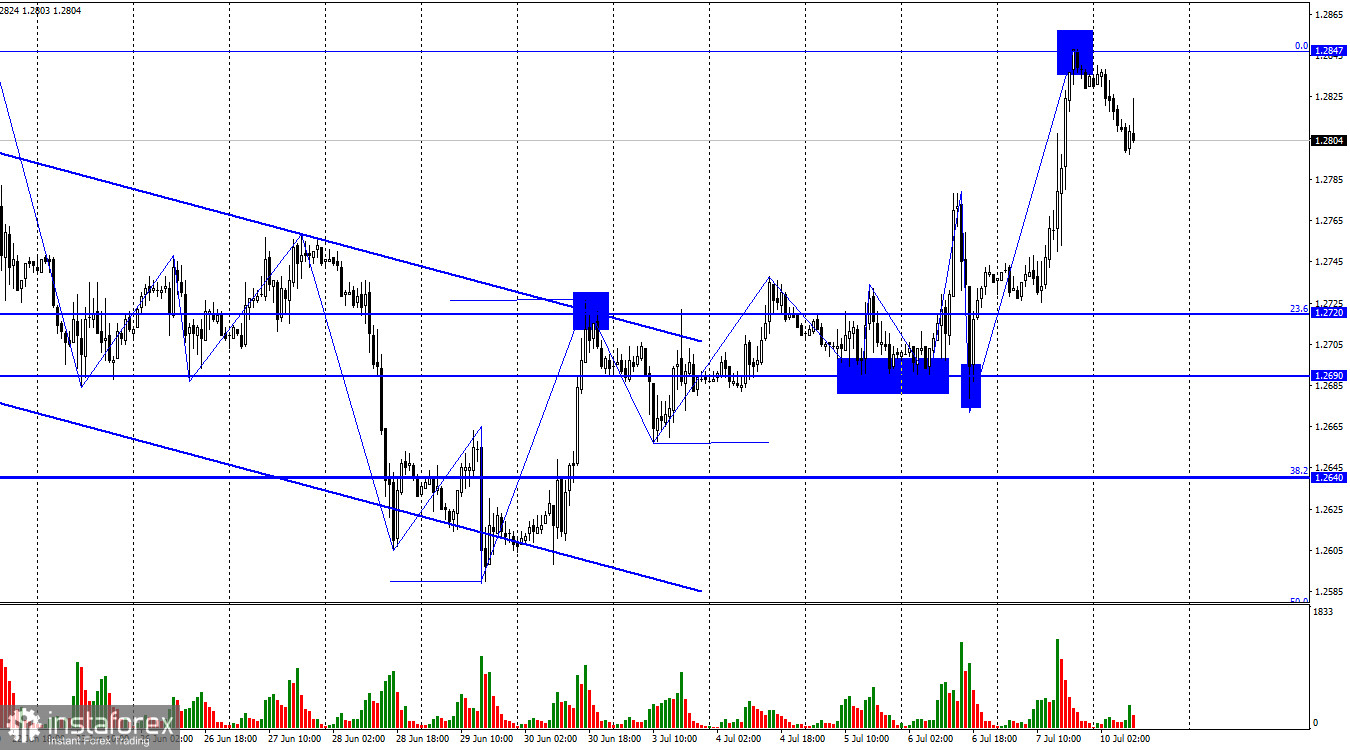

On the hourly chart, the GBP/USD pair continued its growth on Friday after rebounding from the 1.2690 level and consolidating above the corrective level of 23.6% (1.2720). By the end of the day, it had reached 0.0% (1.2847). The rebound from this level favored the US dollar, which can now recover slightly. Consolidating quotes above the 1.2847 level will increase the likelihood of the British pound continuing to rise.

Undoubtedly, the dollar's fall on Friday was caused by a weaker-than-expected Nonfarm Payrolls report. However, the discrepancy in the forecasts was minor, and the unemployment rate fell. Overall, everything suggests that the bulls slightly overreacted to a single report. Creating 209,000 jobs instead of 224,000 will not influence the Federal Reserve's July decision on the rate. I want to remind you that a weak labor market could be a reason for ending a tightening policy. But that's if we talk about a weak condition. However, the payrolls show fairly good monthly values, and unemployment remains around half-century lows. What global disappointment led to the significant fall of the dollar?

The FOMC will almost certainly raise the rate by 0.25% in July, as reported by the minutes of the last meeting last Wednesday. And inflation now has more significance for the policy outlook, as a new report will be released this week. According to economists' expectations, inflation could fall to 3.1%, which would already be a strong enough reason to expect only one rate hike in 2023. But at the same time, core inflation is unlikely to fall below 5%, so we can still expect two hikes. Thus, the payrolls on Friday did not have such serious consequences as to cause the dollar to collapse by 110 points.

