The ADP report on employment in the private sector, published a day before the non-farm payroll data, was so shocking that it instantly raised expectations for the labor market as a whole, leading to rapid repositioning on Friday before the data release. However, the non-farm payroll figures were significantly weaker than expected, as the US added 209,000 new jobs (225,000 expected), and the payrolls growth revised down by 110,000 in the prior two months.

Employment growth is slowing, but the pace remains high. As for wage growth, the figures were an unpleasant surprise for the Federal Reserve. Wages rose by 0.4% last month instead of the expected 0.3%, and annual growth rates remained at 4.4%, which is higher than the 4.2% forecast.

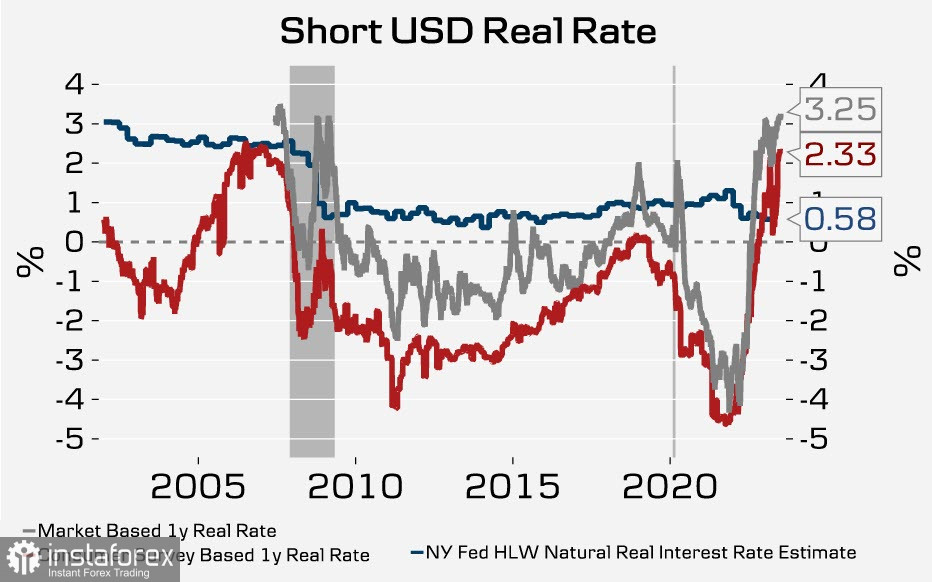

Steady wage growth does not allow inflation expectations to fall, the growth of real rates does not allow the Fed to start lowering the rate this year.

The U.S. inflation index, which will be published on Wednesday, is the main item of the week and the last important data before the Fed meeting at the end of July. The markets expect an 89% probability of a quarter-point rate hike. Furthermore, the probability of another increase in November has already exceeded 30%, and the first cut is now expected only in May 2024.

The U.S. dollar fell after the data and closed the week weaker than all G10 currencies. The growth of real rates in the current conditions makes a recession in the U.S. almost inevitable.

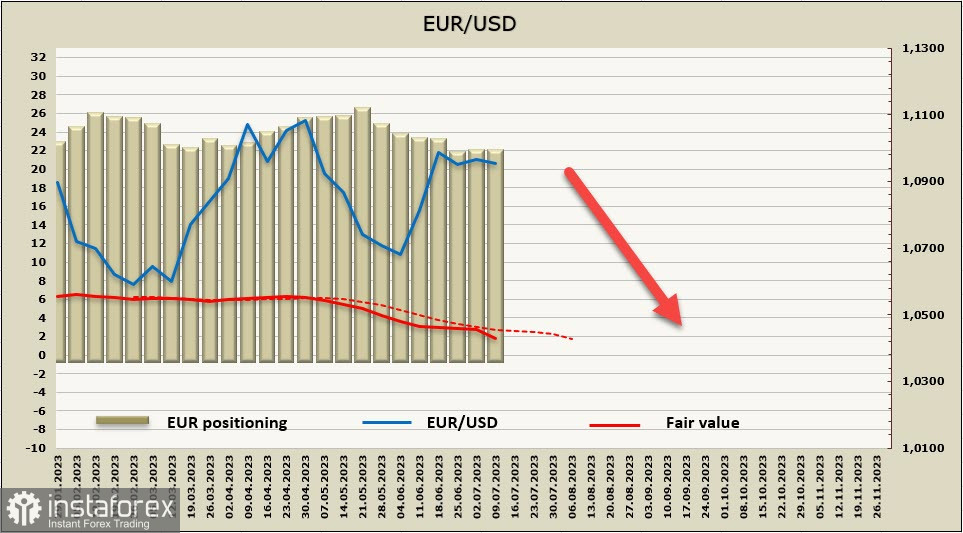

EUR/USD

The eurozone Sentix Investor Confidence Index has fallen for the third time in a row to -22.5 in July, the lowest level since December 2022, and expectations also remain depressed. The eurozone economy has fallen into a recession as of early July. The situation in Germany is even more depressing – the index has fallen to -28.5 points, and the possibility of improvement is ephemeral.

