When to open long positions on GBP/USD:

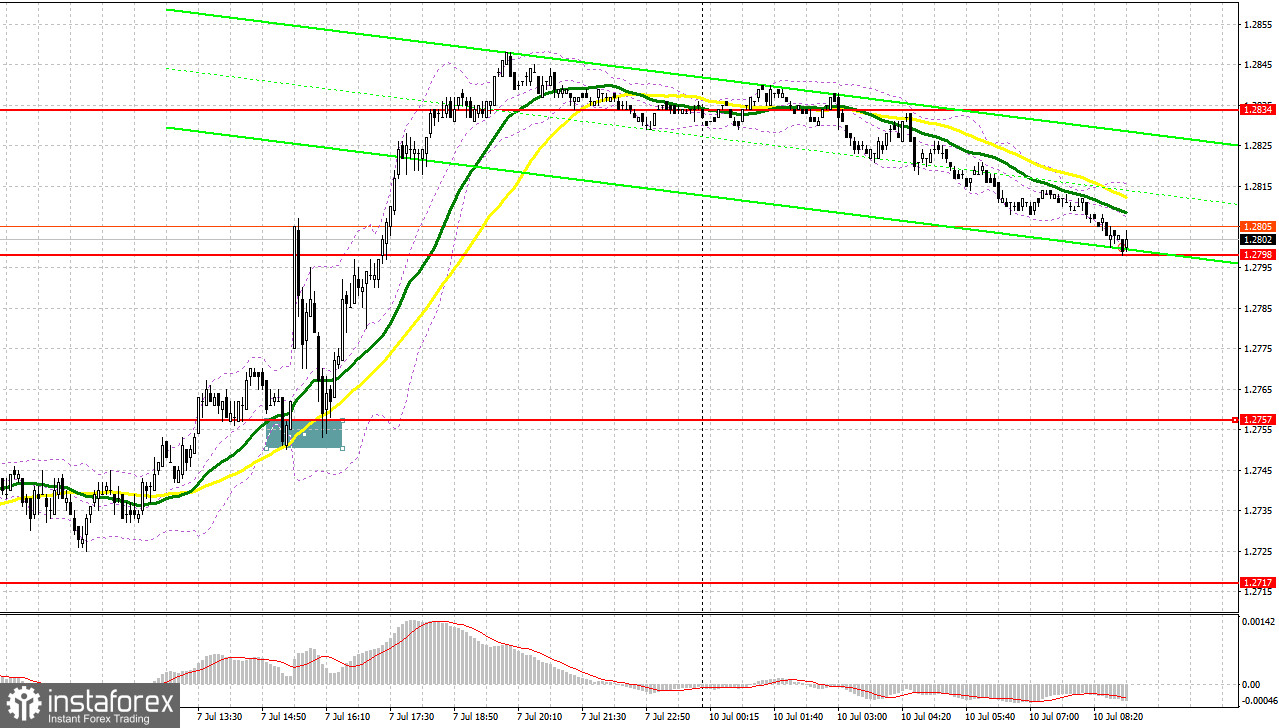

The pound sterling climbed markedly amid weak US NFP data. The US dollar which has been facing bearish pressure throughout the week, declined. Bulls made an attempt to reach monthly highs. However, during the Asian session, the pressure on the pound sterling returned. At the time of writing this article, the pair had lost almost half of Friday's gains. Given that the economic calendar is almost empty excluding Andrew Bailey's speech, the lack of market reaction to his statements may trigger an even bigger sell-off of GBP/USD during European trading.

For this reason, it is better to refrain from opening long positions.

A false breakout of 1.2798, where the moving averages are benefiting bulls, will be an excellent buy signal in the continuation of the trend. A jump should be quite sharp. It could help the pair reach the resistance level of 1.2840, formed last Friday. A breakout and consolidation above 1.2840 may give an additional buy signal with a climb to 1.2876. A more distant target will be the 1.2911 level where I recommend locking in profits.

If the pair fails to rebound from 1.2798, which is likely, the pressure on the pound sterling will only increase. It will create even more uncertainty about further prospects for the pair. In this case, only the protection of 1.2757 as well as a false breakout of this level could provide entry points for opening long positions. You could buy GBP/USD at a bounce from 1.2717, keeping in mind an upward intraday correction of 30-35 pips.

When to open short positions on GBP/USD:

Bears failed to take the upper hand last Friday. However, on Monday, they began to return to the market. The main task for today is to protect the resistance level of 1.2840 as well as regain control over the support level of 1.2798. If the pair grows, a false breakout of 1.2840 may give an excellent sell signal. It will signal that traders are unwilling to buy above this level.

