The EUR/USD currency pair traded higher again on Monday without properly correcting since Friday. We were expecting some decline in the euro because the market unilaterally interpreted all the statistics from across the ocean on the week's last trading day. However, the market has already started working on the upcoming inflation report in the US, which we will discuss further below. The European currency again rose on Monday, though the volatility was quite low. Therefore, we are seeing a rise in the euro for the second day, which might not have been expected considering the fundamental background.

Remember, the ECB maintains a "hawkish" attitude towards monetary policy, but we also expect two more rate hikes from the Federal Reserve. Naturally, looking at the current size of inflation in the EU and the US, it is clear that the ECB should increase the rate more strongly this year, which can provide support for the euro. But at the same time, it should be remembered that the pair has been growing for ten months in a row and that the ECB rate remains below the Fed rate. Nevertheless, the market stubbornly wants to consider only some of the full spectrum of macroeconomic factors and arguments. From time to time, the pair corrects downwards, and on the 24-hour TF, consolidation continues in the range of 1.05–1.11. However, we again see how the market turns towards the euro.

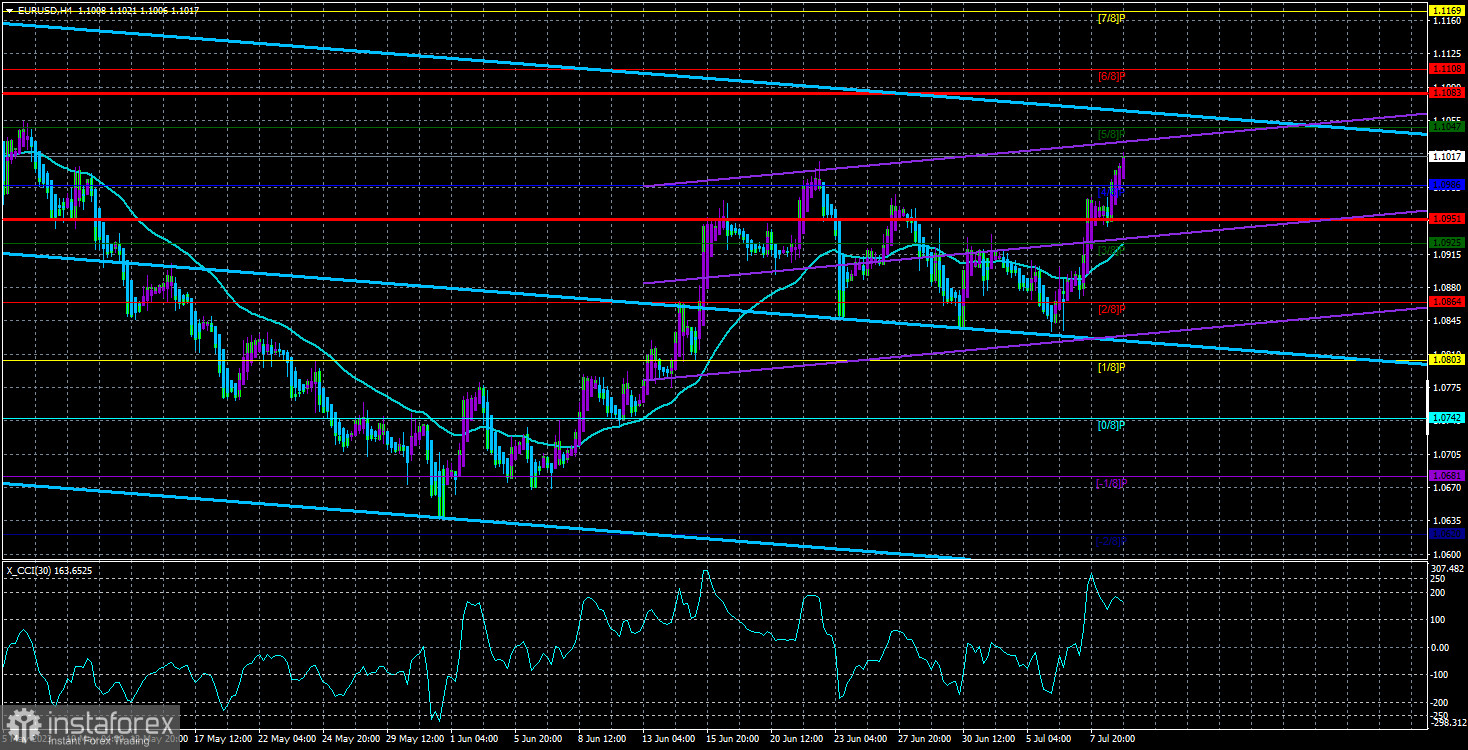

On the 24-hour TF, it can be seen that the pair is approaching the annual highs again, exceeding the 10th level. In principle, if we ignore the "fundamentals," the pair can calmly continue to grow, as there are currently no sell signals on either the 4-hour or the 24-hour TF.

The inflation report may already be affecting market sentiment

On Wednesday, an inflation report for June will be published in the States. Since forecasts suggest a very likely slowdown to 3.1% (current value: 4%), the market can already sell the dollar based on this report. We said earlier that the market processes the most important key events "in advance." If inflation drops to 3.1%, traders can expect at most one more rate hike from the Fed. And even if there will be two, as planned now, the market's mood changes towards "dovish." Traders assume that a rapid drop in inflation is not only a decrease in the chances of further monetary policy tightening but also the approach of the moment when the Fed will begin to ease monetary policy, which is again bad for the dollar.

