The demand for the US dollar continues to fall, although the news background does not always support such market actions. In previous reviews, I have already questioned the logic of the market movement, as the reports on Friday, Monday, and Tuesday rather spoke about a likely upside bias for the dollar than the euro or pound. I also mentioned that some economists are no longer analyzing, but trying to somehow explain why the euro and pound are growing. Economists from UOB called the labor market data "ambiguous," and TDS analysts reported that good data is bad for the USD. Presumably, they meant the consumer price index, which is falling quite quickly in America and lowers market expectations for two Federal Reserve rate hikes. But inflation is not the only important factor!

The US will release a new inflation report on Wednesday, and economists' expectations are bleak, for the dollar at least. Inflation is expected to soften to 3.1%, which is already very close to the 2% target mark. However, if someone found the payroll report on Friday to be "ambiguous," then the report on Wednesday can also be called ambiguous right now. If the market expects a sharp drop in inflation in June, it cannot ignore that core inflation remains quite high. FOMC members have repeatedly drawn attention to this indicator, calling it no less important than regular inflation. If core inflation remains high, the FOMC will not soften its hawkish stance and there are no reasons for concern about two rate hikes. But the demand for the dollar is still decreasing.

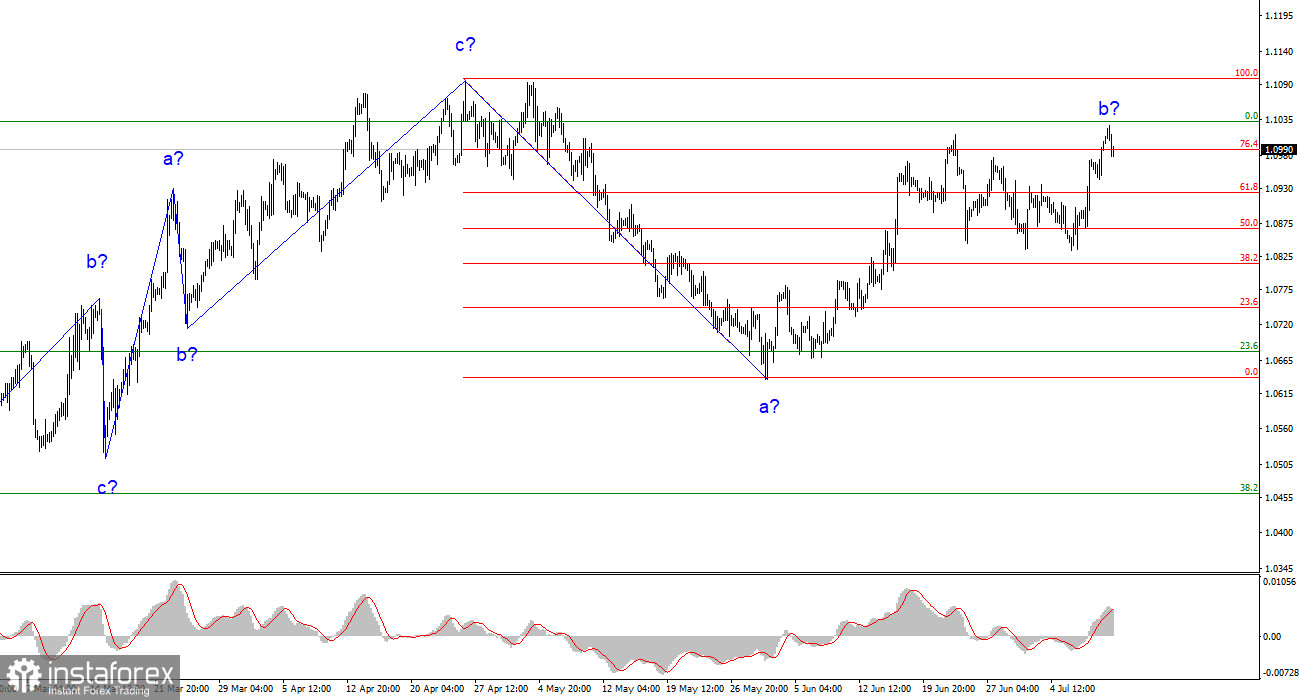

At the same time, in the European Union, Francois Villeroy de Galhau, the President of the Bank of France, stated that the European Central Bank is close to the peak interest rate. He reported that inflation should return to 2% no earlier than 2025, and such a long term of decrease suggests that the rate in the European Union will stop rising in the near future. It turns out that the ECB begins to soften its rhetoric, while the Fed's stance remains unchanged. Eurozone data remains very weak, but the market does not pay attention to these factors. That's the reality right now. I expect the dollar to rise on Wednesday, as the market might have already priced in a slowdown in US consumer price growth in June. For the EUR/USD pair, this means that wave b may still end. On the other hand, it means nothing for the GBP/USD pair, as the pound is growing even stronger than the euro.

Based on the analysis conducted, I conclude that the downtrend is currently being built. The instrument has enough room to fall. I believe that targets around 1.0500-1.0600 are quite realistic. I advise selling the instrument on "down" signals from the MACD indicator. The supposed wave b may end soon, now it has taken a three-wave form. According to the alternative layout, the ascending wave will be longer and more complicated, but in this case, it can become almost any length.

The wave pattern of the GBP/USD instrument has changed and now it suggests the formation of an upward set of waves. Earlier, I advised buying the instrument in case of a failed attempt to break through the 1.2615 mark, which is equivalent to 127.2% Fibonacci, and now a successful attempt to break through the 1.2842 mark will indicate a complication of the ascending wave 3 or c (which is quite likely). Therefore, I advise long positions with targets located around 1.3084, which corresponds to 200.0% according to Fibonacci.