It will return the pressure on GBP/USD. The price may decline to 1.2798 – the support level formed last Friday. A breakout and an upward retest will force bulls to close long positions. The pair may fall to 1.2757, losing all Friday's gains. A more distant target level will be a low of 1.2717 where I recommend locking in profits.

If GBP/USD rises and bears fail to defend 1.2840, the bull market will continue. In this case, I would advise you to postpone short positions until a false breakout of the resistance level of 1.2876. If there is no downward movement there, you could sell GBP/USD after a bounce from 1.2911, keeping in mind a downward intraday correction of 30-35 pips.

COT report

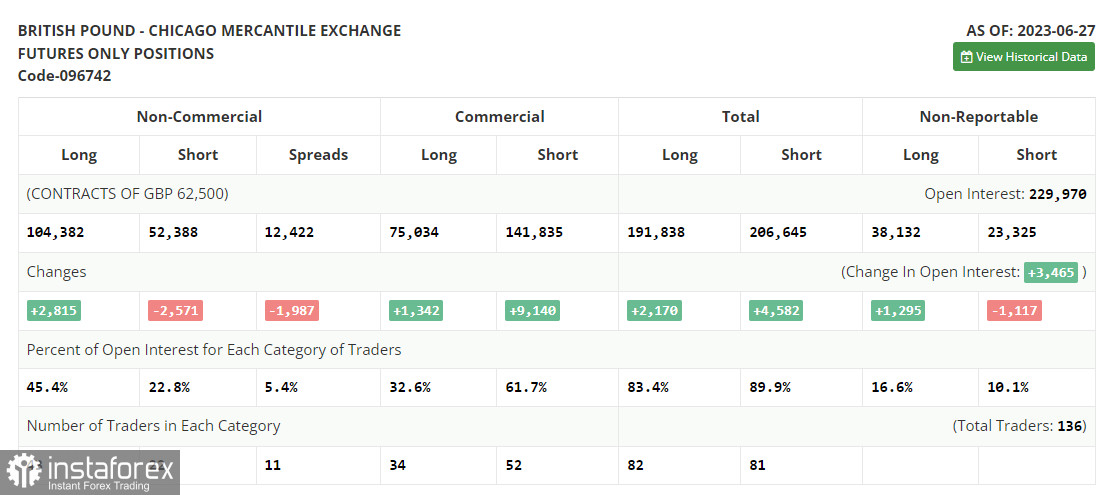

According to the COT report for June 27, there was a slight drop in short positions and an insignificant increase in long ones. Bulls will definitely have a chance to regain control as the Bank of England will stick to momentary tightening despite all the problems in the economy. Inflation remains high. It affects living standards. The Fed skipped a rate hike last month. The Bank of England is not going to do this yet. It makes the pound sterling more attractive for investors. It is better to buy the pair on the decline. The latest COT report showed that short non-profit positions increased by 2,815 to 104,382, while long non-profit positions fell by 2,571 to 52,388. This led to slight growth in the non-commercial net position to 51,994 against 46,608 a week earlier. The weekly price d amounted to 1.2735 against 1.2798. Indicator signals:

Indicator signals:

Moving averages:

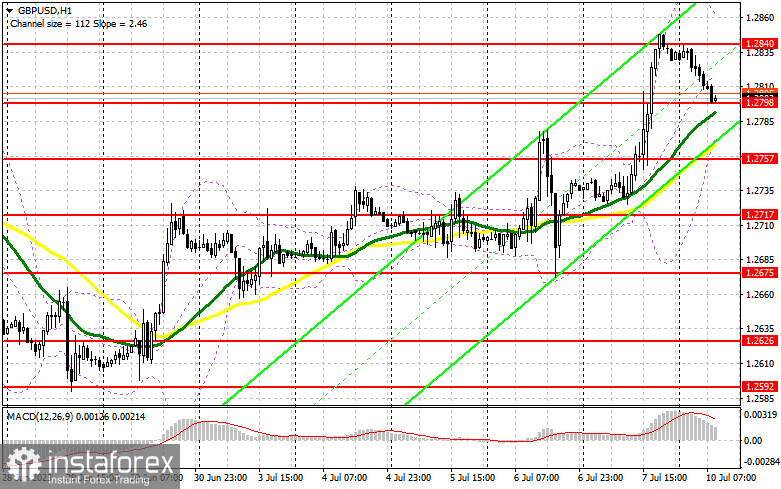

Trading is carried out above the 30-day and 50-day moving averages, which indicates a bullish attempt to regain control over the market.

Note: The author considers the period and prices of moving averages on the H1 (1-hour) chart that differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

If GBP/USD declines, the indicator's lower border at 1.2785 will serve as support.

Indicator description:

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Non-commercial short positions are the total short position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.