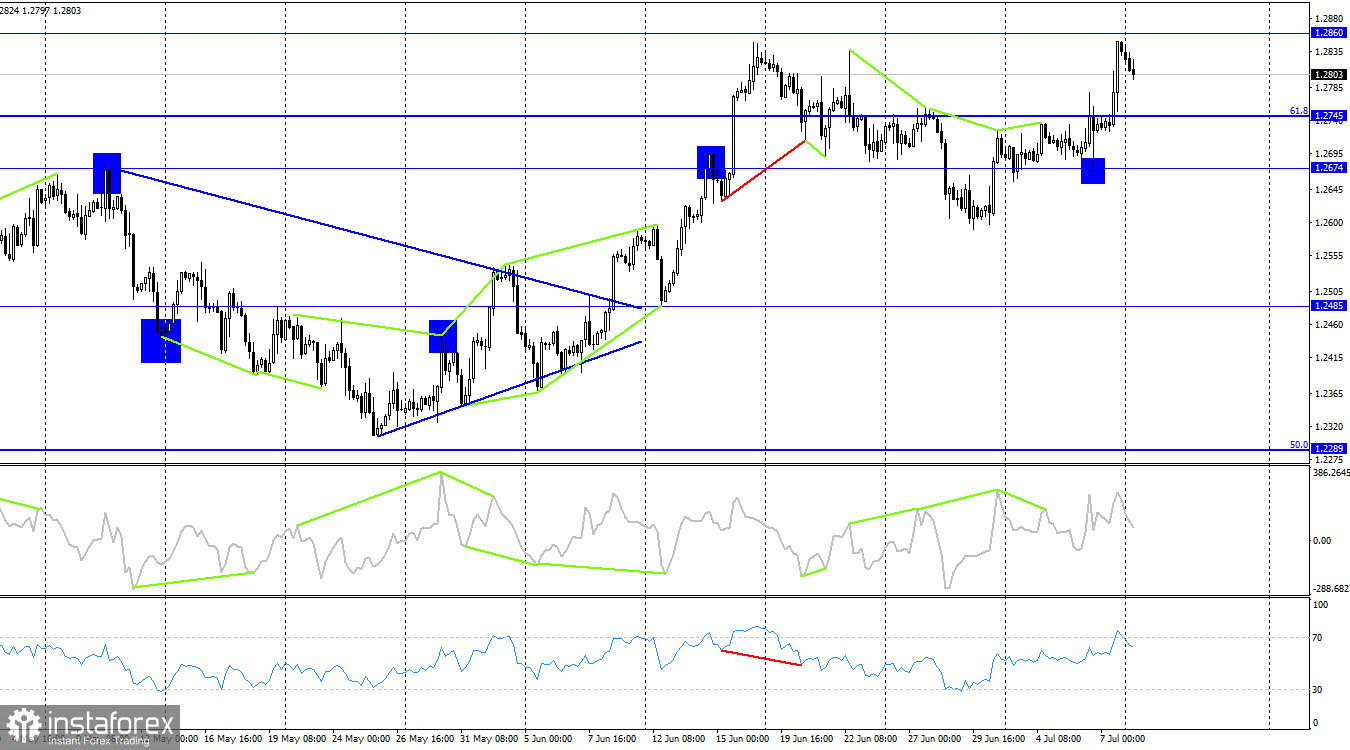

On the 4-hour chart, the pair rebounded from 1.2674 and rose almost to 1.2860. More important is the 1.2847 level on the hourly chart, and a rebound from it allows us to expect a fall in the pair. This will be fair as the US currency fell too much last week. However, consolidating above the 1.2860 level will increase the likelihood of further growth toward the next level of 1.3044. There are no emerging divergences today in any indicator.

