Long positions on EUR/USD:

It is difficult to predict the US labor market statistics, but considering yesterday's ADP report, anything can be expected. The focus will be on the US unemployment rate, which is likely to decrease, as well as the change in the number of non-farm payrolls. The latter has a significant impact on the Federal Reserve's plans, and if the data surpasses economists' expectations and we see an increase in employment, it would be safe to sell the euro and buy the US dollar.

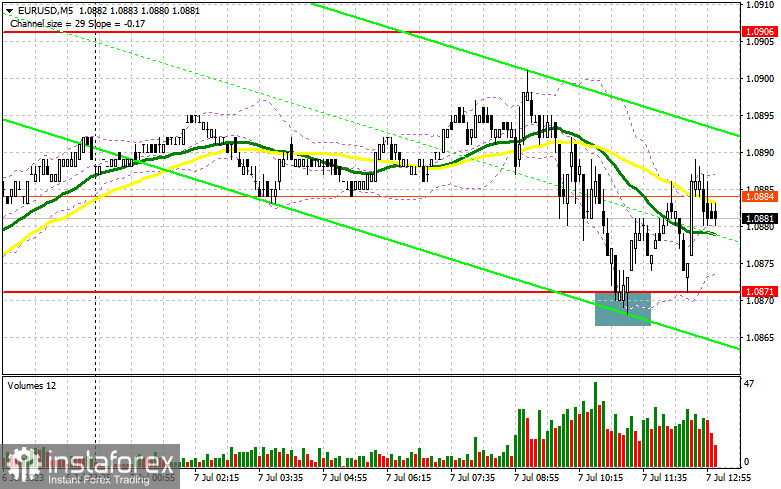

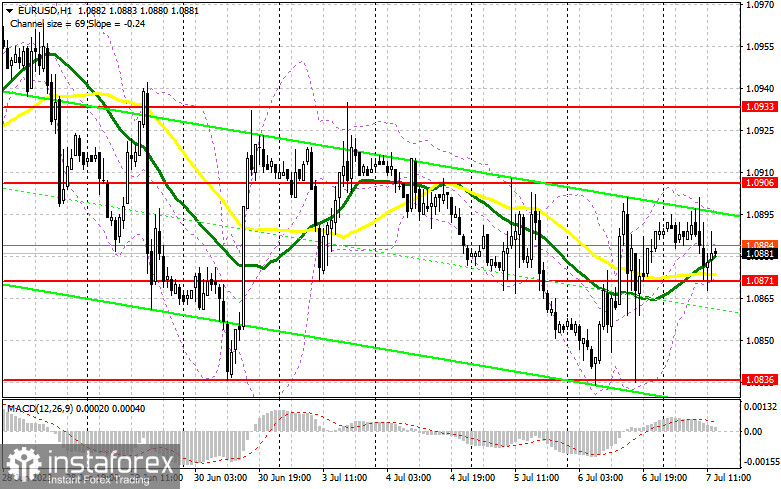

Since the level of 1.0871 has already been tested today, placing bets on it should only be considered in the most extreme case if the US labor market contracts more than economists' expectations. The recommended action remains the same: to act only on the decline towards the support level of 1.0871, formed based on yesterday's data. A false breakout there would provide a buying signal, allowing a return to the significant resistance at 1.0906. A breakthrough and a top-down test of this range, accompanied by weak employment data, would strengthen the demand for the euro, with a chance to reach 1.0939. The next target remains in the area near 1.0975, where profits can be taken.

In the event of a decline in the EUR/USD pair and the absence of buyers at 1.0871, which can only occur if the labor market remains overheated, bears may regain control of the market. Therefore, only a false breakout near the next support at 1.0836, coinciding with the weekly low, would provide a buy signal for the euro. One may open long positions on a rebound from the low of 1.0807, allowing an upward intraday correction of 30-35 pips.