Thus, the American currency suddenly receives new factors for its fall without properly correcting it. We have said before that in case of a significant downward correction on the 24-hour TF, no one opposes the continuation of the euro's rise. The problem is that we did not see a significant correction. Nevertheless, considering the rapid drop in inflation, the American currency may lose even more market support, which is already not at its peak.

Yesterday, Loretta Mester, a Federal Reserve's monetary committee member, made a speech. She declared that the Federal Reserve should raise rates slightly to bring inflation to 2%. Mester believes it is better to raise the rate one extra time now rather than see a new acceleration of inflation later. She noted the excellent state of the US economy, which strongly withstands the regulator's tough monetary policy and allows for further tightening. The head of the Federal Reserve Bank of Cleveland also pointed out the resilience of core inflation, which the Federal Reserve focuses on more than the primary rate. It's worth noting that core inflation would allow for two or more rate hikes, as it remains above 5%, but what difference does it make if the dollar is falling regardless of the Federal Reserve's disposition?

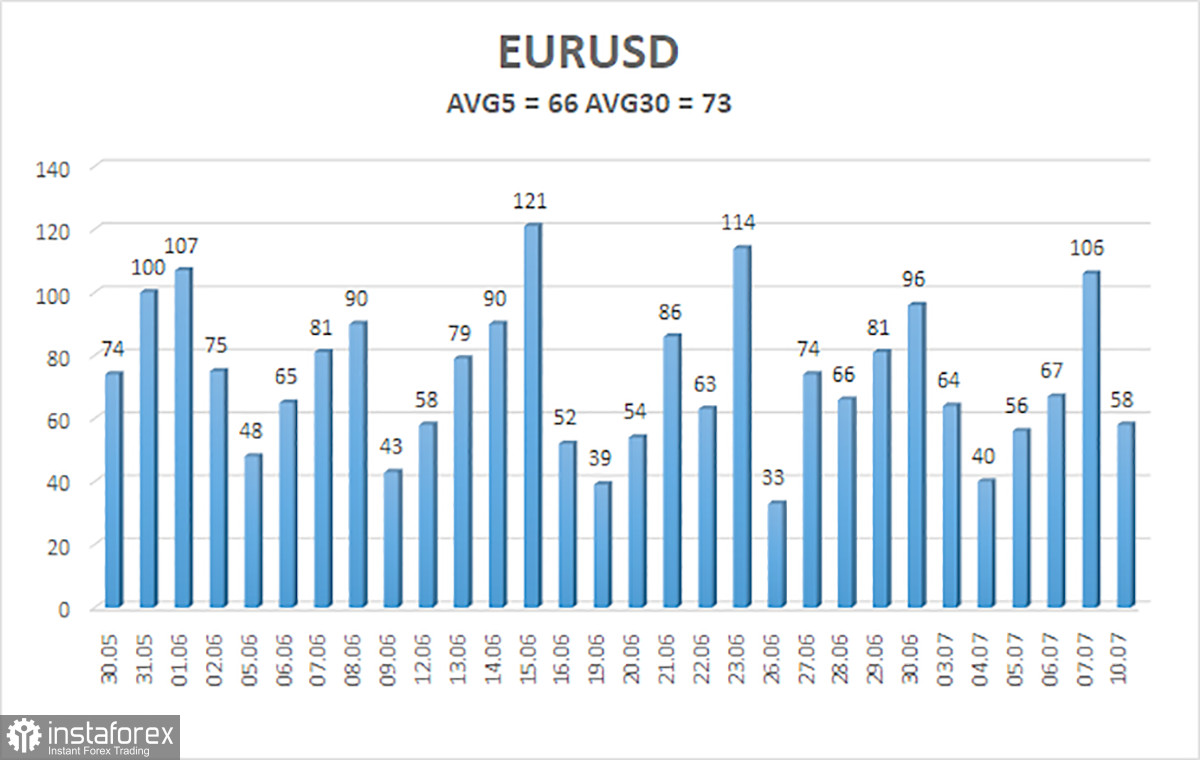

The average volatility of the euro/dollar currency pair over the last five trading days as of July 11 is 66 points and is described as "average." Therefore, we anticipate the pair to move between levels 1.0951 and 1.1083 on Tuesday. A downturn of the Heiken Ashi indicator will point to a new round of descending movement.

Nearby support levels:

S1 – 1.0986

S2 – 1.0925

S3 – 1.0864

Nearby resistance levels:

R1 – 1.1047

R2 – 1.1108

R3 – 1.1169

Trading recommendations:

The EUR/USD pair has resumed its upward trend. It is possible to remain in long positions with targets at 1.1047 and 1.1083 until the Heiken Ashi indicator turns down. Short positions will become relevant until the price is consolidated below the moving average line, with targets at 1.0864 and 1.0803.

Explanations for the illustrations:

Linear regression channels help determine the current trend. If both are directed in one way, the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted.

Murrey levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal in the opposite direction is approaching.