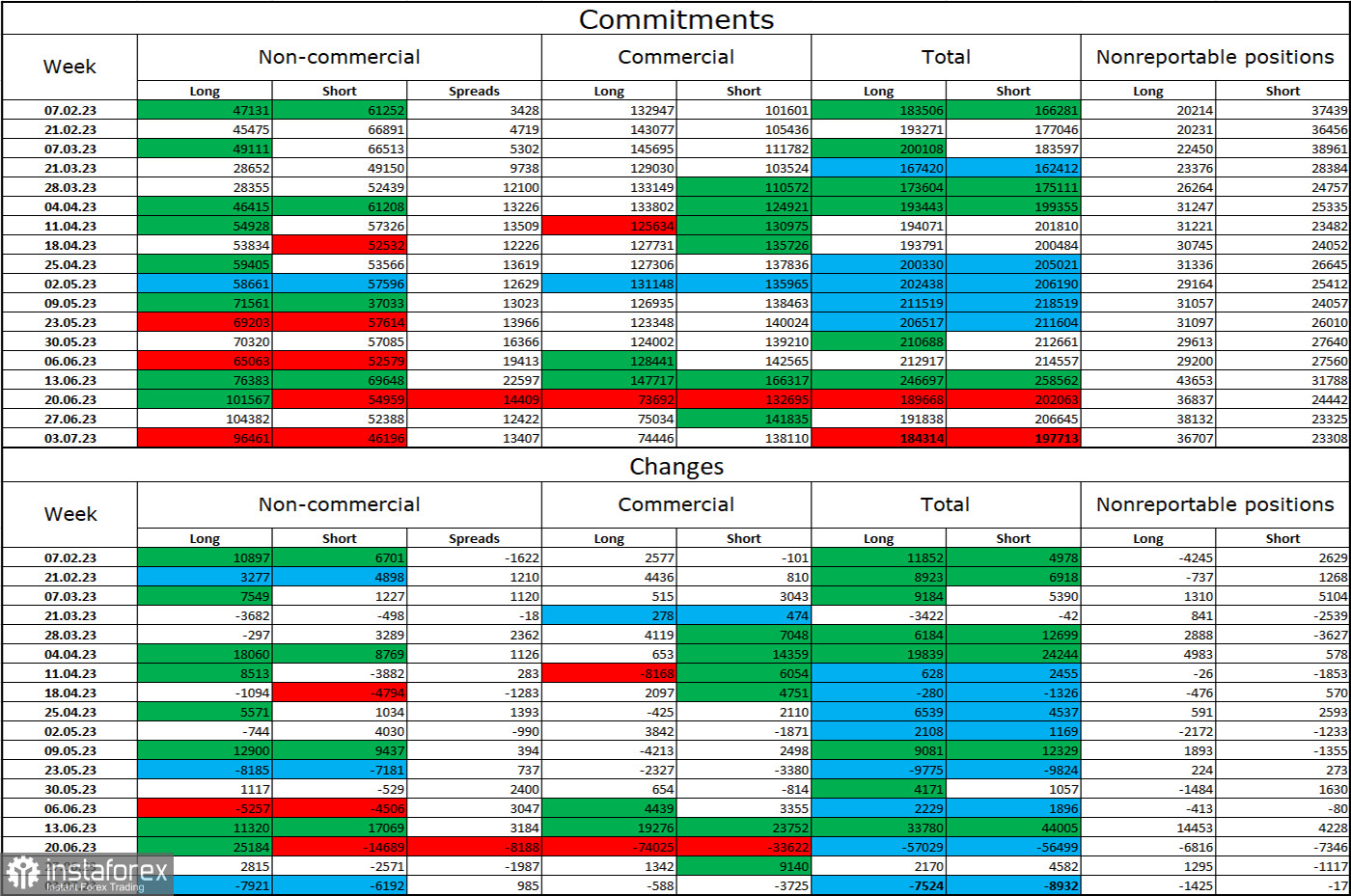

Commitments of Traders (COT) report:

The mood of the "Non-commercial" category of traders has become less "bullish" over the last reporting week. The number of long contracts held by speculators decreased by 7921 units, but the number of short contracts also decreased by 6192. The overall mood of large players remains fully "bullish," and there is a twofold gap between the number of long and short contracts: 96 thousand versus 46 thousand. The British pound has good prospects for continued growth, and the current news background supports it more than the dollar. However, it is becoming increasingly more work to count on the strong growth of the pound. The market does not consider many factors supporting the dollar, and the pound is growing only on expectations of further rate hikes by the Bank of England.

News calendar for the US and the UK:

UK - Speech by the Bank of England Governor Bailey (19:00 UTC).

On Monday, the economic events calendar contains only one important entry. The influence of the news background on the mood of traders for the rest of the day may be weak or moderate in strength.

GBP/USD forecast and trading advice:

Only very small pound sales on a "bullish" trend are possible. For example, in the case of a rebound on the hourly chart from the level of 1.2847 with targets of 1.2779 and 1.2720. I advised purchases with a clear closing above the 1.2720 level on the hourly chart with targets in the 1.2750-1.2800 area. The targets have been reached. I recommend new purchases upon closing above the level of 1.2847 on the hourly chart or in case of a rebound from the level of 1.2779.