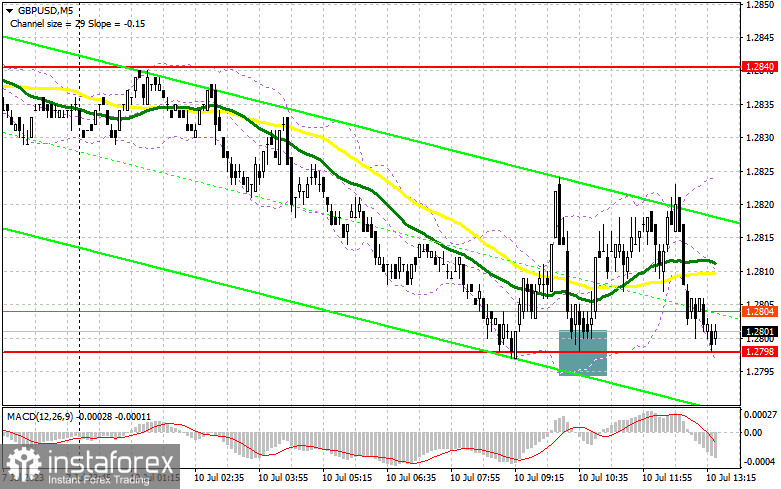

In my morning forecast, I pointed out the level of 1.2798 and recommended using it as a basis for making decisions about entering the market. Let's examine the 5-minute chart and understand what happened there. A decrease and a false breakout at 1.2798 provided an excellent entry point for long positions, but after several upward movements of 20 points, the pressure on the pair returned. The technical picture still needs to be revised for the second half of the day.

To open long positions on GBP/USD requires:

Those wishing to buy pounds around 1.2798 are present but need more support from major players. Given that the second half of the day will be accompanied by interviews with representatives of the Federal Reserve System, where it will be announced again that rates need to be raised further, buyers of the pound have little chance. The downward correction may turn into an intraday bear market.

Action will only be taken after another false breakout at 1.2798, where moving averages are happening, which play on the bulls' side. This will be a new signal to buy GBP/USD in continuation of the trend's development, similar to what I discussed above. The target of recovery, in this case, will be the new resistance 1.2840, formed as a result of last Friday. A breakthrough and consolidation above 1.2840 will create an additional buying signal with a surge to 1.2876. The furthest target will be the 1.2911 area, where I will fix profits. In the absence of fast movement up from 1.2798, and most likely so will be, pressure on the pound will only increase, creating more uncertainty and further prospects for the pair's growth. In this case, only the protection of the 1.2757 area and a false breakout on it will signal to open long positions. I plan to buy GBP/USD immediately on a rebound only from 1.2717 with a correction target of 30-35 points within the day.

To open short positions on GBP/USD requires:

Sellers tried, but they failed to break through 1.2798. They may retreat until testing the more significant resistance at 1.2840, as protecting this level is a much more priority task. A false breakout at 1.2840 will provide an excellent selling signal, which will return pressure on GBP/USD with the target of another update of 1.2798 - support formed as a result of last Friday. Bulls may not withstand a retest of this level, and a breakthrough and a reverse test from bottom to top of 1.2798 will deal a more serious blow to buyers' positions, pushing GBP/USD to 1.2757, covering the entire Friday's growth. The farthest target remains a minimum of 1.2717, where I will fix profits. In the scenario of GBP/USD growth and the absence of activity at 1.2840 in the second half of the day, the development of the bull market will continue. In this case, I will postpone sales until testing resistance 1.2876. A false breakout there will provide an entry point for short positions. If there is no movement down there either, I will sell the pound immediately on a rebound from 1.2911, but only in anticipation of a 30-35 points downward correction within the day.

Indicator signals:

Moving averages

Trading is conducted above the 30 and 50-day moving averages, indicating further pair growth.

Note: The author considers the period and prices of moving averages on the hourly chart H1 and differ from the general definition of classical daily moving averages on the daily chart D1.

Bollinger Bands

In case of a decrease, the lower boundary of the indicator will act as support around 1.2798.

Indicator descriptions:

• Moving average (smooths volatility and noise, identifies the current trend). Period 50. It is marked in yellow on the chart.

• Moving average (smooths volatility and noise, identifies the current trend). Period 30. It is marked in green on the chart.

• MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Fast EMA period 12. Slow EMA period 26. SMA period 9

• Bollinger Bands. Period 20

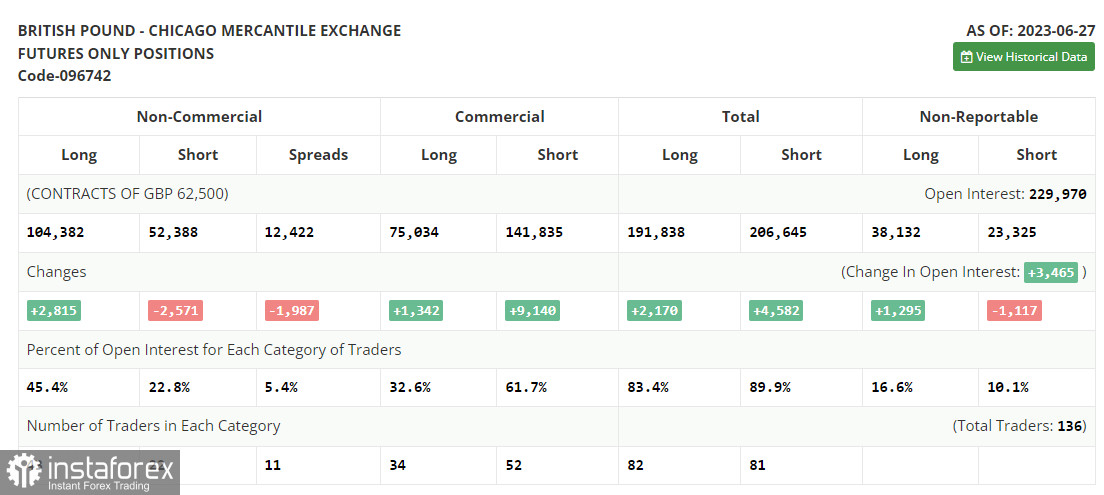

• Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions, use the futures market for speculative purposes and meet certain requirements.

• Non-commercial long positions represent the total open long position of non-commercial traders.

• Non-commercial short positions represent the total open short position of non-commercial traders.

• The total non-commercial net position is the difference between non-commercial traders' short and long positions.