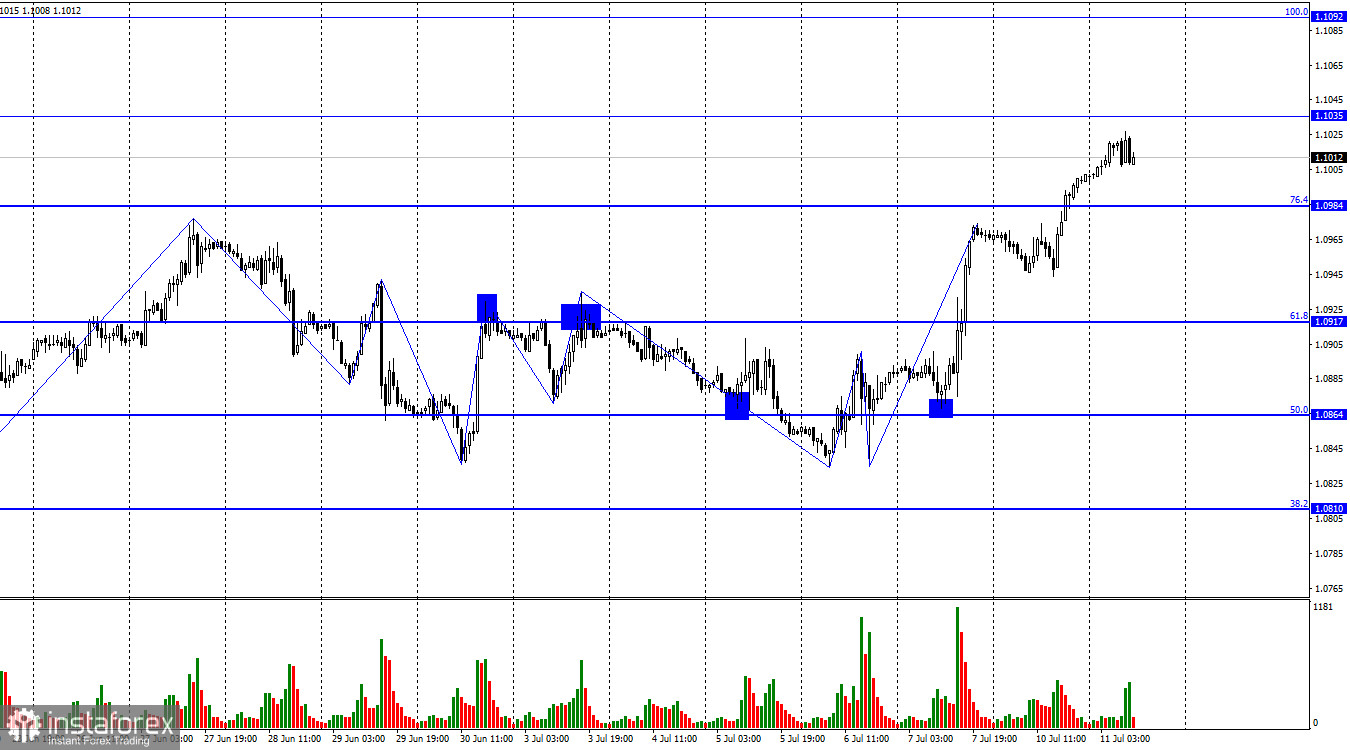

On Monday, according to the new Fibonacci grid, the EUR/USD pair resumed growth and secured itself above the corrective level of 76.4% (1.0984). Thus, the growth process continues now towards the next level of 1.1035. A rebound from this level will favor the US currency and some fall, while a close above it will increase the chances of continued growth towards the next Fibonacci level of 100.0% (1.1092).

The waves are currently telling us about a "bullish" trend. The peak of the last ascending wave is higher than that of the penultimate wave, and the entire wave will likely take a larger form. A downward wave may be formed soon, but I expect new growth in the European currency after it. There are no prerequisites to expect the end of the "bullish" trend on the hourly chart.

The information background on Monday was quite boring. Several speeches by members of the ECB and the Fed took place, and each of them overall repeated everything traders have long known. I can only highlight the speech of the Federal Reserve Bank of San Francisco President Mary Daly, who stated that several more interest rate hikes may be needed by the end of the year. Recall that there was talk of 2 hikes, and even earlier (a few months ago), the market expected the tightening program would end in May. However, the Fed feels the strength of the American economy and continues tightening, which does not help the dollar. The American currency has resumed its decline, and even the "hawkish" rhetoric of the FOMC members does not help it.

