The Bank of England's increase in borrowing costs will support the pound, making it more attractive compared to its main competitors in the currency market.

However, until at some point the risk of a slowing economy takes precedence over the risks of inflation growth during the tightening of monetary policy. Once the Bank of England halts raising interest rates, the pound will lose support from its side, and a reverse process may begin.

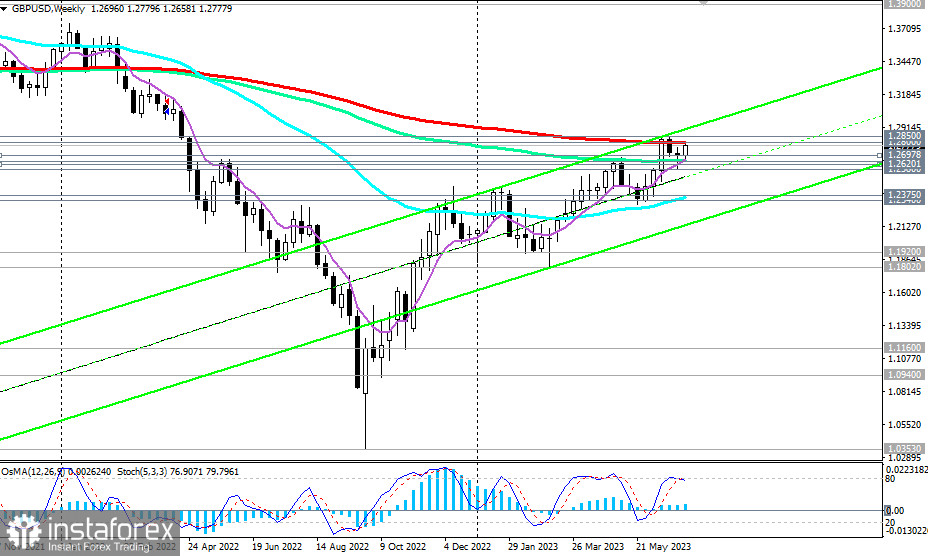

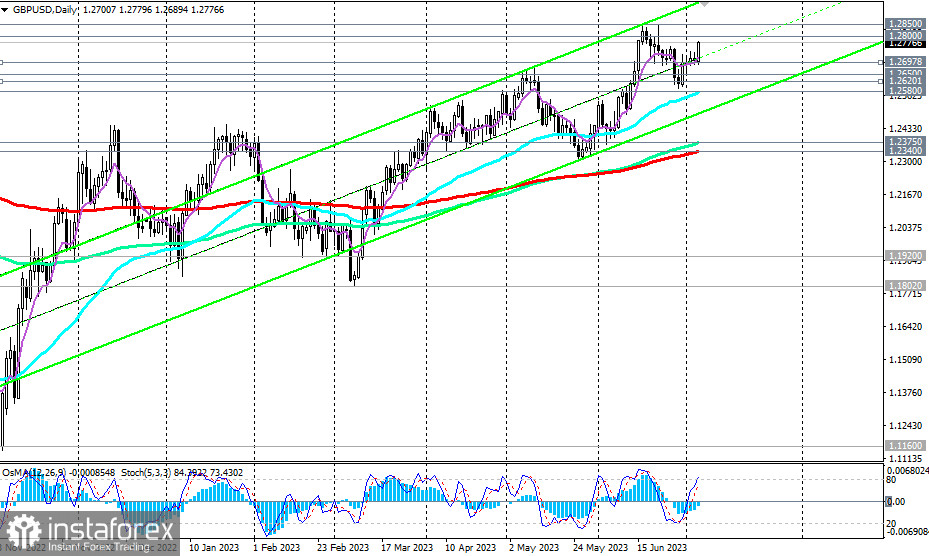

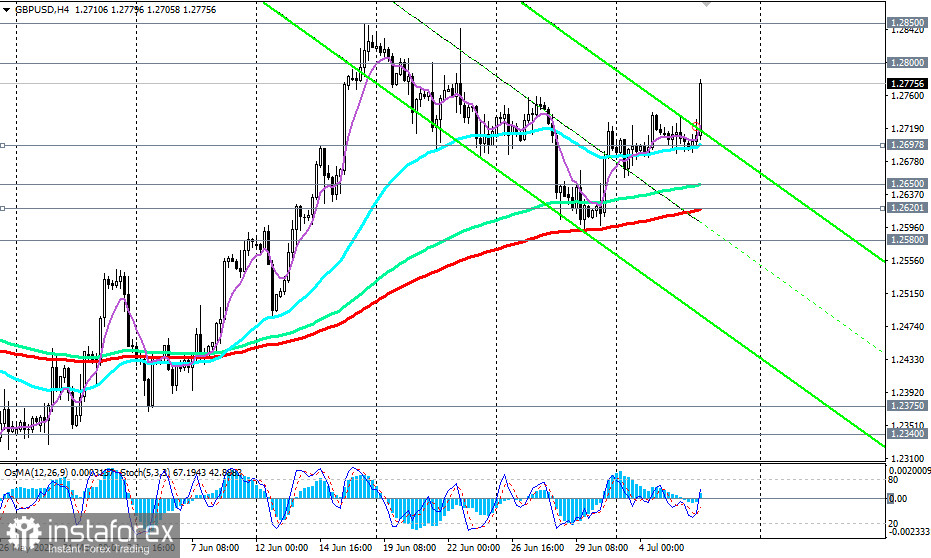

As of writing, the pair was trading near the 1.2780 level, sharply strengthening in the early European trading session, once again approaching the key long-term resistance level of 1.2800 (200 EMA on the weekly chart).

Most likely, as it was last month, there will be another rebound from this level, or if not from it, then from the higher strong long-term resistance level of 1.2850 (50 EMA on the monthly chart).

Below these resistance levels, GBP/USD remains in the long-term bearish market zone, and below the resistance levels of 1.3900 (144 EMA on the monthly chart) and 1.4335 (200 EMA on the monthly chart), it remains in the global bearish market zone.

For a breakout of the resistance zone and levels of 1.2800 and 1.2850, GBP/USD needs very strong fundamental drivers. In this regard, let's wait until the end of the week when key data on the U.S. labor market will be published.

A signal for resuming sales can be both a rebound from the resistance levels of 1.2800 and 1.2850, as well as a break below the support levels of 1.2620 (144 EMA on the 4-hour and weekly charts) and 1.2620 (200 EMA on the weekly chart). The fastest sell signal here can be a break below the important short-term support level of 1.2698 (200 EMA on the 1-hour chart).

A break of the support level of 1.2580 (50 EMA on the daily chart) will confirm our forecast for a decline in GBP/USD, and a break below the key medium-term support levels 1.2375 (144 EMA on the daily chart) and 1.2340 (200 EMA on the daily chart) will bring the pair back into the zone of medium-term and long-term bearish markets.

In an alternative scenario, a confirmed breakout of the resistance levels of 1.2800 and 1.2850 will direct the pair towards the key strategic resistance levels of 1.3900 and 1.4335. Their breakout, in turn, will move the pair into the global bullish market zone.

Support levels: 1.2698, 1.2650, 1.2620, 1.2580, 1.2400, 1.2375, 1.2340

Resistance levels: 1.2800, 1.2850, 1.3900, 1.4335