correction of 30-35 pips within the day, but it is unlikely to reach that point.

For short positions on GBP/USD:

Bears failed to achieve their goals yesterday, and now the main task is not to miss the major resistance at 1.2730, which is just below the weekly high. Taking into account the persistence of the buyers, a breakout on this mark could happen in the first half of the day after strong PMI data is released. A false breakout at this level will provide a sell signal, returning pressure on the pair with the target at 1.2686, the support level formed amid yesterday's results. A breakout and an upward test of this range will deliver a more serious blow to bullish positions, pushing GBP/USD towards 1.2659. The farthest target remains at the low of 1.2626, where I will take profit.

If GBP/USD rises and sellers fail to be active at 1.2730, this will lead to the formation of a new bullish trend. In this case, I will postpone selling until the price touches the resistance level of 1.2762. A false breakout there will provide an entry point for short positions. If there is no downward movement from that point, I will sell the pound on a rebound from 1.2798, but only with the expectation of a 30-35-pip correction within the day.

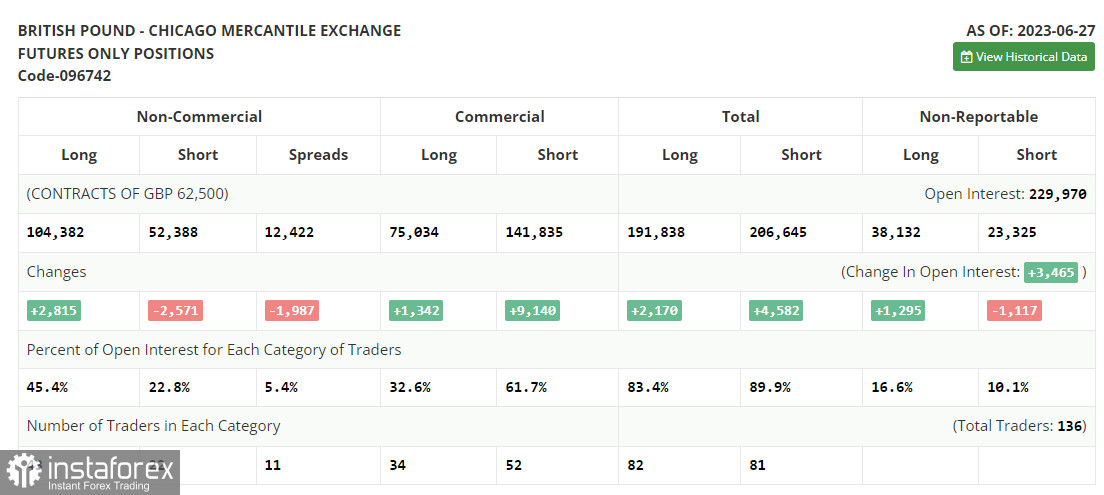

COT report:

According to the COT report from June 27, there was a slight reduction in short positions and a similarly minimal increase in long positions. Buyers of the pound sterling definitely have a chance to continue acting more aggressively since the Bank of England, regardless of all the pressure and economic problems, will continue to maintain a policy of high interest rates due to serious inflation issues that are affecting household living standards. The fact that the Federal Reserve paused its cycle of tightening monetary policy last month while the Bank of England has no plans to do so. In this light, the British pound is becoming even more attractive. Buying the pair on declines remains an optimal strategy. According to the latest COT report, non-commercial short positions increased by 2,815 to 104,382, while non-commercial long positions decreased by 2,571 to 52,388. This led to a slight increase in the non-commercial net position to 51,994 compared to 46,608 in the previous week. The weekly price declined to 1.2735 compared to 1.2798.

Indicator signals:

Moving Averages

Trading is conducted around the 30- and 50-day moving averages, which points to the market uncertainty.

Note: The period and prices of moving averages are considered by the author on the one-hour chart that differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

If the pound sterling drops, the lower limit of the indicator located at 1.2686 will act as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.