Fed's policymakers made mixed statements yesterday. Someone said that inflation remains at elevated levels and should be brought down. Someone cautioned about a recession scenario next year. Anyway, investors gave a negative response to their remarks. The US dollar came under pressure again after a massive sell-off on Friday triggered by the US nonfarm payrolls.

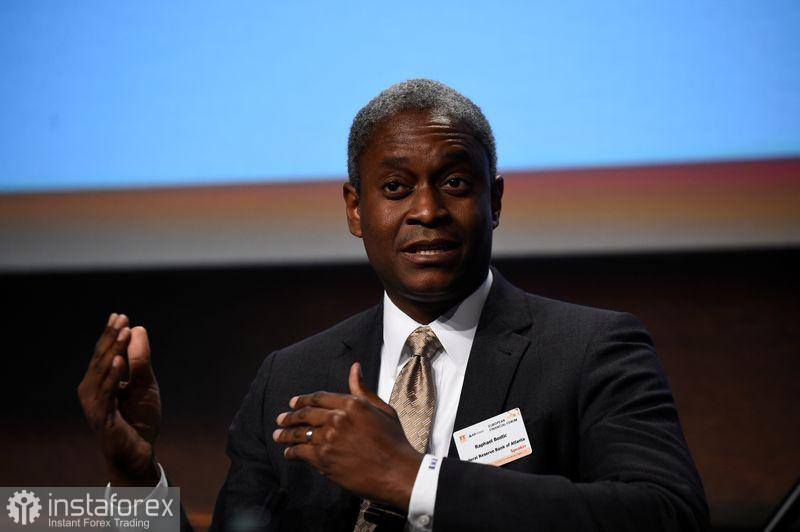

Atlanta Federal Reserve Bank President Rafael Bostic said in an interview yesterday that while inflation is too high, policymakers can be patient amid signs of easing economic growth. "I believe we can be patient — our politics is clearly in restrictive territory right now," Bostic said in a speech Monday at the Cobb County Chamber of Commerce in Atlanta. "We continue to see signs that the economy is slowing down. This suggests that the restrictions are working."

Let me remind you that almost all Fed members advocate for an additional increase in interest rates in 2023, with the exception of Bostic, who called for keeping rates unchanged until the end of this year and until 2024 to look at how the economy adjusts to them. Markets are now assessing the likelihood of a quarter-point increase at the upcoming FOMC meeting slated for July 25-26.

Remarkably, the Federal Reserve has already raised its key interest rate by 5 percentage points since March last year, when the campaign to tighten policy kicked off. While inflation has slowed down from its 2022 peak, it remains well above the central bank's target.

This is especially noticeable in core consumer prices, which are not declining as actively as policymakers would like. The CPI report for June will be released tomorrow. The data will help economists and traders revise their forecasts of further rate hikes. The slowdown in inflationary pressure will definitely affect the position of the US dollar. The greenback is still losing ground in tandem with the euro and the British pound. We will talk discuss the technical picture a bit later.

Bostic also stressed yesterday that although the US nonfarm payrolls for June showed less employment growth than economists had projected, inflation remains too high and far from the official 2% target. At the same time, the policymaker expects the policy decision in July to be another challenge for the economy.

As I noted above, tomorrow market participants will receive another report, the consumer price index, which is expected to show that annual inflation has slowed to 3.1% in June, the lowest level in more than two years. However, much will depend on the core inflation, which could accelerate by 5% compared to last year.

As for the technical picture of EUR/USD, if the buyers want to maintain control, they need to push the price above 1.1025 and consolidate there. This will allow getting out to 1.1050. Already from this level, the door will be open to 1.1090, but it will be quite problematic to do it without new positive data on the eurozone. In case of a decrease in the trading instrument, I expect any serious actions on the part of large buyers only in the area of 1.0985. If no one is there, it would be a good idea to wait for the update of the low at 1.0945, or open long positions from 1.0910.

As for the technical picture of the GBP/USD, the demand for the pound remains quite strong which indicates that the bull market is still in progress. We could count on the growth of the pair after the bulls ensure control over 1.2880, as a break in this range will strengthen hopes for a further recovery to the 1.2910 area. Once GBP/USD climbs there, it will be possible to talk about a sharper upward move to the 1.2940 area. If the instrument falls, the bears will try to take control of 1.2835. If they cope well, a break of this range would hit the bulls' positions and push GBP/USD to a low of 1.2790. Then, the price could decline to 1.2755.