US stock index futures declined alongside bonds, indicating that central banks will likely continue raising interest rates to curb inflation. Investors have received another confirmation of that with the release of latest US labor market data from ADP once again. S&P 500 futures dropped by more than 1.0%, while the NASDAQ lost over 1.2%. The In the EU, the Stoxx 600 index fell to a six-week low.

Data released by ADP research institute revealed that US companies created significantly more jobs in June than initially projected, highlighting the current strength of the labor market. Job growth amounted to 497,000, more than double the average estimate of economists. Following the ADP report, treasury bond yields surged across the curve. The two-year rate, which is sensitive to policy changes, rose above 5%, and the 10-year rate climbed to 4% for the first time since March.

In the UK, the yield on 10-year government bonds reached levels last seen in 2008. Traders are now anticipating the Bank of England to set its peak interest rate at 6.5% by March of next year.

As mentioned earlier, the continued aggressiveness of central banks has diminished hopes for a soft landing of the global economy, pushing traders away from risk assets. The minutes of the June FOMC meeting highlighted disagreements among policymakers regarding the decision to pause rate hikes, with all voting members planning to raise rates again this month.

The fact that the FOMC has now officially announced its intention to continue raising rates, accepting the possibility of a recession, has negatively impacted risk assets. It is possible that the Fed will have no choice but to resort to these measures to cool down the economy. This development spells trouble for risk assets and companies with valuations that far exceed their earnings. The technology companies listed on the NASDAQ, which have seen substantial gains this year, are particularly vulnerable.

Tomorrow, the highly-anticipated US non-farm payrolls report will be released, shedding light on the future direction of monetary policy. Preceding the non-farm payroll data, the JOLTS report on job vacancies is expected to reveal a decrease in available positions, while unemployment claims are expected to rise.

Elsewhere, China's central bank, the People's Bank of China, has expanded its support for the yuan by raising the daily rate. According to Goldman Sachs Group Inc., Chinese investors do not expect policymakers to announce aggressive stimulus measures or major economic reforms until the end of this month.

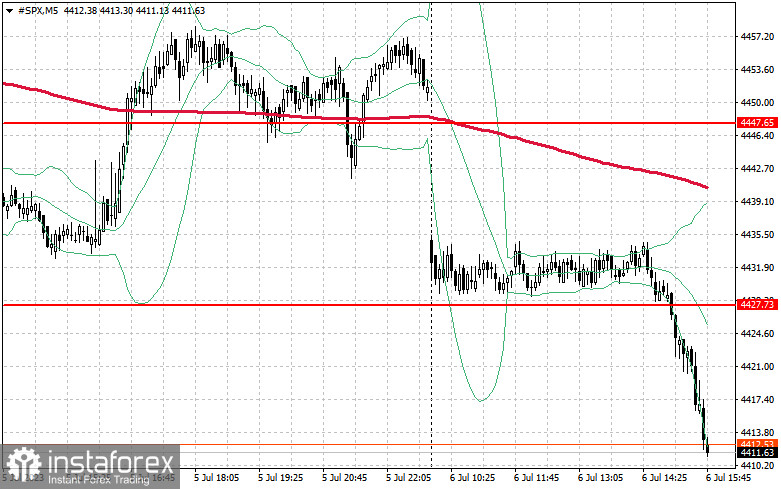

Regarding the technical outlook for the S&P 500, demand for the index has slightly decreased. However, bullish traders still have the opportunity to extend the uptrend. Bulls must make a strong push to reclaim the levels of $4,427 and $4,447. From this level, the index may possibly surge to $4,469. An equally important task for bulls will be to maintain control over $4,488, which will strengthen the bull market. However, if the index continues to decline amid waning risk appetite, buyers must establish their presence around $4,405. A breach of this level would likely push the trading instrument back to $4,382 and potentially open the way towards $4,357.