Disappointing business activity indices in both the UK and the eurozone did not surprise markets as they coincided with forecasts. Reportedly, producer prices fell from 0.9% to -1.5%, indicating that inflation will continue to decrease quite confidently. This caused euro to dip in price, while the European Central Bank will most likely maintain a tough monetary policy, intending to further raise interest rates.

Retail sales data in the euro area lies ahead, and it should show a rise from -2.6% to -3.2%. This points out that the tight monetary policy of the ECB pushes the European economy into recession. However, nothing will change immediately.

Most likely, euro and pound will decline after the release of such a weak number. Market players need not worry though as a rebound to the values at the start of the trading day may occur after the US publishes its latest employment data, which forecasts say will indicate an increase of about 160,000, with monthly data rising by more than 200,000.

So, on the eve of the publication of the US Department of Labor report, data may suggest the possibility of an increase in the unemployment rate, which will lead to a weakening of dollar.

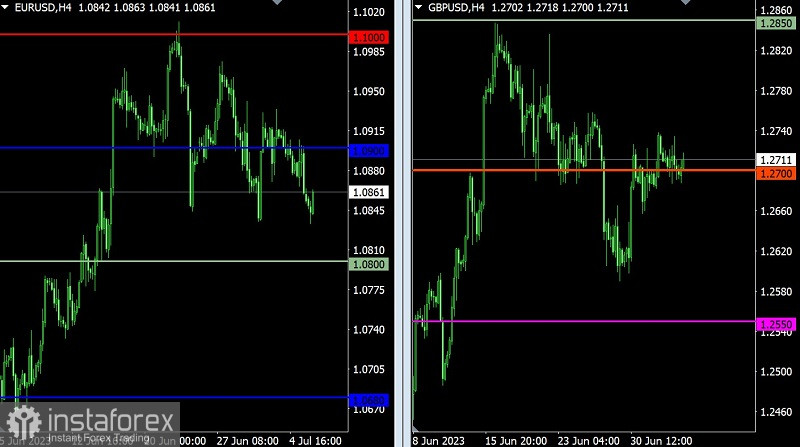

As a correction continued in EUR/USD, a stable trading below 1.0840 will result in a further decrease to 1.0800. Meanwhile, a stagnation relative to the current values will lead to a price rebound.

GBP/USD formed a stagnation along 1.2700, with an amplitude of about 50 points, which indicates a possible process of accumulating trading forces. A breakdown will end this situation.