Daly also reported that the US economy continues to surprise with its resilience, allowing the Fed to continue raising rates. She assured that the Fed would make decisions based on incoming information. The inflation report will be out tomorrow.

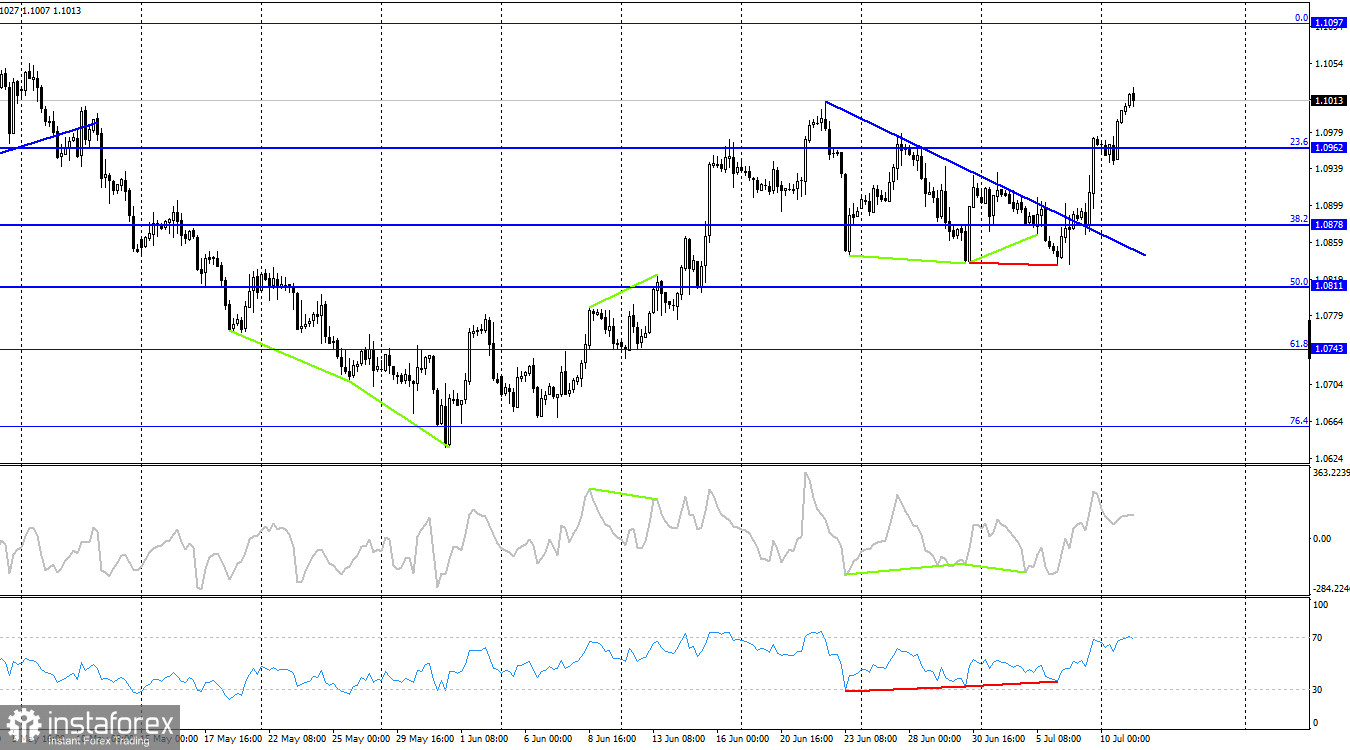

On the 4-hour chart, the pair has returned to the Fibonacci level of 23.6% (1.0962) and secured itself above it. Thus, the growth process can be continued toward the next corrective level of 0.0% (1.1097). As I already said, traders do not pay attention to the "hawkish" rhetoric of the Fed, so nothing prevents the euro from growing. No emerging divergences are observed today from any indicator.

