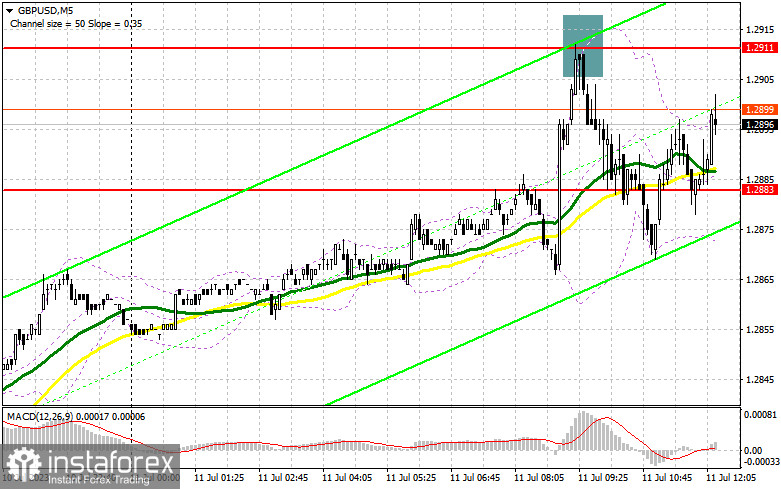

In my morning forecast, I drew attention to the 1.2911 level and recommended making decisions about entering the market from there. Let's look at the 5-minute chart and figure out what happened there. Growth and the formation of a false breakout at 1.2911 provided an excellent entry point for short positions, which led to a fall of the pair by more than 40 points and a new support level. The technical picture for the second half of the day has mostly stayed the same.

To open long positions on GBP/USD requires:

The growth of the average salary in the UK led to a spike in the pound in the first half of the day, as an increase in this indicator will certainly continue to unwind the spiral: income growth – inflation growth, which will force the Bank of England to continue to raise interest rates. In the second half of the day, nothing could strongly help the dollar, so one should not exclude another assault on monthly highs and go beyond 1.2911. Figures for the NFIB Small Business Optimism Index and a speech by FOMC member James Bullard will be mediocre.

Quite a few want to buy the pound, which, after the correction, led to the formation of new support at 1.2870. I prefer to open long positions in the second half of the day only after a decrease and the formation of a false breakout there. This will be enough to get a signal to buy the pound with the target of another upward surge around 1.2911, where buyers have already experienced certain problems today. A breakout and consolidation above this range will form an additional signal to buy with a rise to 1.2943. The ultimate target will be the 1.2971 area, where I will fix the profit. In the scenario of a decline in GBP/USD during the American session and the absence of a fast movement up from 1.2870, pressure on the pound will increase, which will create even more uncertainty with further growth prospects of the pair. In such a case, only the protection of the next 1.2831 area and a false breakout on it will signal to open long positions. I plan to buy GBP/USD immediately on a rebound only from 1.2789 with a correction target of 30-35 points within the day.

To open short positions on GBP/USD requires:

Sellers put up serious resistance, but this was just an excuse for large players to accumulate new long positions. Now all the focus is on protecting resistance at 1.2911, which I no longer strongly believe, as this area has already been worked through. Only another false breakout there, similar to what I analyzed above, will provide an excellent sell signal. This will return the pressure on GBP/USD with the target of another update of 1.2870 – support, formed due to the first half of the day. A test of this level may occur in case of hawkish rhetoric from the Federal Reserve representatives, and a breakout and reverse test from bottom to top of 1.2870 will inflict a more serious blow to the buyers' positions, pushing GBP/USD to 1.2831. The ultimate target remains the minimum of 1.2789, where I will fix the profit.

In the event of GBP/USD growth and no activity at 1.2911 in the second half of the day, the bull market will continue. In that case, I will postpone selling until the resistance of 1.2943 is tested. A false breakout there will provide an entry point for short positions. If there is no downward movement, I will sell the pound immediately on a rebound from 1.2971, but only with the expectation of a pair correction downwards of 30-35 points within the day.

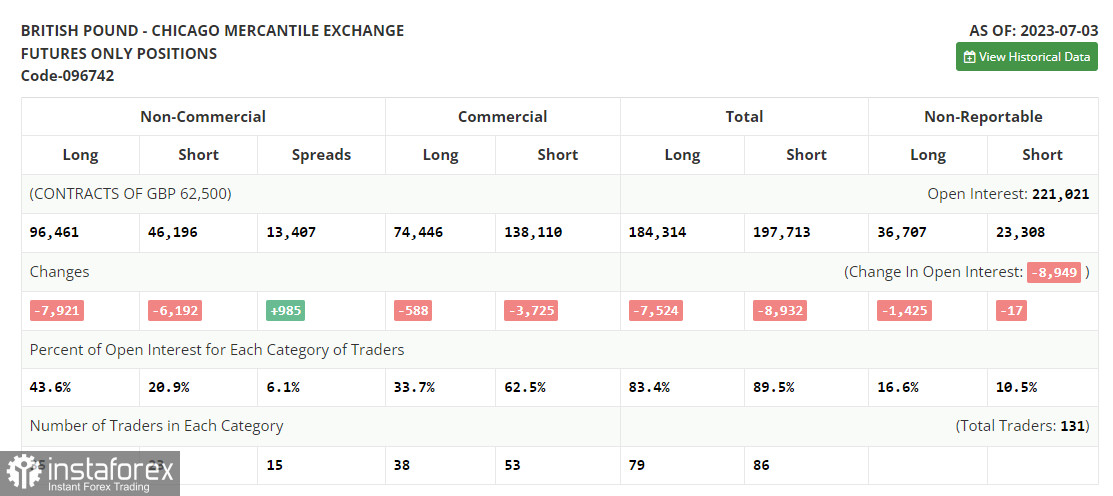

In the COT report (Commitment of Traders) for July 3rd, short and long positions were reduced. Pound buyers have all the chances to act more aggressively, as the Bank of England, despite all the pressure and economic problems, will continue to stick to high-interest rate policies due to serious inflation problems affecting household living standards. As for the Federal Reserve, no matter what politicians say, traders are beginning to revise their attitude toward the dollar, betting on its weakening in the medium term. The reason for this is the interest rates in the US, which are about to reach their maximum values. The optimal strategy remains to buy the pound on a decline. The latest COT report states that short non-commercial positions have decreased by 6,192 to 46,196, while long non-commercial positions have dropped by 7,921 to 96,461. This led to a slight decrease in the non-commercial net position to 50,265 versus 51,994 a week earlier. The weekly price decreased and amounted to 1.2698 against 1.2735.

Indicator signals:

Moving averages

Trading is being conducted above the 30 and 50-day moving averages, which indicates further pair growth.

Note: The author considers the period and prices of moving averages on the H1 hourly chart and differ from the general definition of classic daily moving averages on the D1 daily chart.

Bollinger Bands

In case of a decrease, the lower boundary of the indicator at around 1.2831 will serve as support.

Indicator descriptions

• Moving average (determines the current trend by smoothing out volatility and noise). Period 50. Marked yellow on the chart.

• Moving average (determines the current trend by smoothing out volatility and noise). Period 30. Marked green on the chart.

• MACD indicator (Moving Average Convergence/Divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

• Bollinger Bands. Period 20

• Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions, who use the futures market for speculative purposes and meet certain requirements.

• Long non-commercial positions represent the total long open position of non-commercial traders.

• Short non-commercial positions represent the total short open position of non-commercial traders.

• The total non-commercial net position is the difference between non-commercial traders' short and long positions.