Short positions on EUR/USD:

Sellers have shown themselves, but there is still interest in the euro ahead of the US data release. Everyone is counting on poor US statistics, so in case of an increase, bears need to defend 1.0906. Only an unsuccessful consolidation at this level, similar to what was discussed earlier, would provide a selling signal capable of pushing the pair back to 1.0871. A break below this range, as well as a reverse test from below, may pave the way to 1.0836. The next target would be the low of 1.0808, where profits can be taken.

In case of an upward movement of the EUR/USD pair during the US session and the absence of bears at 1.0906, the situation will return under the control of bulls, and the pair is likely to break out of the sideways channel. In that case, it would be better to postpone short positions until the price reaches the next resistance at 1.0939. Selling can also be considered there, but only after an unsuccessful consolidation. You may open short positions on a rebound from the high of 1.0975, allowing a downward correction of 30-35 pips.

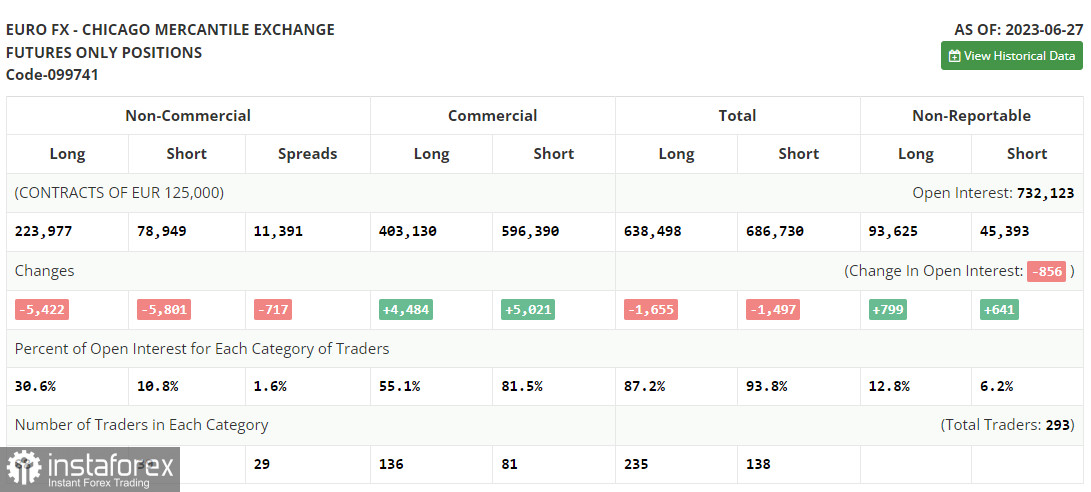

COT report

In the COT (Commitment of Traders) report for June 27, there was a reduction in both long and short positions, leaving the market balance unchanged. Last week, the GDP data confirmed the resilience of the US economy in the face of high interest rates, allowing the Federal Reserve to actively combat high inflation, gradually cooling it down. The minutes of the Fed meeting will be released soon, and we will also learn about the state of the US labor market, which could strengthen the US dollar against the euro. In the current conditions, buying on declines remains the optimal medium-term strategy. According to the COT report, non-commercial long positions decreased by 5,422 to 223,977, while non-commercial short positions fell by 5,801 to 78,949. The overall non-commercial net position increased slightly to 145,028 from 144,025. The weekly closing price increased to 1.1006 from 1.0968.

Signals of indicators:

Moving Averages:

The pair is trading near the 30-day and 50-day moving averages, indicating market equilibrium.

Note: The period and prices of the moving averages considered by the author are based on the H1 chart and differ from the general definition of classical daily moving averages on the D1 chart.

Bollinger Bands:

If the pair increases, the upper band of the indicator near 1.0900 will offer resistance.

Description of Indicators:

- Moving Average determines the current trend by smoothing volatility and noise. Period 50. Marked in yellow on the chart.

- Moving Average determines the current trend by smoothing volatility and noise. Period 30. Marked in green on the chart).

- MACD (Moving Average Convergence/Divergence).Fast EMA 12, Slow EMA 26, SMA 9.

- Bollinger Bands. Period 20.

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.

- Non-commercial long positions represent the total long open positions of non-commercial traders.

- Non-commercial short positions represent the total short open positions of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.