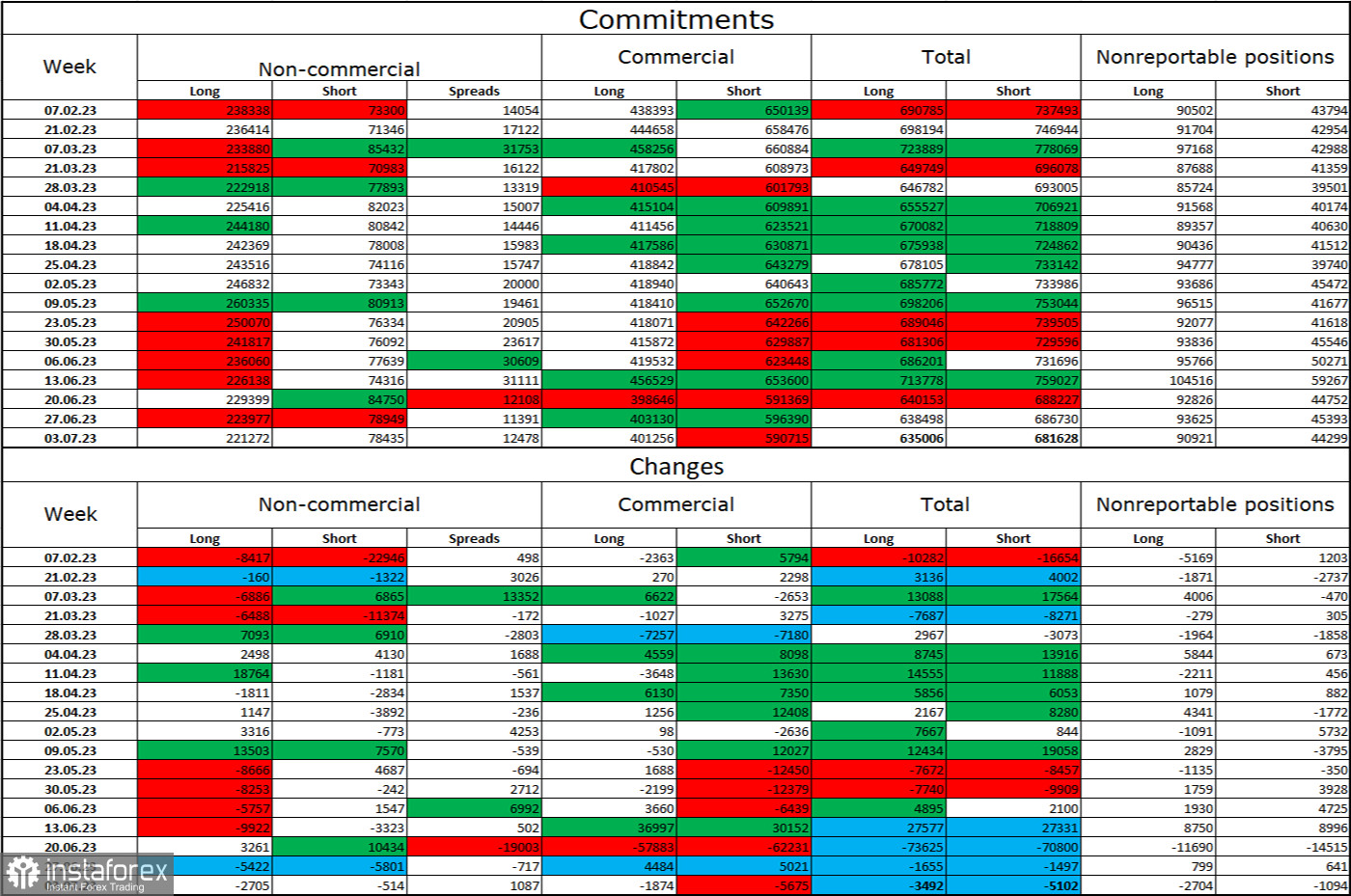

Commitments of Traders (COT) Report:

During the latest reporting week, speculators closed 2705 long and 514 short contracts. The sentiment among major traders remains "bullish," but it is slowly weakening. The total number of long contracts held by speculators now stands at 221,000, and short contracts at just 78,000. The "bullish" sentiment continues, but I believe the situation will gradually shift in the opposite direction. The European currency has been falling slightly more often than it's been rising over the past two months. The high volume of open long contracts suggests that buyers may start to close them soon (or have already started, as indicated by the recent COT reports) - there's currently a significant bias toward bulls. These figures allow for a new fall in the euro soon.

News calendar for the US and the European Union:

EU - ZEW Economic Sentiment Index in Germany (09:00 UTC).

EU - ZEW Economic Sentiment Index (09:00 UTC).

The economic events calendar for July 11th only includes two not-so-important entries. Since the morning, traders have shown that they are not waiting for these reports and are ready to continue buying the euro. The influence of the informational background on the mood of traders for the rest of the day might be weak.

EUR/USD forecast and advice for traders:

Small sales might be possible if a rebound from the 1.1035 level on the hourly chart, targeting 1.0984. The current trend is "bullish," so a significant fall in the pair is not expected. I advised buying the pair after closing above the trend line on the 4-hour chart and closing above the 1.0962 level with targets at 1.1012 and 1.1097. Only the last target has yet to be fulfilled.