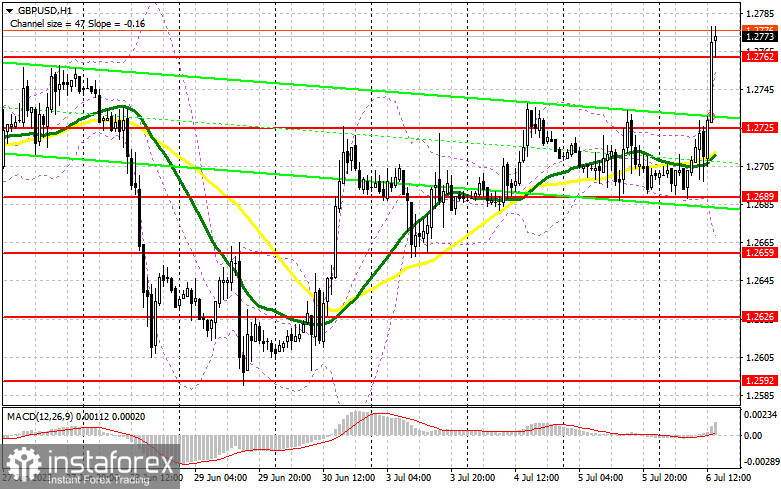

In my morning forecast, I focused on the level of 1.2730 and recommended making market entry decisions from it. Let's look at the 5-minute chart and figure out what happened there. In the first half of the day, the pound strengthened, and a false breakout at 1.2730 provided an excellent entry point for short positions, leading to a decline of over 30 points. The technical picture has changed for the second half of the day.

To open long positions on GBP/USD, you need the following:

The demand for the pound returned, and the bulls have every chance to continue to grow in the second half of the day. All that is needed is weak data on the change in the number of employed from ADP for June of this year and a sharp increase in initial jobless claims in the US. The trade balance surplus will play a small role in the currency market, which cannot be said about the ISM service sector business activity index. A deterioration in this indicator will pave the way to June's highs.

As long as trading is above 1.2762, one can expect further growth of the pair, but I will open long positions from this level only after forming a false breakout there. This is necessary to ensure that large players are present in the market. The nearest resistance of 1.2798 will be the target in this case, the breakout and testing of which from top to bottom will form an additional signal to buy, which will return the strength to the pound and lead to an update of 1.2834. If it also goes above this range, we can talk about a rush to 1.2876, where I will fix the profit.

In case of a drop in GBP/USD and the absence of buyers at 1.2762, the bears will try to offset all morning growth, leading to a noticeable pair correction. If this happens, I will postpone long positions to 1.2725. They will buy there only on a false breakout. You can open long positions on GBP/USD immediately on a rebound from 1.2689 to correct 30-35 points within the day.

To open short positions on GBP/USD, you need the following:

Sellers tried, but there was a strong desire of large players, especially after yesterday's protection of 1.2690, to continue the upward trend. In the second half of the day, bears must focus on protecting the nearest resistance of 1.2798. Only the formation of a false breakout there will form a sell signal against the intraday bullish trend, aiming for a decline to the support of 1.2725. A breakout and reverse test from the bottom up of this range will give a sell entry point to update 1.2689. The further target will be a minimum of 1.2659, where I will fix the profit.

In the case of GBP/USD growth and absence of bears at 1.2798 in the second half of the day, and everything will depend on the ADP reports, the bulls will strengthen control over the market. In such a case, only a false breakout in the next resistance area of 1.2834 will form an entry point into short positions, counting on the pound to move down. If there is no activity, I advise selling GBP/USD from 1.2876, aiming for a pair rebound by 30-35 points within the day.

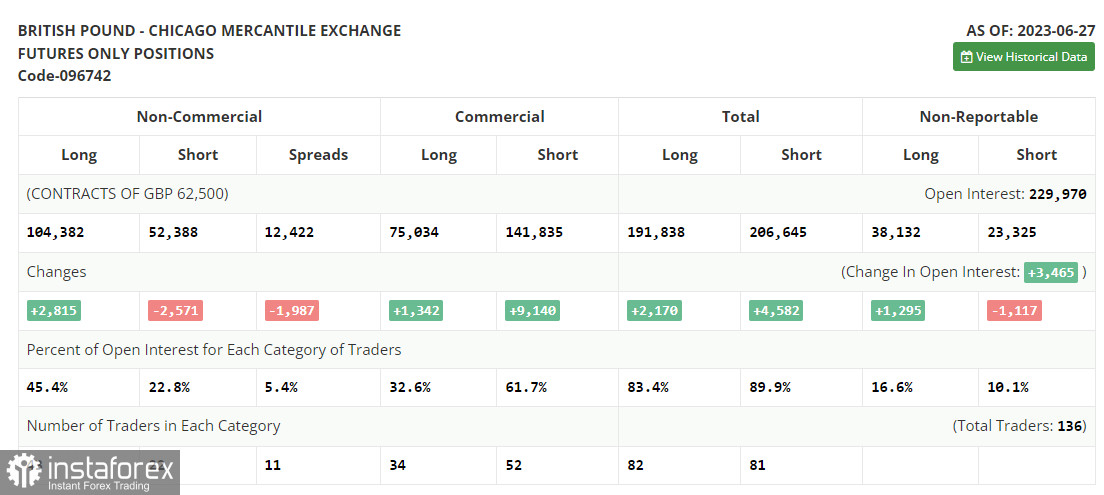

The Commitment of Traders (COT) report for June 27 indicated a slight reduction in short positions and minimal growth in long positions. Pound buyers certainly have every chance to continue to act more aggressively, as the Bank of England, despite all the pressure and problems in the economy, will continue to adhere to a policy of high-interest rates due to serious inflation problems affecting household living standards. The fact that the Federal Reserve took a break in the cycle of tightening monetary policy last month, and the Bank of England does not yet intend to do so, makes the appeal of the British pound stronger. The optimal strategy remains to buy the pair on a decline. The latest COT report states that short non-commercial positions grew by 2,815 to 104,382, while long non-commercial positions decreased by 2,571 to 52,388. This led to a slight increase in the non-commercial net position to 51,994 versus 46,608 a week earlier. The weekly price decreased and was 1.2735 versus 1.2798.

Indicator signals:

Moving averages

Trading occurs above the 30 and 50-day moving averages, indicating further pair growth.

Note: The author considers the period and prices of moving averages on the hourly H1 chart and differ from the general definition of classic daily moving averages on the daily D1 chart.

Bollinger Bands

In the case of a decline, the lower boundary of the indicator at around 1.2659 will act as support.

Description of indicators

• Moving average (determines the current trend by smoothing volatility and noise). Period 50. It is marked in yellow on the chart.

• Moving average (determines the current trend by smoothing volatility and noise). Period 30. It is marked in green on the chart.

• MACD indicator (Moving Average Convergence / Divergence - convergence/divergence of moving averages) Fast EMA period 12. Slow EMA period 26. SMA period 9

• Bollinger Bands. Period 20

• Non-commercial traders - speculators such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

• Long non-commercial positions represent the total long open position of non-commercial traders.

• Short non-commercial positions represent the total short open position of non-commercial traders.

• The total non-commercial net position is the difference between non-commercial traders' short and long positions.