The ZEW index will be published on Tuesday, and the forecast for it is also negative, from -10 points to -10.2 points expected in July. On Thursday, the European Commission will present its forecasts. Bloomberg expects eurozone industrial production to fall in May from 0.2% y/y to -1.1% y/y, a sharp decline that characterizes the entire eurozone economy as negative and is on track for further contraction.

Under the current conditions, the European Central Bank intends to continue raising rates, and even plans to shorten the reinvestment period of the PEPP program. If this step is implemented, a debt crisis, which will put strong bearish pressure on the euro, is inevitable in the face of capital outflows to the U.S. and an expanding recession.

The net long position on the euro has hardly changed over the reporting week and amounts to just over 20 billion dollars, positioning is bullish, there is no trend. However, the calculated price is still below the long-term average and is facing a downtrend.

The euro tried to strengthen on Friday in light of the news, but it was unable to rise beyond the borders of the technical "flag" figure, let alone higher than the local high of 1.1012. We assume that the corrective growth has ended, and the euro will fall from the current levels, the target is the lower boundary of the "flag" at 1.0730/50.

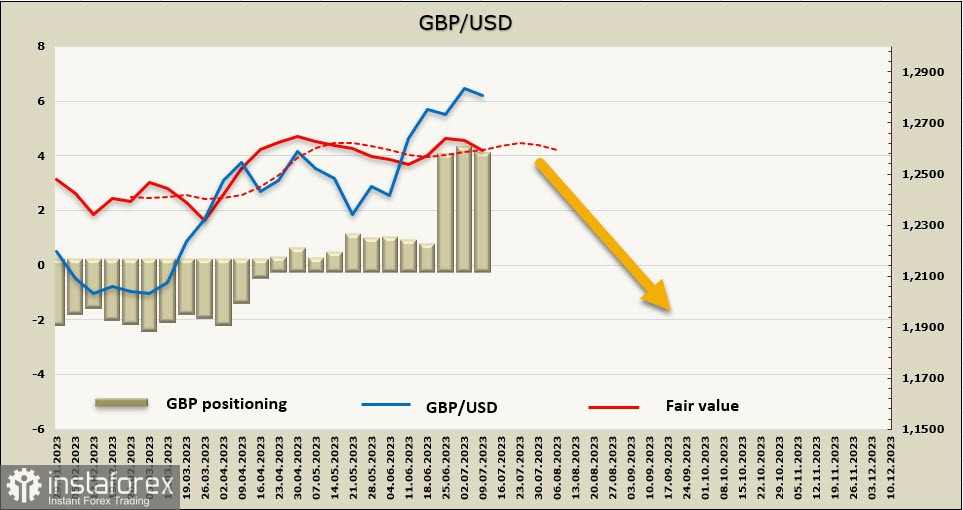

GBP/USD

Updated data on the UK labor market will be published on Tuesday. It is expected that average earnings, including bonuses, increased in May from 6.5% to 6.8%, and if the data comes out as expected, inflation expectations will inevitably rise. As will the Bank of England's peak rate forecasts.

The NIESR Institute expects that further rate hikes could trigger a recession. The cost of credit is rising, and an increase in the volume of bad debts is inevitable in an economic downturn. Inflation did not fall in May, contrary to expectations, and remained at 8.7%, even though energy prices significantly decreased.

Food inflation on an annual basis reached 18.3%, and core inflation at 7.1% is at its highest since 1992. The labor force is decreasing, and if this trend is confirmed on Tuesday, it will almost inevitably result in increased competition for staff, which will mean, among other things, the continuation of wage growth.

The BoE has already raised the rate to 5%, with forecasts implying two more rate hikes.

What does the current situation mean for the pound? If the economy can avoid sliding into a recession, then in conditions of rising nominal rates, the yield spread will encourage players to buy assets, leading to increased demand for the pound. However, if signs of recession intensify, which could be clear as soon as Thursday when GDP, industrial production, and trade balance data for May will be published, the pound will fall, despite high rate expectations.

After an impressive growth from two weeks ago, pound futures have stalled at achieved levels, a weekly decrease of just over 100 million has no significant impact on positioning, which remains bullish.

Resistance is still at the 1.2850 mark, there's a low chance that the pair will continue to rise. The nearest target is the trend line at 1.2680/2700, there's also little basis for a deeper decline. It seems more likely that trading will move into a sideways range in anticipation of new data, of which there will be quite a lot this week.