Earlier reports by the U.S. Bureau of Labor Statistics indicated a continuing slowdown in inflation. If the July report also shows another slowdown in U.S. inflation, it will almost certainly suggest that the Fed will again take a pause at the meeting in July 25–26.

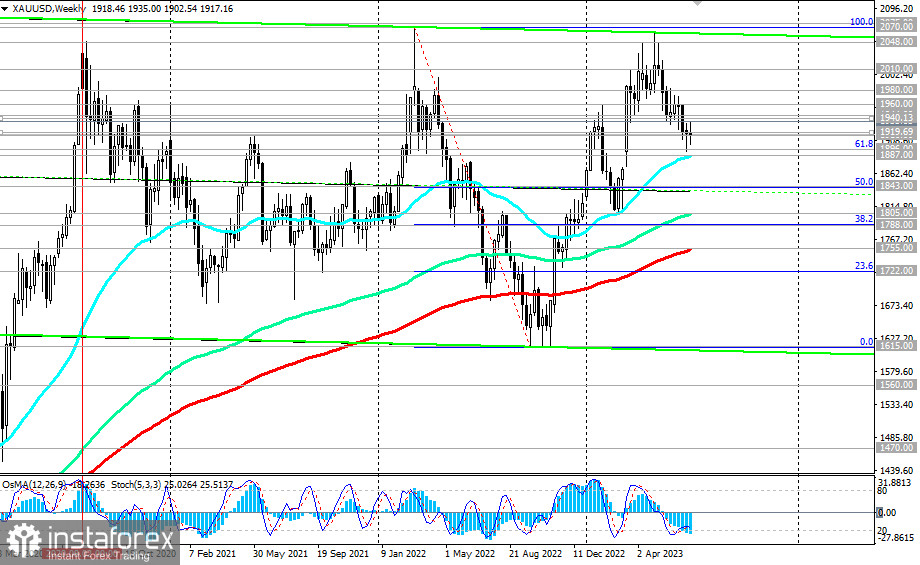

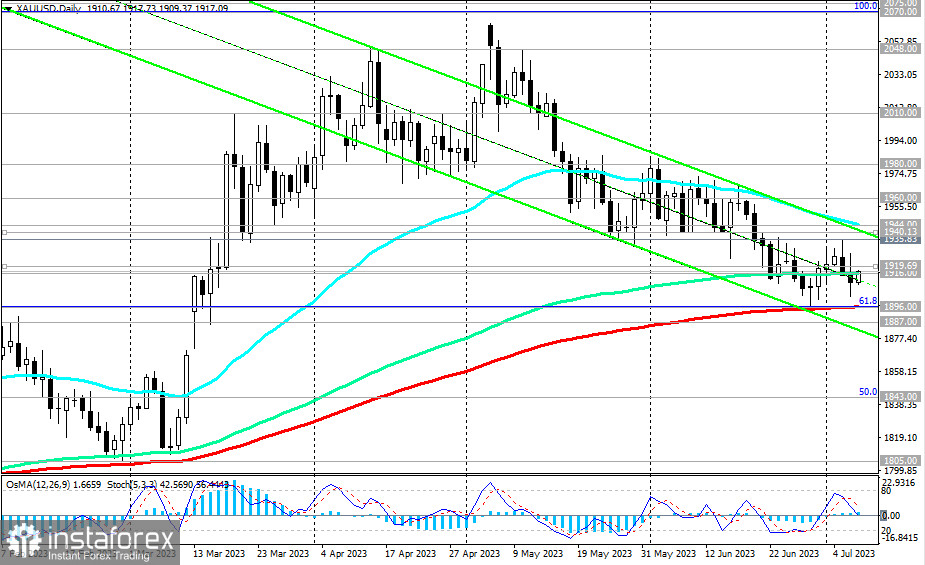

In turn, gold will then have another argument in favor of increasing its quotes, especially as the XAU/USD pair is currently in the zone of key support levels 1896.00 (61.8% Fibonacci level in the wave of the downward correction from its peak at 2070.00 to its low of 1615.00 and 200 EMA on the daily chart), 1916.00 (144 EMA on the daily chart), from which a rebound could occur and a new wave of growth could begin.

The first signal to resume buying XAU/USD is a break above the important short-term resistance level of 1920.00 (200 EMA on the 1-hour chart), 1928.00 (yesterday's high).

Breaking through the resistance zone and levels of 1940.00 (200 EMA on the 4-hour chart and the upper boundary of the downward channel on the daily chart), 1944.00 (50 EMA on the daily chart) will be a confirming signal.

In this case, the growth targets are near the resistance levels of 1980.00, 2000.00, 2010.00, 2048.00, 2070.00.

In an alternative scenario, the price will break through the key support levels of 1896.00, 1887.00 (50 EMA on the weekly chart) and move deeper into the downward channel on the daily chart, towards its lower boundary and the mark of 1875.00.

A break below this mark will open the way for a deeper decline towards the key long-term support levels of 1805.00 (144 EMA on the weekly chart), 1788.00 (38.2% Fibonacci level), 1755.00 (200 EMA on the weekly chart), 1722.00 (23.6% Fibonacci level), separating the long-term bullish trend in gold from the bearish one.

The fastest signal to realize the alternative scenario could be a breakdown of support levels 1916.00 (200 EMA on the 15-minute chart and 144 EMA on the daily chart) and 1909.00 (today's low).

Support levels: 1916.00, 1909.00, 1900.00, 1896.00, 1887.00, 1843.00, 1805.00, 1788.00, 1755.00

Resistance levels: 1919.00, 1927.00, 1936.00, 1940.00, 1944.00, 1960.00, 1980.00, 2000.00, 2010.00, 2048.00, 2070.00